We have written many times how when it comes to planning and investing, human brains are the biggest hindrances to the owners of those brains. The possibility of large investment gains is so seductive, especially with financial news programs showcasing stocks that have absolutely taken off and investors who have made obscene amounts of money from large moves. Even our friends and acquaintances at times seem eager to share the bets they’ve made that paid off. It’s easy to think of the possibility of large gains if enough money were put in the right place. However, the financial news programs are not interviewing those who have lost big on large moves, nor are our friends and acquaintances as eager to share the tales of their bad bets. So it’s understandable if we can’t see sometimes that the probability of large bets paying off is low, and we are tempted at times to invest for the possibility of large gains as opposed to the probability of “large enough” gains. We let the possible get in the way of the probable, and in times like this it can be tempting to consider getting more aggressive with your investments.

Even though the terminology is simple and familiar, especially compared to those months when we’re discussing the Japanese bond market, we need to get the definitions of “possible” and “probable” straight. When it comes to the probability of certain outcomes, every outcome has a probability. However, when we say that something is “probable”, we usually mean it “has a high (or at least above average) probability of occurring”. When it comes to “possible”, however, we mean something is possible in the same sense as it’s possible you’ll win the lottery tomorrow. I mean, we all know it’s possible, but is it probable? No. Not at all. So when we say something is “possible”, we frequently, if not usually mean something is “not likely”, i.e., a low probability; a fair amount lower than average.

For example, is it possible you could flip a coin ten times and it would be heads every time? Yes, it is possible. You would have about a 0.1% chance of flipping a coin ten times and have it be heads every time. So yes, it is possible, but it is not probable.

When it comes to investing, especially during times of runaway market growth like what we saw from March of 2009 to February of 2020, or even during this most recent rebound starting in late March this year, many people are tempted to reach for what seems like relatively easy large gains by adjusting their allocations away from less volatile assets to those that are more volatile, mainly stocks. After all, it is possible that the stock market will continue to climb in the coming months. There are forces pushing it higher right now: investor optimism, the continued belief created during the most recent bull run, the longest in history, that the market will just keep going up, and the US government and Federal Reserve both taking unprecedented actions to help prop it up. But is it probable right now?

Deciding What Is Possible Versus Probable Right Now

One of the more difficult aspects of determining the probability of a given outcome, like how much your investments might make over a given time period, is measuring the starting conditions. If a stock market is peaking, it is much less likely that an investment made into it at that time will lead to a large gain over the short to medium term. Conversely, if the stock market has fallen and has reached its lowest point, an investment made into it at that time has a much higher probability of leading to large gains, even in the short to medium term. So what are some of the factors right now that may impact a riskier investment to lead to large gains or large losses?

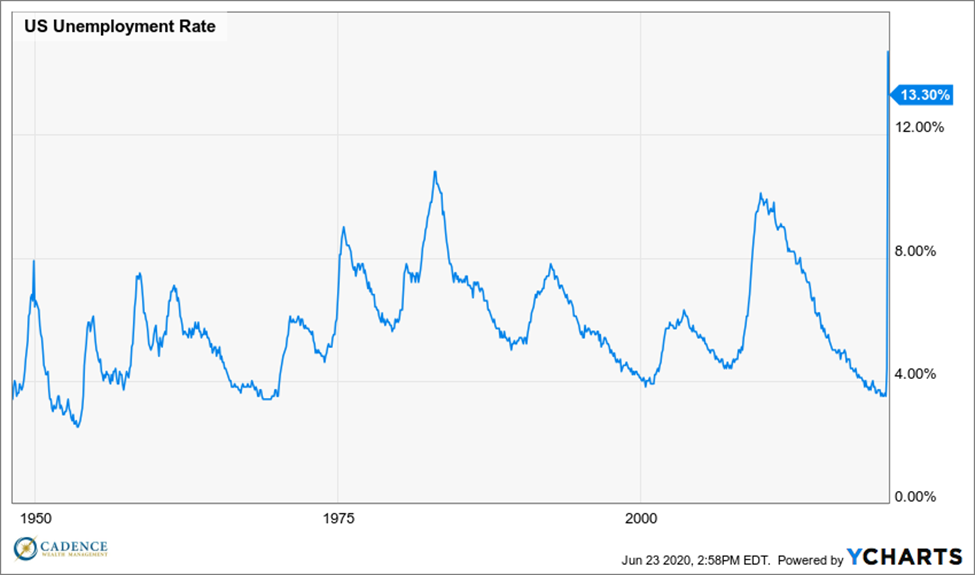

Unemployment. Though how the unemployment rate is calculated is subject to much debate, with many economists saying it is understated for many reasons, the sheer scale of what has occurred this year can be compared to past years and is a useful marker.

