On March 22nd we sent a special edition of our monthly Cadence Clips entitled “Was January 26 the Bull Market Peak?” After that S&P 500 peak of 2,873, the index’s value closed at ~2,581 twice: on February 8th and April 2nd. From top to bottom, that’s around a -10% decline. That special edition went on to discuss the existing conditions, like the unhealthy amount of debt-fueled growth over the past nine years, the small number of large company stocks propping up the indices, and the smaller number of stocks making new highs versus those making new lows, which all point to the potential for January 26th to be the peak of the market before some kind of meaningful downturn.

Despite these conditions being present currently, we still cannot say for certain January 26th will prove to be the ultimate peak because the top is never obvious when it happens. No bell rings and there is no consensus among “experts”. Instead, it can seem like business as usual for a while, with those same experts saying “the economy looks strong” and “the recent decline is a real buying opportunity”. That’s one of the problems when trying to plan for Bear Markets: you never know for sure when they’ve started.

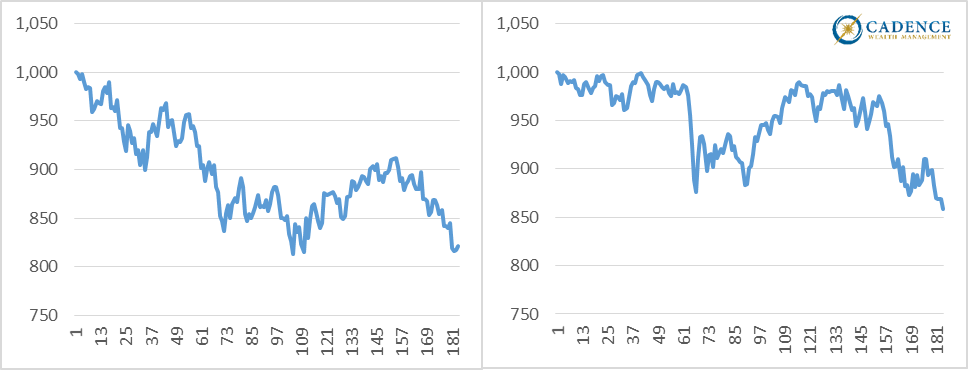

A “Bear Market” is commonly defined as a downturn of at least -20% lasting 60 days or more, so on day 61 we can say “Bear Market”, but that doesn’t mean we could have predicted it beforehand, nor does it mean we should know when it will end and how bad it will get. For example, consider these two graphs showing the falling value of the S&P 500 index over the same number of trading days for two past time periods:

The left graph shows an -18% decline and the right graph shows a -14 % decline.

Can you guess which graph shows the start of an historic Bear Market and which graph doesn’t? Is it the one showing the larger decline over these trading days, or are we trying to trick you and it’s the one that shows the smaller decline? Does one look more volatile than the other, more likely to plunge, or does one seem almost quiet, perhaps too quiet? Tick tock, tick tock. . .

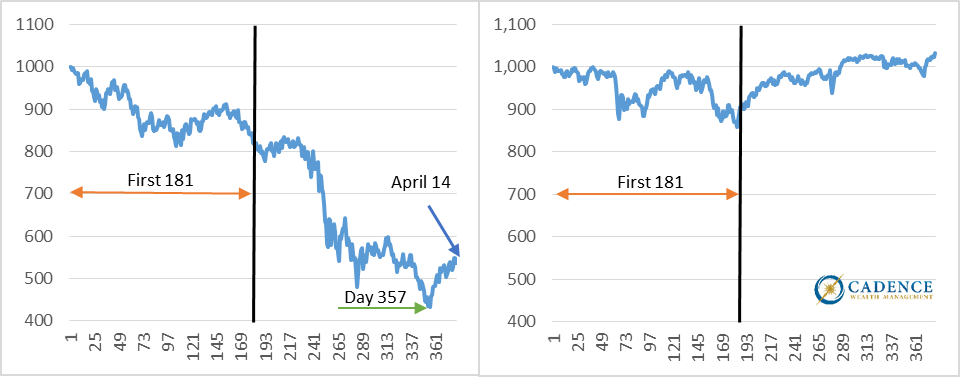

The graph on the left corresponds to the previous left graph and shows the first 181 trading days plus the next 200 trading days. This timeframe starts at the peak of the market in October of 2007, lasts all the way through the market bottom in March of 2009, and includes the first part of the recovery. All told, that was a -56% drop, but who saw it coming when it was only an -18% drop in early July of 2008? The black line marks where the trend line ended on the first graph. Now look at that recovery bounce at the tail end of the line starting on day 357. Given what the graph shows, had you looked at this on April 14, 2009, would you have known the crash was over, or would you have seen the possibility for another failed rally followed by another, even farther market decline? At that time there was no way to know for sure if the market was headed lower again or finally turning up for good.

The graph on the right corresponds to the previous right graph and shows the first 181 trading days plus the next 200. This timeframe starts in late May 2015, continues through the -14.2% market drop, and includes its full recovery by around Thanksgiving 2016. Just like what happened after day 181 on the left graph, there was no way to know at that time where the market was headed and that it would turn up and fully recover. It looks easy, like you should have seen it coming when you see the second set of graphs, but it plays out quite differently in real-time.

