“Americans can always be trusted to do the right thing once all other possibilities have been exhausted.” – Quote often ascribed to Winston Churchill

If there’s one thing most can feel good about these days, it’s the fact that the process of trying “all other possibilities” to keep corporations and the economy afloat is in full swing, which in turn probably means we’re that much closer to getting to a viable long-term solution that benefits most. As touched on in last month’s letter, the “right thing” will likely only come after all these other easier, less painful possibilities have been tried and exhausted. If Churchill actually uttered these words, it’s not hard to see why. Human nature, not exclusive to Americans, is such that we only tend to undertake big change when we’re forced to. It’s hard, requires sacrifice, and as a result, requires that things get worse before they get better. We touched on the social side of this last month. The economic and market side of things getting and truly feeling worse has yet to play out and we remain laser focused on preparing our clients for this part of the process. As scary as recessions, corrections, and retrenchments can be, we’re optimistic that on the other side we’ll see real, lasting change that will benefit more of us. In the meantime, as it relates to our investments and finances, we can’t get distracted.

Since late March, stocks have rebounded in heroic fashion. The tech-heavy Nasdaq and S&P 500 have made new highs in July and are positive for the year. Crisis averted, unless of course you consider 30 million unemployed with assistance set to expire in a few days to be somewhat of a problem (the official figure along with the supplemental PUA program that supports self-employed individuals normally not eligible for unemployment assistance). Although partial re-openings across the country have helped create a bounce in economic activity, we are still firmly in recessionary territory with a very low probability of getting back to pre-Covid levels of economic activity anytime soon. So, yay for stocks achieving new highs, but we urge you to don your earmuffs and keep things in perspective. Stock markets were priced for perfection before the recession. Now with economic output and corporate earnings a good deal lower than before and stocks at the same level, they’re just pure speculation. There’s virtually no reasonable investment component left; at least not on a market-wide basis. As we’ve highlighted before, Wall Street is built around the stock market, and the stock market now supports our economy like never before, so it shouldn’t be any surprise why we’re led to feel that it’s the only way to grow our wealth. It’s not. This is the point in the economic and market cycle where blocking out the noise is critical to investment survival. There are always other options. Fortunately for our clients, those other options that make smarter sense are starting to garner some attention.

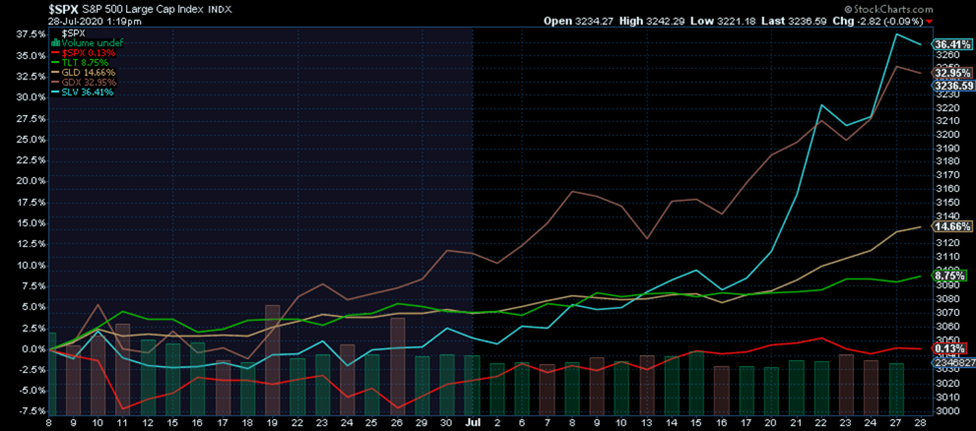

It’s probably no surprise that we feel precious metals (PM’s) make good sense from a macro-economic and valuation standpoint. There’s historical precedent for their outperformance of stocks in decelerating or contractionary growth environments and they have very long-term cycles just like anything else, where they can go from being really cheap relative to other assets to very expensive and vice versa. Most recently, gold, silver, and mining shares reached extremely cheap valuation levels late 2015 and the economy started to contract in late 2018. This set the stage for a shift in conditions that would favor these categories relative to other financial assets. Fair to say, they’ve performed admirably since then (see chart below). Gold and silver have both appreciated in price by over 60% with gold miners up over 130%. Even “conservative” U.S. government bonds are up over 50% since late 2018 compared to the S&P 500 at up ~10%.

