Key Points:

- Economic growth is still slowing despite the talk of a “soft landing”. Given that inflation will likely pick up in the coming months, this creates an environment where the Fed and government can’t rescue markets like they have in the past (due to the risk of exacerbating inflation).

- The labor force is likely significantly weaker than the low unemployment rate would imply as evidenced by the dramatic rise in the number of disabled workers since 2021 and the negative productivity that exists within the economy. The end result is that economic output per unit of input is weak and likely getting weaker (barring more aggressive layoffs and a deeper recession going forward).

- Stock market indexes are historically expensive on both absolute terms and relative to safer money market and bond alternatives. In the past, this has preceded large market declines.

- Artificial Intelligence (AI) has the potential to increase corporate profitability and economic output going forward, but that doesn’t mean investing in market leaders now will lead to profitable investment returns. This will play out slowly as over-hyped companies will likely fall in price in the next bear market in stocks. There will most likely be better entry points for the popular “AI” names.

What an exciting time to be alive. We have markets that seem to defy logic, social strife that leaves us feeling like we’re stuck in Wonderland with Alice, and new investment narratives making us feel as though everybody else but us is riding the high-speed rail to fast profits. Getting lost in all this is easier than not and it’s worth remembering, especially in times like these, that it’s hard to think when we’re too busy feeling. And so, it’s wise to step back from it all from time to time to assess how much of this is real and lasting versus artificial and fleeting. We’d argue that it’s a combination of both, but history reminds us that long periods of peace, prosperity, and relative ease create complacency, entitlement, and third-world problems that wouldn’t exist in an environment more concerned about the fundamental needs of safety, survival, and carving out a better life through hard work. So, to the extent that the odd constructs around us exist because of recent “easy times”, we’d suggest they are inextricably related and more cyclical in nature. The historic and mystifying rise in markets over the last 13 years has perpetuated, if not helped to create, much of the craziness around us today. For those who thrive in upside down land, we regret to inform you that at some point the financial house of cards will tumble and usher in more sanity and a recalibration of priorities. Thus is the paradox. We need to be careful what we wish for; perpetually rising prices and prosperity often times get us the opposite.

For those who now realize it’s counterproductive to fear, or view as pessimistic, an economic contraction or bear market in stocks, please read on. Below is an honest, data-based assessment of what we’re seeing out there and explains why we’re positioned the way we are with respect to our clients’ portfolios. We take very seriously our responsibility to deliver our clients to a place of financial independence and security and don’t have much appetite for playing fast and loose in one of the most dangerous financial periods in history. Despite the large rally in stocks and the hype around “AI” (artificial intelligence), we remain very cautious. Here’s why:

