The last few weeks have been very unkind to gold investors with the rather choppy upward trend since the beginning of 2016 being called into question with a seemingly day after day drop in price. From a technical standpoint, gold has definitely broken through a couple more recent support levels and is beginning to threaten longer term support. The reason for this drop has been attributed to everything from the stronger dollar to rising rates. There are also those who feel there may be some manipulation at work in the futures markets in an effort to keep gold prices depressed. In the end, it doesn’t much matter since there will always be noise over the short term in any asset class. The important questions are: Does the longer-term case for gold remain compelling and what are the risks and rewards of holding it through the short term in order to get to that longer-term holding period?

In a nutshell, we do feel the longer-term picture for gold is compelling. Given what’s going on in the world with trade wars and currency debasement paired with the relatively cheap price of gold (and other commodities as well) compared to stocks and other financial assets, gold appears to offer much more upside opportunity than it has in quite some time. In the short term, things have without question been bumpy, but there’s data to suggest the recent move lower may be overdone and due for a bounce higher. Here are a few of those data points:

- Sentiment readings such as the Daily Sentiment Index and Commitment of Traders positioning reports are extremely pessimistic, which from a contrarian standpoint usually coincides with a near term bottom in prices

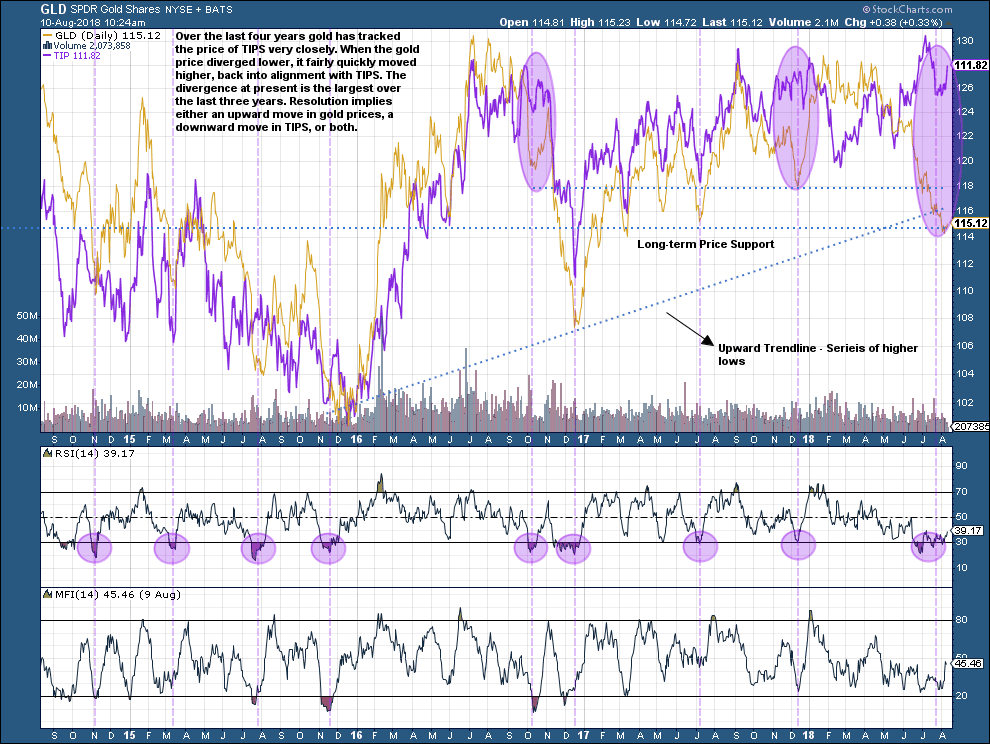

- The Relative Strength Index (RSI) for gold has been very low over the last few weeks. As you can see in the chart below, this also usually corresponds to, at the very least, short-term turning points in price.

- Gold as tracked by the ETF GLD, is currently hovering right near a long-term support line around $115. This is a level that technical traders and price models pay attention to since it represents a price level where turning points occurred in the past. These turning points can also be emotionally relevant due to the fact that they mark that point where investors went from making money to losing it or visa-versa. Decisions tend to get deferred until these important turning points are reached again, thus their importance. As long as gold holds above this level, it serves to support or validate the other technical indicators we’re discussing here.

- Finally, the movement in the price of gold over the last four years has tracked very closely that of Treasury Inflation Protected Securities (TIPS). However, in recent weeks the price movement in gold has deviated significantly from TIPS. This is the largest deviation over the last four years with those previously resolving themselves through a combination of higher gold prices and lower TIPS prices. One could reasonably expect that if this price correlation continues to hold up going forward, that a similar upward move in gold prices should follow. In the chart below, GLD is the gold line while TIPS is marked with purple.

If there’s one thing investors need to understand going forward, and this has been made very clear over the last few years, it’s that there is almost nothing worth investing in today that doesn’t come with some volatility. In other words, if an investor needs to earn a return above that of cash paying around 2% today in CD’s and money market funds, he/she must be willing to accept at times uncomfortable price fluctuation over days, weeks, and even months. Whether we’re talking about traditionally aggressive investments such as stocks or those considered safer such as bonds and gold, in todays markets they will all experience price swings along the way.

The most effective way of dealing with these swings both emotionally and financially is to continually ask the two questions referenced earlier; 1) Does the longer-term case for a particular investment remain compelling and 2) What are the risks and rewards of holding that investment through the short term in order to get to that longer term holding period? For gold, we feel the answer to that first question is yes. (See our June letter “Price Will Matter Eventually”). The trick is making sure to allow for just enough fluctuation to remain invested so that longer term story can play out, but not so much that we incur unnecessarily large hits to our principal. It’s a delicate balance, but given the evidence we’re seeing at this point, we feel there’s still ample reason to carry on and keep focused on that longer-term opportunity.

Of course, as the data change, our opinion will as well. At some point very close to where we’re at, principal protection will take priority over the data regardless of how compelling it is. When and if this happens, we’ll sell out, move to cash, and wait for a better opportunity to buy back into that longer-term picture.