The arrow was added because the rate went up so high so fast that it almost looks like the vertical border on the chart. Our current level of unemployment, though it has come down from its high, is still worse than what we experienced during the height of the financial crisis of 2008. If it took the stock market years to recover during that environment, what is the probability of the stock market reaching and maintaining a level above where it started this year before record unemployment?

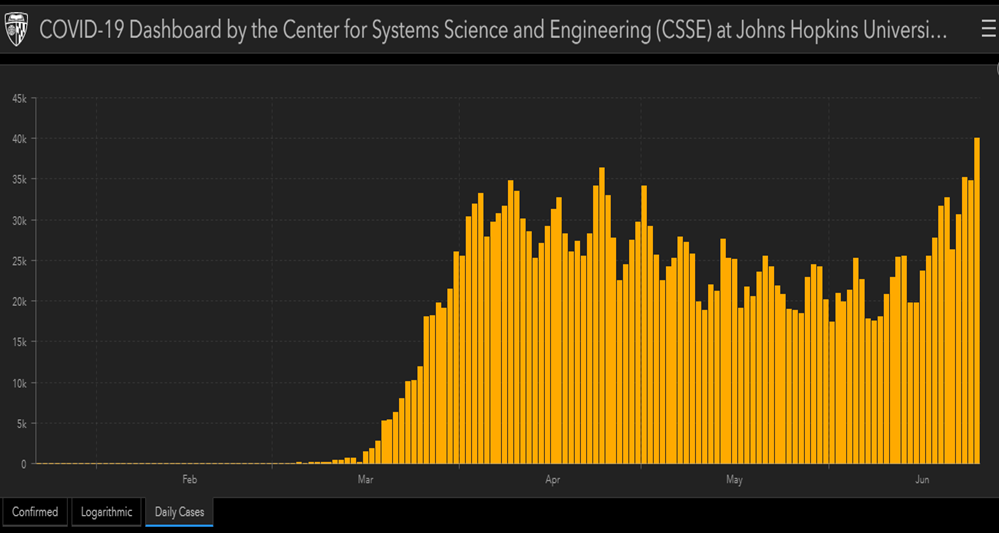

Global Pandemic. If this were a normal recession and unemployment were due to the natural cycle of economic expansion and contraction, then that would be one thing. However few of us, possibly no one reading this, has lived through a market collapse, recession, and global pandemic all at the same time. Obviously, we’re in uncharted waters here. If the US had been able to get on top of the virus and put procedures in place to keep the spread low while continuing to open more and more of our economy, then perhaps we would be able to create models to increase our confidence around what to expect from this most recent recession. However, with the confirmed case counts in many states increasing again, in part because the rate of positive tests are increasing as opposed to it being just from increased testing, there is no clear indication of what the regional economies around the country will be able to do. The daily positive confirmed COVID-19 tests from the Johns Hopkins website shows the slow decrease during the month of May, with a gradual and as of late more sudden increase since the beginning of June:

If we’re allowed to eat in restaurants and go shopping like the pre-virus days, even with masks on, are enough people going to feel comfortable out and about spending money to keep the economy growing and stock prices rising? Is it possible enough Americans will have jobs and be willing to carry on as normal to keep the economy expanding? Sure, it may be possible, but is it probable?