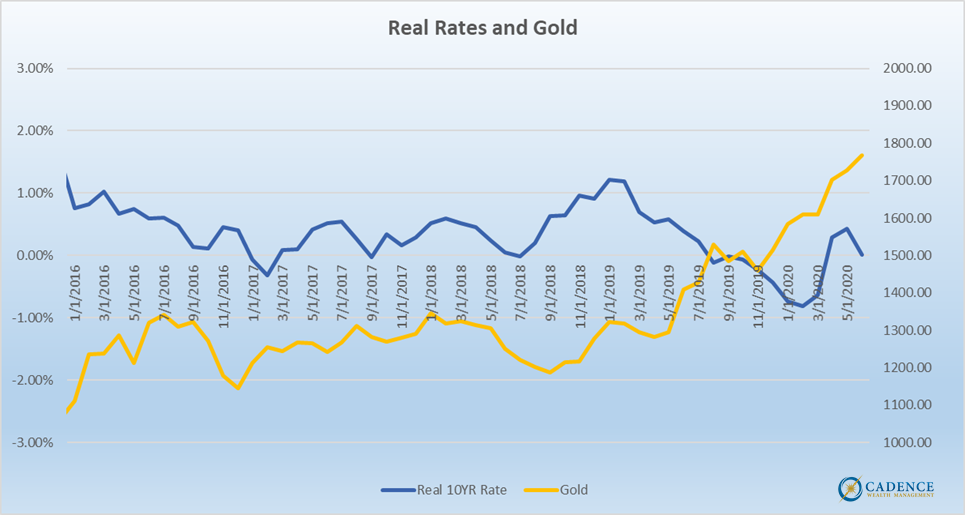

Although this outperformance over stocks has been consistent since the late 2018 cycle peak, the last two months have marked a noticeable shift in investor sentiment toward the precious metals. Whether the reality of our country’s dire financial trajectory is finally setting in (government debt reaching a point where it will likely never be retired/paid back) or markets are pricing in inflation around the corner is unclear. It could even be some other reason, or a combination of all of them perhaps. We won’t pretend to know the exact “why” behind the price increases, but the “how” is very clear to us. PM’s and the companies that mine for them can become very attractive to many in a world in which global currencies are being de-based at record rates via deficit spending and the concomitant debt issuance. If all this eventually leads to inflation, and governments are motivated to keep interest rates low (because they wouldn’t stand a chance of making debt payments at higher rates), then we have negative inflation-adjusted interest rates or real rates which destroys the purchasing power of money invested in government bonds (see chart below).

So how could demand for PM’s and the companies that mine them increase so markedly over the last couple months? Investors seeing all of these things as much more likely than they did a few months ago, that’s how. The chart below illustrates the performance difference between PM’s, miners, and the S&P 500. It’s somewhat reminiscent of the Hemingway expression about going bankrupt; gradually, then suddenly. The same can be true about long-term trend changes or phase transitions. They can happen gradually at first, largely unnoticed by most, then suddenly as the masses catch on. This chart appears to reflect that process.

Again, to us the magnitude of this divergence in investor preference is an important message. Where that leaves stocks remains to be seen, but what’s abundantly clear is that there are other options for investors that don’t involve investing in asset classes at historically high valuation levels at precisely the wrong point in the economic and market cycle. Those keen enough to spot them a couple years ago and tune out the financial market all-time high celebrations and headlines are quite a bit further ahead. Congratulations to those who donned the earmuffs in late 2018 and have kept them on ever since.

Going forward

To us, that famous Churchill quote couldn’t be a better template for what we’ve already seen and will likely continue to see from both the Federal Reserve and U.S. Treasury. They will try everything until circumstances prevent them from continuing. This means more debt will be issued to try and keep the economy from receding further and the populace from experiencing severe hardship. If there aren’t enough buyers of our debt (lenders to the U.S.), then the Federal Reserve will buy it with the click of a button that essentially amounts to printed money. Remember, the alternative to this is for Congress and the current administration to let businesses fail and people suffer through this downturn. These are tough choices that elected officials don’t have the will to make; in any country. It’s just human nature.

And so as extreme as the printing and spending is now, it’s likely to get worse. What we think will become obvious to most in time is that you cannot fix a debt problem with more debt. In other words, liquidity can’t solve a solvency problem. Common sense one would think, but humans will go to great lengths to cast aside common sense in support of their interests. As we’ve written about before, cycles play out and gravity ultimately prevails. We can look back at American history, European history, even the story of Sisyphus from Greek mythology for reminders of the futility of trying to cheat gravity. Whether we can arrest it for a bit longer we shall see, but the risks associated with a return to something more normal and stable are huge. This may seem a bit hyperbolic, but given the magnitude of the upward trajectory in markets, debt, and speculation over the years, science and math would suggest an equally magnificent outcome on the other side of all of this. Intuitively, most people probably understand this concept. Our hope is that the economic fallout from this cycle change isn’t severe. That’s not good for anyone and we understand the desire to limit any large negative outcome here. With any luck, we can get back to a more stable, sustainable system without a dramatic economic shock. Financial markets however, have a tendency to recoil much harder and in proportion to their ascent. That’s where we would expect to see the largest impact throughout these multiple cycle transitions back toward more “typical” conditions.

Again, to the extent that we’ve identified the risk in traditional stock and bond investments and taken measures to minimize exposure to them, we can let others play that game and focus on better portfolio choices. As governments get more desperate with respect to policy measures and spending, there’s a good chance that investors will continue to seek out the relative safety of precious metals. If and when inflation starts to pick up, this demand will likely broaden out across other commodities in an effort to protect against a decline in purchasing power. Eventually, traditional stock and bond categories will reach levels where they become attractive long-term investments again rather than tools of speculation. Similarly, PM’s and commodities will eventually rise in price to the point where they have less relative appeal and become excessively speculative. Not yet though. We’re probably a good deal away from that point.