Inflation

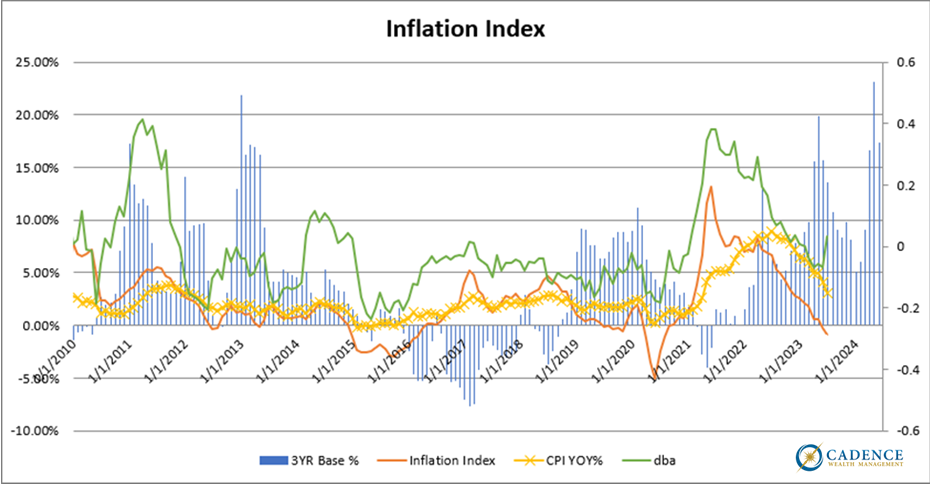

The good news is that inflation has come down quite a bit from its peak. As you can see in the chart below, CPI is right around 3% (yellow) while our price index is actually negative (red). This is what we’d expect in a slowing growth/pre-recessionary environment as demand gets negatively impacted more than supply causing prices to fall. Of note, however, is that we are now out of the easy prior year base effects (blue) which will make a lower year-over-year inflation print harder to accomplish mathematically. For example, if prices stay the same next month as they are this month, but next month they’re being compared to a lower number from the same month one year ago, the annual growth rate will be higher. These falling base effects will persist right into Q1 2024, providing a tailwind to rising year-over-year prices. In addition, commodity prices across the board have stopped falling and seem to be rising again. Food prices are shown below in green, but the same is true for oil. Should they continue to rise, inflation will likely follow given the influence energy prices have on overall inflation rates. The implication of this is that rate cuts, which markets are looking ahead to, would be harder for the Federal Reserve to justify. If inflation ramps back up again, investors will have to grapple with the economic situation at hand without the prospect of a return to easy money. Higher rates for longer, along with higher prices for the consumer, would equal further economic pain. Markets are nowhere near pricing that in.

Growth

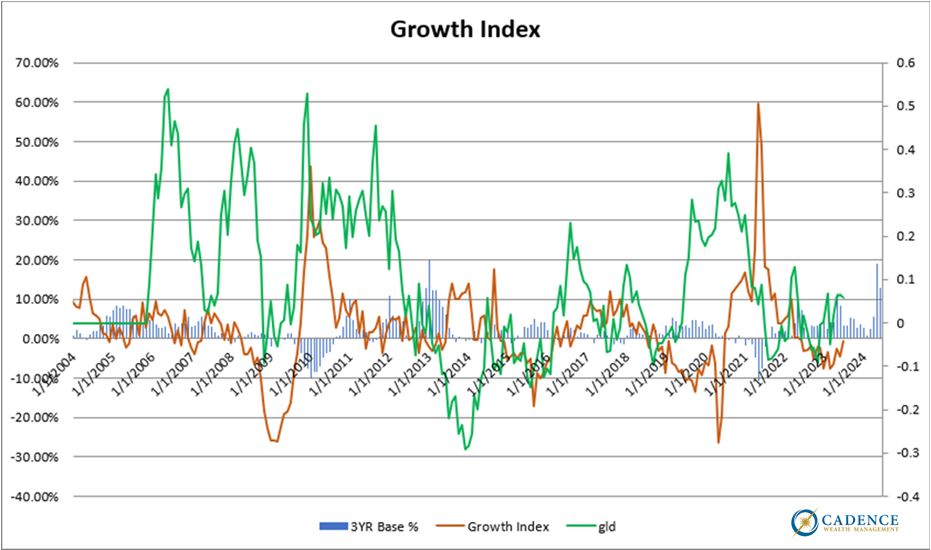

Economic growth has slowed considerably from its peak in 2021. We’re seeing a slight bounce in our index over the last couple months, but this is to be expected given the influence markets have on some of these inputs. Like prior slowdowns, we’d consider this a counter-trend bounce rather than a bottom. It would be really unusual for the economy to stage a recovery with the interest rate yield curve (discussed in the July newsletter last month) still so deeply in negative territory. Growth typically doesn’t resume, nor do markets bottom, until the yield curve is well back into positive territory. Those things also tend not to happen until we see a rise in unemployment.