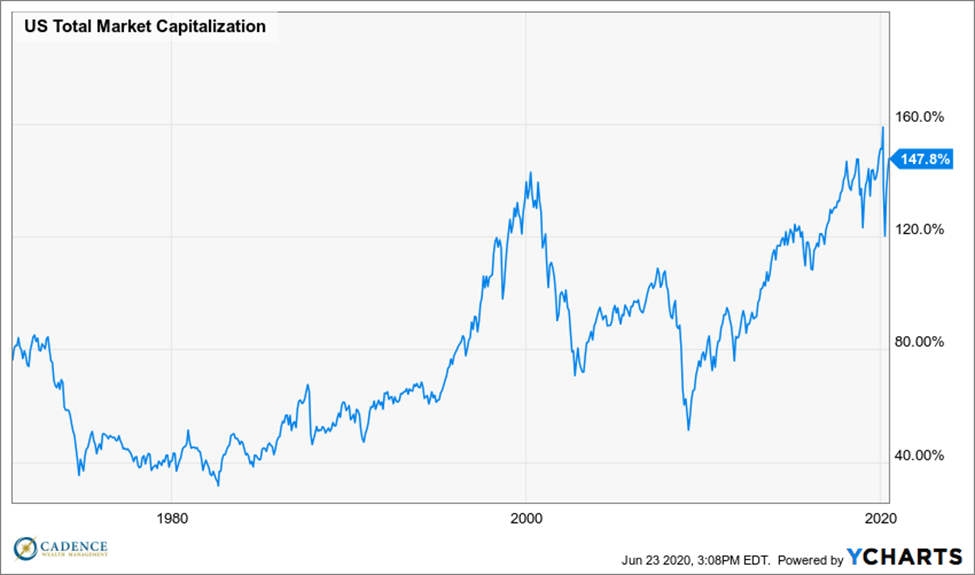

Current Stock Market Valuations. The last chart shows the market capitalization of US stocks, which is the value of all public companies in the index, divided by US Gross Domestic Product. The higher the number, the more likely stocks are to be expensive relative to their future prospects. In this case you can see even after a historically fast stock market decline earlier this year and historically bad unemployment figures, this measure of stock valuation is showing stocks are more expensive today than they were at the height of the Dot-Com bubble:

If a normal measure is 75-100 for this ratio, this suggests that stock prices are 30-50% overvalued relative to the size of the economy right now. Is it possible that with record unemployment and positive COVID tests trending in the wrong direction, the economy could grow enough to bring this number closer to its long-term average? Like every other time this question has been asked so far, yes, it is possible. However, at some point what is probable is going to win. Even without record unemployment and a global pandemic, we’d be saying probability is going to catch up with the stock market. Factor just those two things in and ignore the shape the rest of the world is in, or how much money the federal government will have to borrow to keep this all going, or that the Federal Reserve is acting in ways to prop this all up that may not even be legal, and the probability of runaway positive stock market returns going forward start decreasing further.

So what is an investor to do when faced with this data? If an investor is going to focus on what is possible right now, it should be how much they could possibly lose by getting more aggressive, not gain. The possibility of a large gain appears too small and the probability of a loss, large or otherwise, appears too great at this time. Over the long term, the avoidance of large losses is mathematically the better way to proceed than trying to reach for large gains. Yes, there are times and situations where exposing some percentage of a portfolio to an opportunity that could lead to outsized earnings can be beneficial, but always within a larger framework of what the probable range of outcomes is for your portfolio such that you never expose yourself to the possibility of too large of a loss. When you feel like you are missing out on large gains, you have to maintain your discipline and remember that you are also reducing your chances for large losses. By managing the risks in your portfolio around the possibility of large losses, and by managing the growth prospects around the probability of large enough gains over time, an investor can create a winning process that has a higher probability of success than exposing him or herself to the large losses that come with reaching for large gains at the wrong time.

So for now, though there are variables that can push the stock market higher, it appears like there is still a high enough probability of stock market losses to make taking more risk seem akin to betting on 34 red. We are probably not yet in the part of the economic and market cycle where the possibility of large gains is high enough to warrant the extra risk, but that day will come. At some point, the possibility of large gains will become the probability of large gains, but it is unlikely during historic unemployment, a newly surging pandemic, and extremely high stock market valuations. If you gear your pre and post-retirement investments around a large percentage of volatile assets are you never going to run out of money? Possibly. If you gear your pre and post-retirement dollars around reducing risks and use a saving and a spending strategy that can work with a lower risk portfolio are you never going to run out of money? Probably.

Editors Note: This article was originally published in the July 2020 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.