The most recent monthly jobs report came out last Friday and was solid on most counts. The pundits were very excited about it and used it as an example of how strong the economy is and where it’s likely headed. Heck, even the President tweeted that he was excited to see it (an hour before it was released.) So was the strong report actually a good thing? Of course. More people at work earning a living is always a good thing. There’s no debating that. The question is, what does that mean for the stock market and economy going forward? Here’s where we take issue with the narrative coming from financial media and all its players.

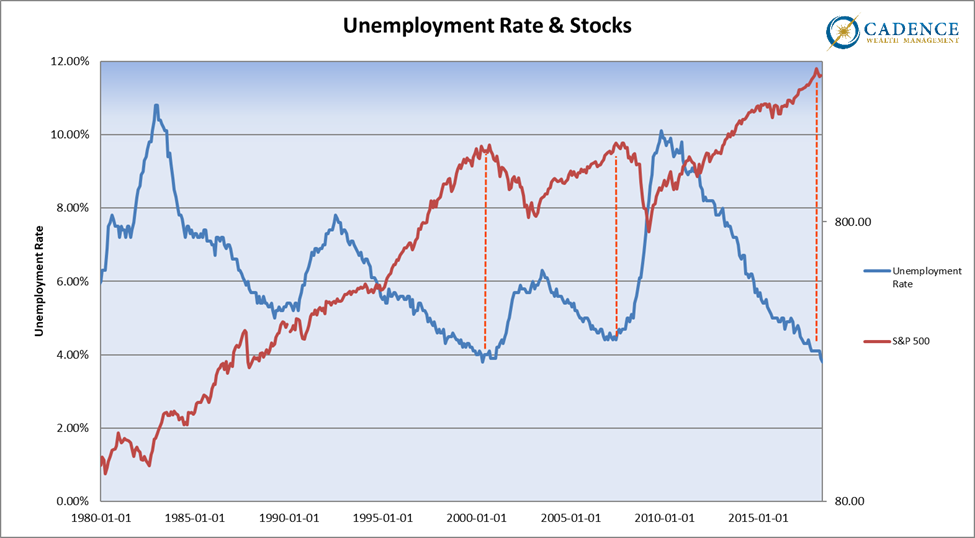

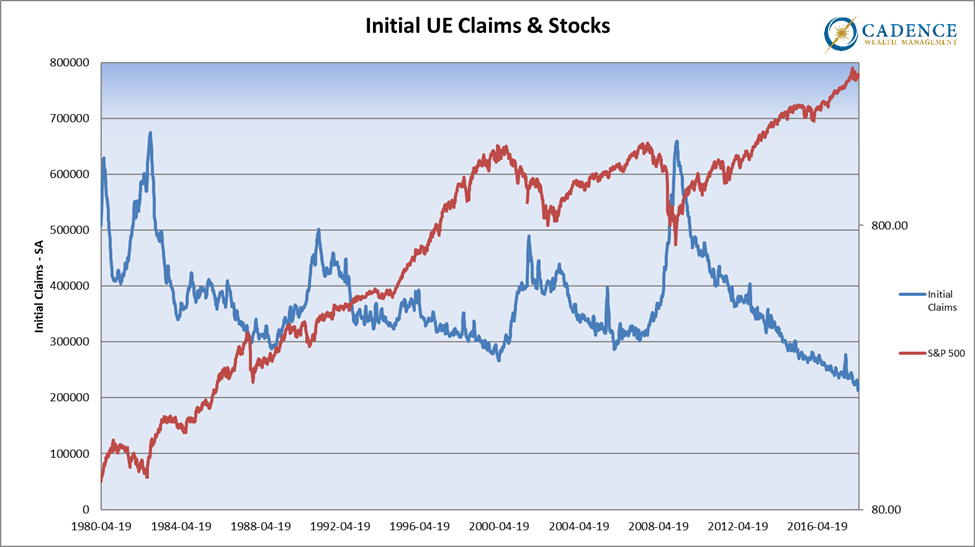

As we can see in the charts below, there’s clear precedent for low unemployment rates and low initial jobless claims being a sign of an economic expansion that is much closer to its end than its beginning. This is neither good nor bad, it’s just a normal outcome of the expansionary side of the business cycle. Once “full employment” has been reached – which is normally defined as the maximum number of people the economy can realistically employ – things tend to happen that sow the seeds of the next contraction such as wage inflation, higher interest rates, investor complacency, etc.

Most important to note, the last two recessions and bear markets began at levels of unemployment and jobless claims above those we’re seeing now. In other words, despite how great it is having greater numbers of people employed, this doesn’t necessarily mean good news for stocks or the economy going forward. These strong employment reports should leave you feeling much more cautious than comfortable.