Productivity

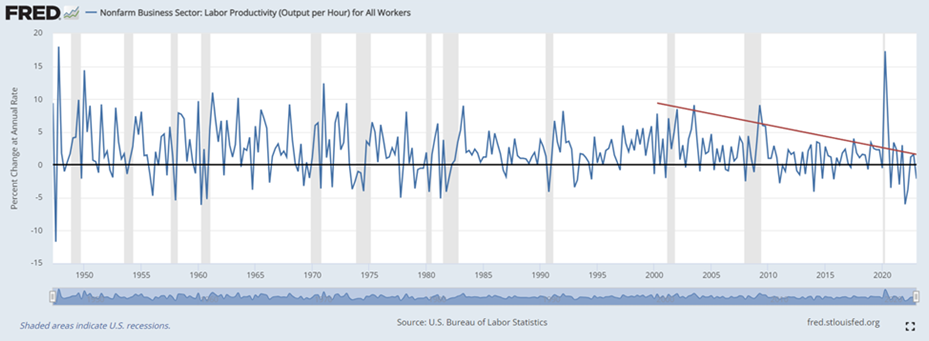

Productivity is defined as the output of something produced per unit of input – that input being a combination of labor costs, materials, capital expenditure, etc. There are two reasons productivity is relevant to the discussion this month: First, it informs our economic forecast, and second, it facilitates a follow-up discussion about artificial intelligence (AI).

As for the economic relevance of productivity, it’s important to note that, all else being equal, it tends to fall toward the end of sustained periods of growth as input costs become more expensive, and it rises again throughout economic contractions as input costs, primarily labor, come down. You’ll notice in the chart below that productivity is currently negative, which consistent with the other data we’ve talked about, suggests that further economic contraction sits squarely ahead of us. Also of note is the red trend line in productivity since 2000 sloping downward. This suggests that our economy is generating less prosperity for each unit of fuel pumped into it. It’s worth considering two ways to address this problem. One, allow market forces to bring down the costs of the inputs sufficiently that productivity rises throughout an economic contraction and beyond. Admittedly, it would require a rather large deflationary event or large-scale recession to accomplish this. Two, technology that can help increase output and/or decrease input costs could help to reverse the long-term decline in productivity. This is where a discussion around AI comes in.