Nobody knows when the -5% drop will turn into a -10% correction, which leads to a -20% Bear Market, which is just the precursor to an even larger drop. Even if market declines were straight lines slanting downward, nobody would be able to see the end. Because they’re not straight lines down and have a tendency to bounce around, it’s even more difficult to know what is an actual bottom and the beginning of a recovery and what is just a momentary move higher before another plunge. Now that the 2007-2009 Financial Crisis is almost a decade behind us, it seems like we should have been able to see just how far and how fast the market was going to drop, and when we were supposed to get full-blown aggressive again and take advantage of the entire recovery and following bull market.

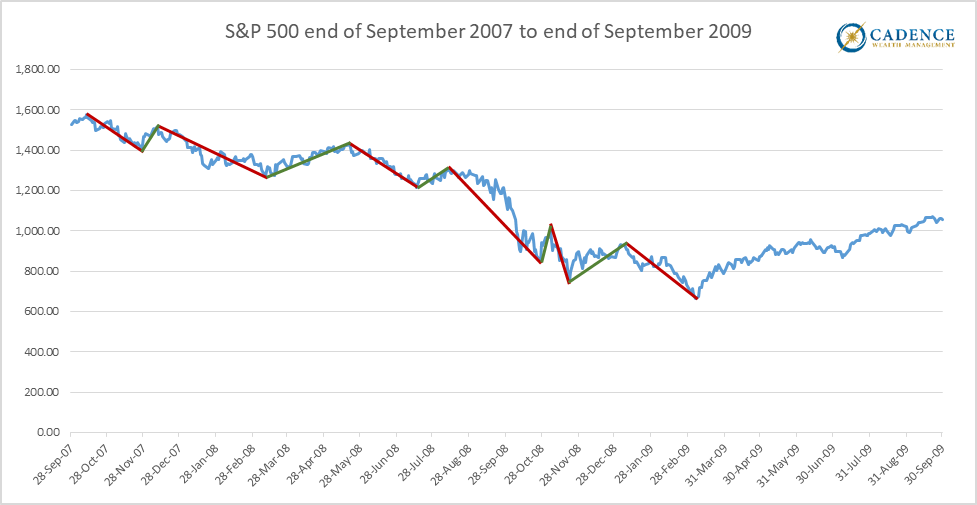

Let’s look at the market moves during the Financial Crisis in a little more detail, as we first covered in our September 2015 Cadence Clips, to revisit why it can be so difficult to see the big drops while they are happening, and why they can be so emotionally difficult beyond just watching some of your investments lose value.

As previously mentioned, the first reason a Bear Market’s severity and duration is hard to spot is that you don’t know when it’s started until it’s actually happened. The second reason is that while the market is falling, it is also rising occasionally, and each rise gives the appearance that the fall might be over. What looks like an obvious decline is actually a series of down and up movements, which is easier to see when identified with red down lines and green up lines. Despite the overall move being severely negative, there were many periods during the crash where it looked like the downward move had stopped and was on its way back up.

These up and down movements also make Bear Markets, especially the big crashes, emotionally difficult to handle at times. Seeing accounts lose value, only to see them seemingly stabilize, and then lose more value can drive a high percentage of investors to make bad decisions at the worst times. It’s scary and confusing to go through that. That’s why many people compare these periods to being on a roller coaster – anxiety-filled downward moves give way to temporary level or even calming upward movements, only to be followed by another stomach-flipping downward plunge. We fear that might be particularly in play the next time around as investors have once again forgotten just how much risk the Market carries, especially at such high valuations. As a result, many investors have gotten overly aggressive, just like in 2007 and 1999, and have not been getting defensive while the storm clouds continue to gather. Investors seem just as conditioned to take heavy losses the next time around as they have been in the past.

However. . .

Believe it or not, these up and down movements also present an opportunity over short periods of time to be temporarily bullish. Even if historical precedent and basic math point toward longer-term downward movements, major downturns provide opportunities to be bullish on stocks long enough to create some gains inside of the big downward moves. Within that 2007-2009, 17-month downward market crash were multiple opportunities lasting months for stocks to make 10%, 15%, even 20% with active strategies able to identify times worth getting more aggressive. So despite how emotionally difficult those up and down movements can be, opportunities to make some hay while the sun shines temporarily can present themselves even during bad Bear Markets, and can benefit your returns.

Getting temporarily more aggressive can help, however it is not as important as having the right strategy going into Bear Markets. For most investors, this means looking at circumstances specific to them, such as how much they can afford to lose and what their allocations are likely to lose in a major downturn, as well as looking at factors present in the market, like stock valuations and other signals that seem to suggest the storm clouds are gathering. If unprepared, especially if the preceding Bull Market has convinced them to get more aggressive, investors can see years of gains wiped out by Bear Markets. The 2007-2009 crash highlights this, as 12 years of market gains were destroyed by the time it bottomed out. An investor’s best bet is to allocate properly and be prepared ahead of time.

It is a fallacy to believe that market peaks can be predicted, and that Bear Market durations and severities can be anticipated. You won’t know for sure when it has started, nor how bad it will get, so you need to protect yourself from losing too much, especially when the conditions are as ripe for an ugly downturn as they are today. That being said, even the nastiest downturns can provide opportunities to benefit from some of the temporary upturns. So preparing for and going through a Bear Market does not mean all opportunities for gains have to be sacrificed. If done correctly, growth opportunities can be exploited. So has the next Bear Market already started? No one knows, but we do know that preparing ahead of time and looking for opportunities while it is happening will get you through the next one.