Since the US stock market bottomed after the Financial Crisis in March of 2009, large cap US stocks have returned around 15% per year. The vast majority of other investment categories have not enjoyed nearly the returns of the US stock market, however as that is the investing area that receives the most media attention, its behavior over the past ten years has shaped a lot of our expectations for what will happen going forward. Our brains have a tendency to assume the conditions to which we have grown accustomed will keep going, a tendency which has been labeled “recency bias”, but the upward part of this investment cycle cannot continue forever.

If the only investors who were assuming the stock market was going to continue paying larger than average gains and not experience a large loss were those with high appetites for risk and enough time to recover from a large downturn, the harm from another crash would be minimized. However, recency bias plagues conservative investors too, and many of them, including those in retirement or close to it, have also been driven far enough by the fear of missing out on large gains to once again expose their investments to a higher amount of investment risk than they can probably afford, just like during the Tech Bubble and the years before the Financial Crisis. Available data backs this up by exposing, for example, how most 401(k) investors, including those nearing retirement, have 70% or more of their investments in stocks as opposed to something more conservative. Fortunately for risky investors, they have been rewarded for taking large risks since the last historic market crash. Unfortunately for those same investors, and for many who do not want to take large risks but have been lulled into complacency by the longest bull run in history, the downside of the current cycle gets closer every day.

And make no mistake, there is a downside to this cycle. Without central bank intervention here and in other countries, it probably would have arrived already. When creating long-term plans and strategizing on how to fund them, investors make assumptions around what their long-term returns will be. Selecting an assumed average return for planning purposes is deceptive, because what we know is that it’s not making 5% versus 7% over time that will determine someone’s ability to afford their goals, specifically retirement, but it’s the pattern of returns over time that matter. A smooth 5% return is far different than a volatile 5% return for one main reason: large losses matter. Avoiding them is the key to longer-term success, far more than the average return over time. We talk about minimizing losses frequently, but let’s look at how sustaining large losses impacts a retired couple’s spending.

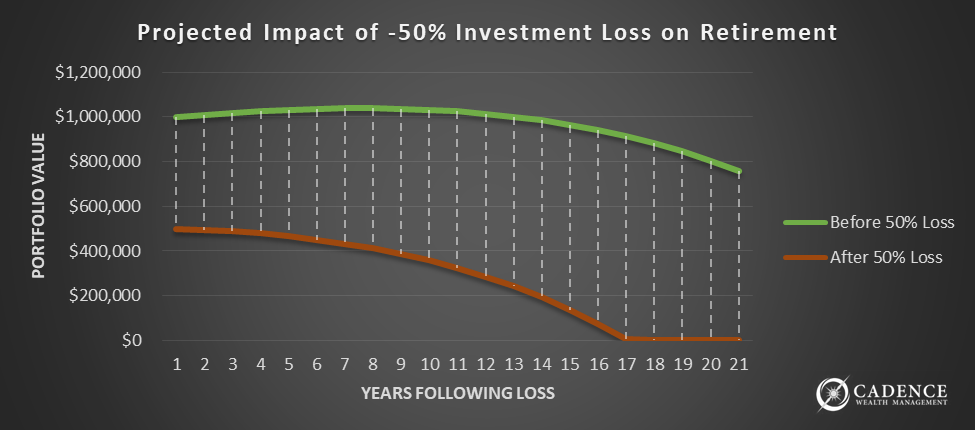

A retired couple with $1,000,000 in investment assets and $40,000 in social security income needs to take $40,000 out of their portfolio to afford their $80,000 per year lifestyle. However, were that portfolio to lose -50%, continuing to take that $40,000 out of their investments every year would jeopardize their ability to pay for their lifestyle throughout retirement:

After such a large loss, it would make sense for this couple to reduce their expenses in order to not take too much out of their investments and threaten their long-term financial stability. An example for this couple would be to also reduce the amount they are taking from their investments by -50%, so taking out $20,000 instead of $40,000 every year.

Were this scenario to happen to you, what would you cut from your expenses? Would it be fun things, like trips, hobbies, or nights out at restaurants? Cutting out entertainment is difficult enough, but how about having to go without everyday things, like going cheaper with your diet, or cutting out one car, or even potentially selling your house to unlock the equity because you just can’t cut enough out of your budget to handle how much you need to take out of your investments? Retirees tend to spend to the level of their means, so even were someone to have more or less to work with than this example’s amount, large losses will dramatically impact their plans.

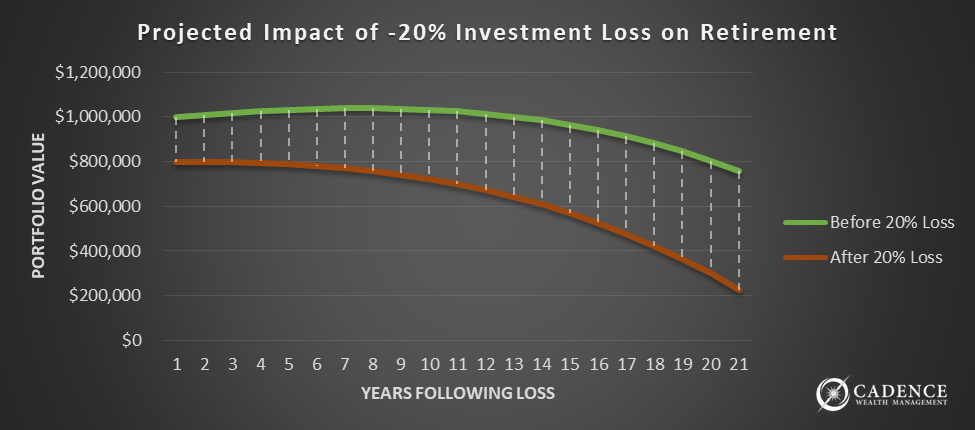

Now consider another retired couple experiencing only a -20% value loss in their portfolio:

Without cutting anything out of their budget, this couple is already in much better shape than the other that lost -50% and has many more years left in their portfolio. However, they could also cut back a bit to compensate for losing -20%, and cutting their expenses by a similar -20% requires them to only cut $8,000 out of their annual budget. How much easier would it be for you to reduce your annual spending by $8,000 as opposed to $20,000? Were neither of these two couples to adjust their withdrawal amount, it’s obvious which couple runs the greater risk of taking too much from their investments to be able to recover from their investment loss.

This is why we have been preaching caution for the past few years. Clients and regular readers of our newsletter know we pay attention to the data that says many investment categories are over-valued and are very susceptible to meaningful and sustained downward pressure. We not only analyzed recent data, but we are also mindful of historical periods where unlike the last two stock market crashes, stock values plummeted but did not bounce back quickly. Though some time periods have had multiple large losses like the 2000’s did, even just one large loss can be “too many large losses”.

Avoiding large losses, especially into and during retirement, is imperative for most people’s long-term plans. Even though there were some years of true discomfort, fear, and sleepless nights within recent memory, recency bias has pushed many conservative investors to buy into the idea the current bull market will continue for longer than it will. There is a downside to this cycle; it really will arrive some day. Avoiding large losses in the face of that downward cycle is the best way to achieve your goals over the long haul.