Labor Force

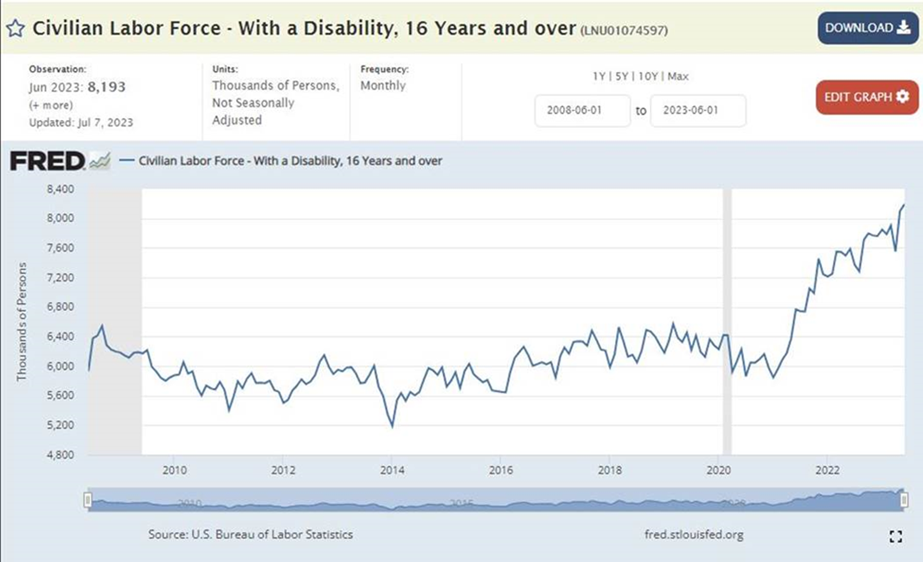

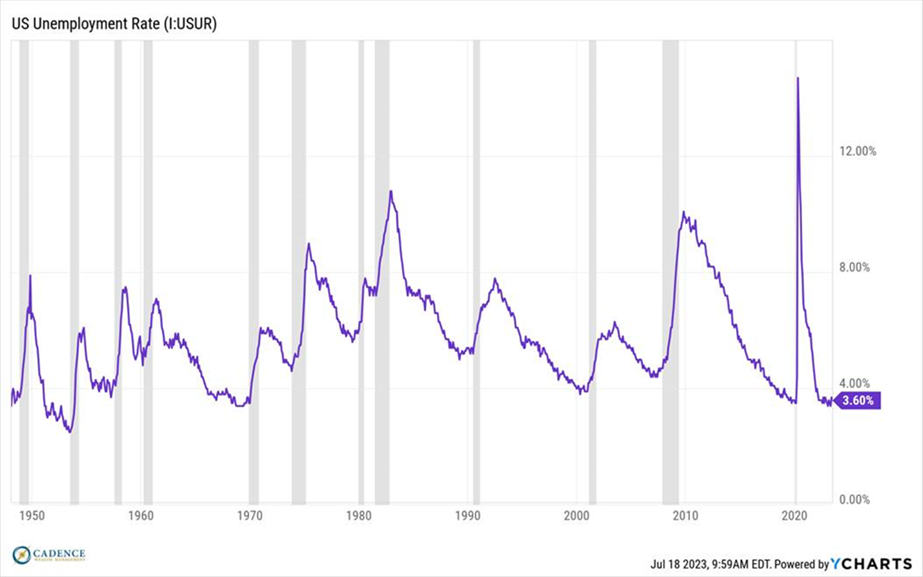

Mainstream discussions around the labor force tend to center around new jobs created in any given month, unemployment claims, or the unemployment rate, but almost nobody in mainstream finance is talking about the chart below from the St. Louis Federal Reserve. What it shows is that since 2021 we’ve seen a very unusual rise in the number of workers over the age of 16 who have become disabled – approximately 2 million. The first question everyone should be asking is the same one a two-year old would; “Why?” We’ll let you decide what factors might be contributing to this dramatic rise in injured workers, but suffice it to say there’s a story here that only gets addressed when folks rid themselves of biases and preconditions and embrace questions with intellectual curiosity and an open mind. We could let someone give us their answer, or we could, with input from many and our own rational distillation, arrive at it with confidence, ourselves. Second, per the chart below titled “U.S. Unemployment Rate”, unemployment is near an all-time low at 3.6%. What if however, those 2 million folks who have become recently disabled were suddenly added to the unemployment statistics? Of course, we know if they’re not actively looking for work, they won’t show up in the U-3 unemployment rate (theoretically would be in the U-6 rate), but they represent a drop in the workforce nonetheless. If we adjusted U-3 for these 2 million people, it would stand at 4.8% rather than 3.6%. That’s a big difference. The point is this: We may in fact have 2 million people considered to be in the workforce who either aren’t currently working or are less productive than they’d like to be. Ideally, these folks get better and we see improved productivity across the economy as a result, but should that not be the case, we would expect the unemployment figures, or at the very least, the labor force participation rate to reflect their dropping out of the workforce. For now, it’s a bit of statistical limbo.

“AI”

Big picture, and somewhat philosophically, it’s important to think about how artificial intelligence will impact the economy and society as a whole. Importantly, and probably most relevant to what we discussed above, AI will undoubtedly address the need to increase economic productivity. If one wants to speculate as to how and why the new AI narrative seemed to rise out of nowhere earlier this year, it wouldn’t be ridiculous to imagine it being spawned to address the recent downward trend in productivity we reviewed above and the potentially huge five alarm fire we currently have with the health of the workforce (also reviewed above) which serves to further reduce productivity down the line. Artificial intelligence is not a new concept, but the force and traction behind the AI narrative today certainly makes it feel as though it is. Regardless, the adoption of more “smart” technology in the workplace should increase output, reduce costs, and therefore increase profitability within corporate America. The flip side of the coin however, are the social costs of this improvement in output at the expense of workers. I think most would agree that to the extent it drives willing and able workers out of the workplace, there would be a societal cost. However, one also has to consider new jobs that don’t exist now as a result of more widespread adoption of AI technology. It’s hard to forecast exactly where those new jobs would be created in a more artificially intelligent world, and whether they would be enough to offset those lost as corporate C-suites look to maximize profit margins, but to the extent markets stay reasonably free and fluid, we would expect some sort of equilibrium to be reached – an AI and employment level that leads to a net societal positive. Longer term, we would expect technological advancements such as AI to be a positive factor in boosting productivity.