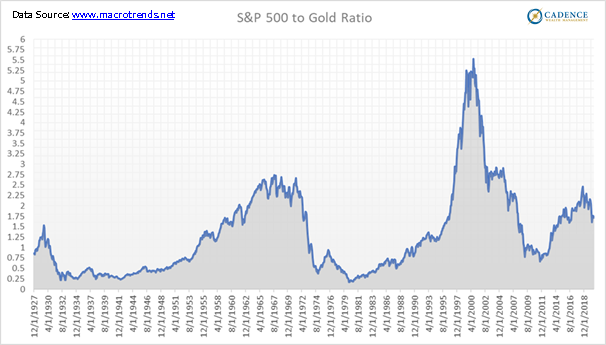

Stock to Gold Cycle

On the following page is a visual look at the price of the S&P 500 versus the price of gold going all the way back to the late 1920’s. What you’ll probably notice first is that this relationship has been very cyclical. It doesn’t climb up and to the right in perpetuity, but rather goes up and down around a fairly horizontal level. What you’ll probably notice second is that there are clear peaks and troughs associated with this cyclical activity. Third, we’re a lot closer to a historical peak than trough, indicating that over the long term we’re probably looking at some combination of gold outperforming stocks. The environment where the ratio falls and gold begins outperforming stocks tends to come after long periods of expansion and excess and corresponds with less robust economic growth – the conditions we’re seeing today. The fourth observation as we noted earlier is that this ratio has been falling since the fourth quarter of 2018. One can view this as a harbinger of things to come for the economy and stocks if they wish, but we’d prefer to focus on the cyclical pattern at hand, the reasons for it, and how long this could continue before we get to previous cycle low points.

If the ratio gets back to 2009 levels, post the global financial crisis, gold would have to rise an additional 170% from here if the S&P 500 held at current levels. To get to the trough lows of the depression and late 1970’s, a stock to gold ratio of ~0.25, would require a more than 500% gain in the price of gold if stocks held current levels. What’s more likely is a combination of gains in gold and losses in stocks, but the point is, if the ratio of stock to gold prices gets anywhere close to previous cycle low points, the performance gap between the two is very large.

The same goes for silver as we can see in the 50 years of historical data plotted below. If anything, silver is even cheaper relative to stocks and has much further to go before getting to historical cycle lows in its relationship with the broad stock market. And although we aren’t able to show data going back the same length of time for PM mining companies, the same is true for them as well. We’re most likely in the early part of a cycle shift that began in late 2018 from historically cheap to something much more expensive.

The challenge investors face today is figuring out how to achieve the investment returns needed to achieve financial security. The reality is, any mix of conventional stock and bond asset classes will likely come up well short over the long term given price starting points that are too high and interest rates that are too low. One can hope for a better outcome, but the math suggests doing something about it might be a better course of action. If we want a different outcome, we need to do things differently. It’s that simple.

The challenge of course can be in identifying alternatives and mapping out a differentiated strategy that can deliver that superior outcome. There are no guarantees in financial markets. Even those products that are literally guaranteed are only as secure as the companies making the offer. Results in anything can vary and losses at some point in the process can in fact be guaranteed. They will happen in every investment that’s worth owning. Understanding this makes it easier to look at every choice equally and without bias from a pure risk and return standpoint. What’s the risk of loss over the short, medium, and long term and by contrast, what’s the return potential over those time frames? This is how one should go about building his or her portfolio. We’ve focused lately on the favorable setup and outlook for precious metals and miners, but this will change. What looks compelling today may not tomorrow and vice versa. This is where having and employing an objective process can help immensely.

Finally, diversification. Warren Buffet in a speech years ago was quoted as saying anyone who wants to achieve a better result than the broad market should invest in no more than 6 companies. “Nobody ever got rich on their 7th best idea,” he added. Charlie Munger said to put all your eggs in one basket, then watch the basket. The idea here is that to get a superior result, one has to do things differently. What they were also saying is that over-diversifying by definition means one ends up investing in lots of inferior investments that can actually detract from performance. Given today’s circumstances around asset prices and interest rates, we couldn’t agree more. The challenge of course is remaining adequately diversified so that we’re protected against unforeseen consequences. No matter how one feels about PM’s or anything else, they shouldn’t have too much of their capital in just one thing. Circumstances and conditions can always change when we least expect them to. Also, long-term trends often get noisy and confusing along the way leading to losses and doubt as to whether we’re on the right course. To protect against this, it’s important to make sure to maintain good diversification in asset classes that make sense for the conditions we’re presently facing and risk-manage those positions along the way. This is core to our approach at Cadence and has served our clients well in recent months. Once one’s portfolio reflects this, it’s time to don the earmuffs, tune out all the noise and nonsense, and trust the process.

Please stay safe out there.

Editors Note: This article was originally published in the August 2020 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.