You may have to account for at least one, but probably more of the preceding issues before and during your own retirement. However, the biggest threat that we can think of is also the one that gets almost no attention in the “biggest threats facing retirees” research we conducted, and it illustrates the need for people to work with a professional more than any of the items mentioned in the preceding paragraphs.

With the U.S. stock market currently enjoying its longest and largest bull market in history, the potential for large investment losses is very high. The last two major market losses, the Tech Bubble Burst and the Financial Crisis, saw stocks lose more than -50% at their worst, however they bounced back relatively quickly from a historical perspective.

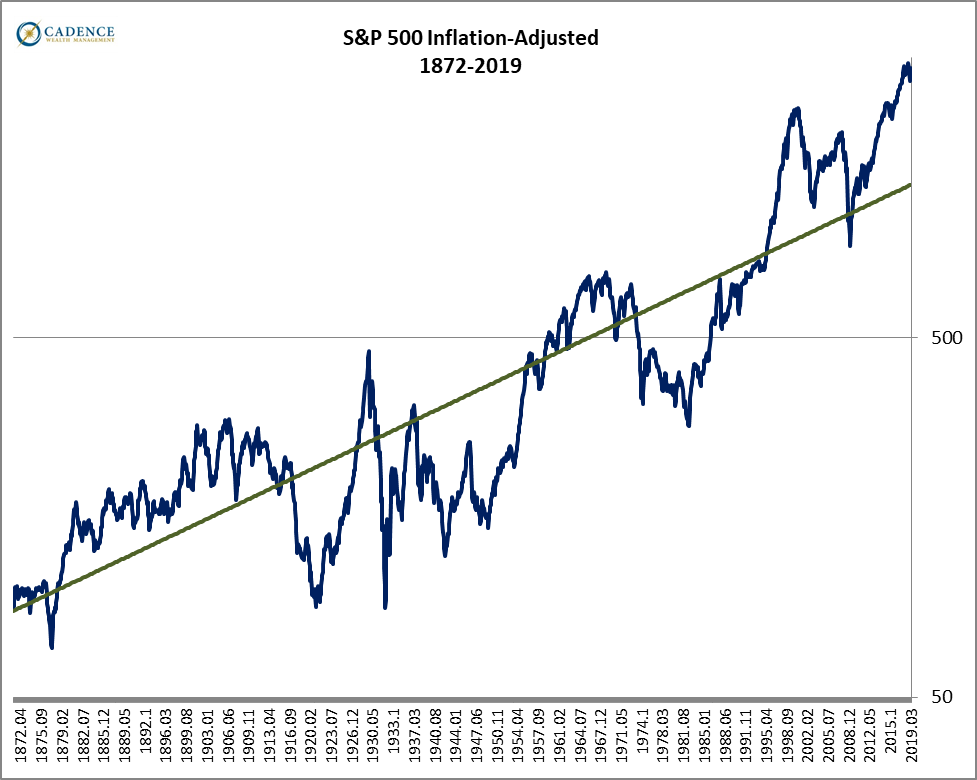

The chart below shows the inflation-adjusted price of the S&P 500 since the 1870’s (in blue) versus its long-term average (in green). The three peaks on the upper right represent the Tech Bubble, the Financial Bubble, and where we are today. You can see with the two previous large losses, the price of the S&P 500 did not lose enough or it rebounded quickly enough to not stay below average for long. This cannot continue. You cannot stay above average forever, and the history of the S&P 500 price moves shows it as plain as day: at some point this bull market will end and we will face a protracted period moving below average.

Just to get back to average, the S&P 500 would either have to lose a little over -50%, or it would have to lose a substantial amount with inflation rising to concerning levels once again. And that’s just to get back to average; getting below average would be an even more stomach-churning combination of those two things.

So while lower than expected investment returns, paying for more and more expensive healthcare, reduced pension or social security benefits, and accessing less home equity than planned are all factors that could impact someone’s retirement in a meaningful way, they do not compare to the prospect of losing half your retirement savings. An investor would have to be pretty aggressively invested to lose that much, and hopefully those close to retirement know better (though we know many, many Americans are currently taking much larger risks than they should), but even someone with only 60% of their investments in stocks would have lost almost -40% during the Financial Crisis of 2007-2009. Most retirees and near-retirees could not financially and/or emotionally handle losing -40%, and the likelihood of reacting to that loss by doing the wrong thing at the wrong time would only compound the problems losing that much would create.

If “safe” investment vehicles were paying more than they currently are, then some of this risk could be reduced, but with interest rates being so low for so long, conservative investors have been tempted to reach for more yield and higher returns by exposing themselves to more risk than they should. When all the stock market seems to do is go up, many other investment areas also appear less risky than they are. Many issues facing retirees are manageable by cutting back here and cutting back there, but large investment losses are a game-over situation for many investors.

All of these conditions highlight the need to work with a professional who can help navigate the dangers currently facing retirees and near-retirees. Identifying these and any other issues that may keep you from reaching your retirement goal, and then strategizing and implementing a solution to these and other issues make successfully navigating these dangers possible. There is an abundance of “What Every Retiree Should Know” type articles out there, but which of their highlighted concerns apply to you? Which of them apply to your parents, or your children? And, what are they leaving out that may be even more important for your specific situation? Although the only certainty with the future may be its uncertainty, we can still reduce the risks of those things most likely to threaten your retirement, even stomach-churning financial market moves. Though we may not be able to predict the future, we CAN plan for it.