Investing in AI

It’s easy to get sucked in to new investment themes when they arrive, especially when the hype behind them is strong. Investors tend to look for the stocks that are most directly related to that new theme and make a couple fatal assumptions in placing their bets.

First, they assume because a company is closely related to or even literally does that thing that’s being hyped, that the majority of the benefits will be bestowed upon that company. For the internet in the late 90’s, these stocks were the dot.coms, software, and hardware companies. For the more recent EV (electric vehicle) craze, the stocks of choice were the EV and battery manufacturers, and for the current AI mania, it’s Nvidia and other chip and software names. The reality is that if a new technology survives and thrives, it will benefit all companies that apply it, not just those that create and bring it to market. Additionally, as a new technology is being developed, competition ensues, and more players appear in the space, it’s very hard to tell which companies will ultimately succeed in carrying the best version of that technology forward.

Second, because most investors tend to congregate toward those most obvious companies, it’s typical for stock valuations to be extremely high. It’s almost guaranteed that by the time you hear about an investment fad, those companies that are the best and most obvious match for that fad are popular, broadly-owned, and therefore expensive. Whether we’re talking about Microsoft in the late 90’s, Rivian more recently (for the EV theme) or Nvidia today, valuations in the middle of a strong narrative-driven theme make it almost impossible to hold onto your profits over a medium to long period of time. See the stock price of Microsoft in the chart below from 2000-2014. Even though the company went on to be one of the most dominant players in the tech and internet space, it didn’t preclude the stock from going down -69% and taking 14 years to recover from its peak in 2000.

So, in thinking about how to invest in AI, consider three things:

1) Where we are in the broader investment cycle. Valuations tend to be highest in those things that are most popular at the end of the investment cycle, and thus, those things that went up the most tend to go down the most when the cycle ends. There may be better opportunities after excesses get flushed out months and quarters down the road and a new growth cycle begins.

2) Consider companies that would benefit from a new investment theme that are further from the epicenter. They tend to be less broadly owned and therefore more reasonably priced. An example we’ve spoken about often is targeting natural resource companies as a way to play the “green” or EV theme without having to feed from the same crowded trough as others.

3) Consider the timeframe that this new theme might play out across. With the internet craze of the late 90’s, it turns out that most of the stocks of companies who ended up dominating that space didn’t recover and start reflecting that dominance until well after 2010. We suspect the same will be true in the end for the dominant EV and “green” companies as well as for those in the AI space. Company success does not equal stock price success when that stock price starts off at obscene valuation levels, which again, they tend to in the middle of a narrative craze. Nvidia is no exception here. If AI succeeds as something that brings tangible net benefit to society, it will make every company that utilizes it better. There will be no shortage of investment opportunities in this respect. In the meantime, if you get an opportunity to take a stab at an industry leader at a reasonable price, such as Microsoft in 2009, it would be well worth the wait. These technologies and themes take years, not months, to play out.

Relative Attractiveness of Stocks – Risk Premium

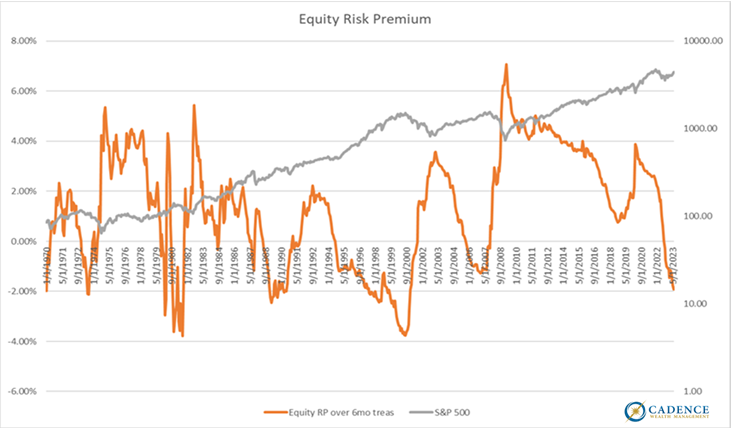

Equity risk premium is the additional earnings yield over a safe risk-free rate one typically gets for taking market risk. It’s generally positive, but from time to time, toward the end of market cycles and in particular, bubbles, that premium goes negative. In other words, investors in the stock market get less yield or reward for taking more market risk. Silly indeed.

The chart below looks at the earnings yield on the Shiller CAPE ratio, which smooths earnings out over 10 years. What you can see is that the Shiller CAPE earnings yield now sits at around -2%; which is to say that earnings from stocks are 2% lower than what you could get on a 6-month treasury bill. The precipitous drop from closer to +4% three years ago is a direct result of short-term rates having risen significantly in recent months. What you’ll also notice is that historically, when the earnings yield drops below 0%, markets tend to struggle if not crater outright (S&P 500 in gray).

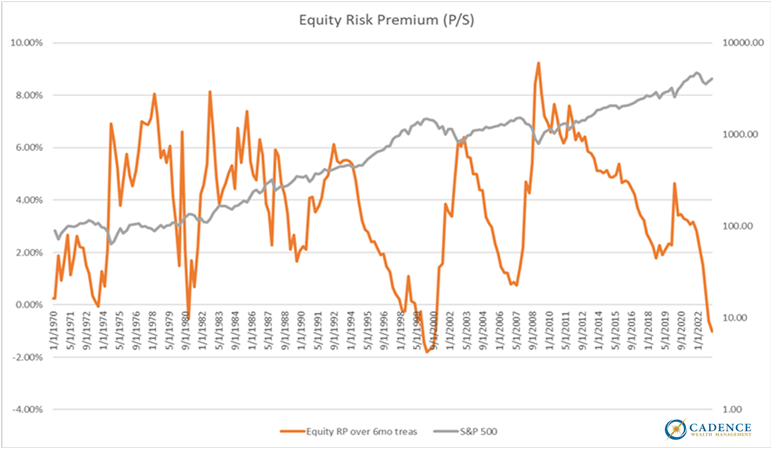

The next chart looks at a current sales yield rather than earnings using the Fed’s corporate gross value-added data divided into the price of the S&P 500. This method removes the effect of inflated “adjusted” earnings, which today makes companies appear about 30% more profitable than they actually are. It also does a better job of smoothing out the volatility in earnings throughout business cycles. Because it’s a sales rather than earnings metric, being below 0% isn’t as relevant as where the metric is relative to its historical peaks and troughs. It’s pretty easy to see that we’re about as low as we’ve been over the last 50 years when comparing equity market value relative to 6-month treasury yields. All prior episodes saw markets struggle before the spread between sales yield and treasury yields improved.

Summary

From an economic standpoint, our view is that there’s a good chance inflation bottoms around now and starts to rise into next year which would handcuff the Fed and exacerbate the slowdown we’re in. Interest rates would have to stay higher for longer, which would continue to pressure the banks and broader financial system. In addition, we have a dangerous and partially hidden trend within the employment picture that could accelerate and weigh on the economy as well in the coming months. All this while corporate profits and productivity sit at pre-recessionary levels and valuations in equity markets are at levels consistent with the onset of large-scale bear markets. So, we remain guarded and protective with respect to our clients’ life savings. This situation isn’t necessarily good or bad. It just is. Sure, for those overexposed to expensive assets, there will be some bad outcomes, and that’s truly unfortunate for those who are unsuspecting. But, like I mentioned at the start, not only are there always investment opportunities throughout full market cycles, but larger societal trends are very much tethered to and correlated with financial markets. With a purging of extremes in one, we’ll likely get some calm and rationality in the other – at least eventually. That, I think most would embrace. In the meantime, let’s continue to empower ourselves with dispassionate, objective assessments and viewpoints, and aim to control what we can.

Editor’s Note: This article was originally published in the August 2023 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.