It’s hard to grasp the significance of a situation that plays out one day at a time over years. Little changes happen periodically and intermittently that get us to a place that eventually looks and feels very different. But, because we were part of those changes along the way, we have to work to shake off the familiarity of the world around us and remember the one that existed before. And, if we reach the edges of our lived experiences, we may lean on historical record to paint an even broader, more objective picture. There are only a limited number of times in modern history where we observe such persistent and dramatic changes over time as to usher in sea changes in thinking around financial markets, social issues, and personal priorities. Neil Howe and William Strauss, in their book “The Fourth Turning”, talk about this phenomenon occurring over cycles spanning roughly 80 years and being largely related to lived and learned experiences and generational memory. Eventually, we forget the lessons learned by those before us and repeat the same mistakes. Human nature almost guarantees it. Humbling as it is to admit, we are no different today in terms of our fears, desires, motivations, or collective wisdom than our predecessors. Regardless of the technological differences between generations, we will continue to make similar mistakes.

Strauss and Howe make a compelling case in talking about these “fourth turning” points in history, which Howe continues to assert, we are in the middle of now. The concept of difficult periods every 80 years or so makes intuitive sense and aligns very well with what we see in financial markets looking back hundreds of years. What’s most interesting to me is how closely related long financial market cycles and their extremes are to social developments and their extremes. The reality is that the world doesn’t function without money at the center, and because humans are generally motivated to acquire as much of it as possible, the structure of monetary incentives and conflicts of interest tends to influence social change over time. For example, in the 1920’s easy credit and monetary policy helped to drive financial markets dramatically higher while simultaneously increasing the wealth divide between the haves and have-nots. This in turn affected political points of view that played a big role throughout the subsequent Great Depression period of the 1930’s. As normal as the 1920’s may have felt, for those fortunate enough to be in the right social “class”, in hindsight it turned out to be a very extreme period of time – one that Strauss and Howe would categorize as a Fourth Turning period that led to the broad sea change of the Great Depression.

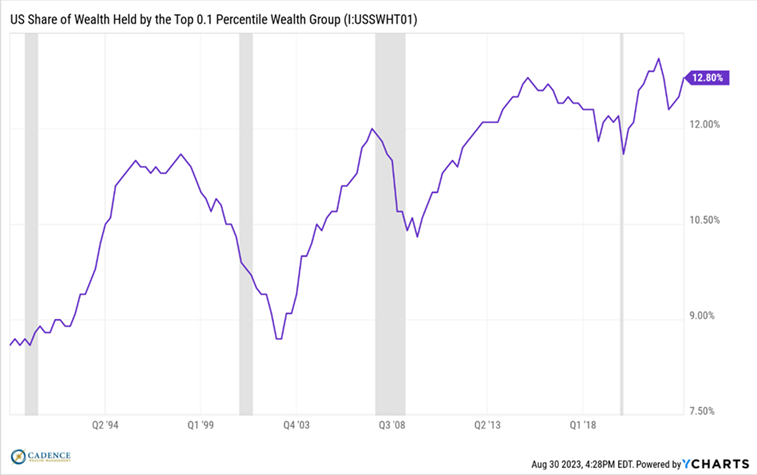

A bit more than 80 years hence, we sit in an eerily similar spot. Historically easy money and credit spanning over a couple decades have led to financial market valuations that are even more extreme than they were in the late 1920’s. We’re also seeing a nearly identical and historically large wealth divide between the richest Americans and the rest, and the social issues being prioritized and fought over seem both very unusual and very heated in relation to those that have been more customary across time. Just like financial asset bubbles, we don’t necessarily see or appreciate them in the moment, but when we woke up this morning, we woke up in a world that is dramatically different than what history would consider more typical.

(The chart below shows the percentage of U.S. wealth held by the top 0.1% of the wealth strata near long-term highs at 12.8%. Also note significant rebalances in this wealth distribution taking place in and around economic contractions in gray.)

We often talk about and take questions centering on the possibility of this being the “new normal”. What if markets stay perpetually expensive, the wealth gap permanently wide? Expensive and wider for a day, week, or year longer than today, sure, but eventually the cycles of life play out. Extremes beget extremes, and one Fourth Turning ushers in sea change or paradigm shifts that start the cycle all over again. Mistakes made, lessons learned, rinse and repeat.

What happens in financial markets when the last drop of profit is squeezed from the fruit? What if costs have been cut as far as they can, the consumer no longer has the capacity to buy more widgets, and business growth going forward is no longer assured? Simply put, this is an environment where investors see no opportunity for return.

Speculators may continue to gamble while markets are rising, but investors are taking a hard pass. It’s this situation – a market bubble driven exclusively by speculation – where falling prices perpetuate falling prices. Throughout this process and over time, the wealth gap shrinks, personal priorities change, and collective sea changes begin to occur. Thoughts on markets change in wholesale ways, the role of government in providing support and backstops and to whom changes, and the list goes on. This is the lifecycle of a multi-generational extreme and we’re smack in the middle of it.

The most important thing to us at Cadence in understanding the enormity of this is not discounting the impact it could have on our clients – not getting sucked into the sleepiness of it all and the trap of feeling like just because it’s played out slowly over years that it’s completely normal. It’s not. The most important and constructive question we can ask is what to do about it and how to best prepare. Although far from easy to carry out, our thinking is relatively simple:

- Avoid those investments and assets that don’t make investment sense (are in a bubble). Over time, we are nearly guaranteed to lose money by paying too much for something regardless of how much we make in the near-term.

- Keep speculation to a minimum. When bubbles pop, speculation gets destroyed. A good idea at the wrong price at the wrong time can go to zero.

- Stick to assets that make good investment sense. This often means an attractive return on investment from both a profit and dividend perspective. If the investment goes down in price for a period of time, the dividend and ongoing profitability of the company or investment can help one ride out that period of volatility.

- Don’t reach for yield. Companies or investments paying too high a dividend yield or interest rate are often in financial trouble. If you lose a good amount or all of your principal investment, it doesn’t matter how high the dividend or interest rate is.

- Be patient. Just because speculative bubble assets haven’t popped yet, and the more attractive long-term investments haven’t been broadly recognized, it doesn’t mean the process isn’t underway. These things take time. Old habits die hard. Think about it in terms of risk. If the risk in a speculative investment is excessively high, then that’s it. The risk can’t and shouldn’t be taken, period. Forget about it, move on and let someone else play that game of musical chairs.

- Broaden your personal knowledge base, skill set, and overall value proposition. People tend to define themselves in terms of their profession, which oftentimes is highly specialized. The reality is that life is multi-disciplinary. When and if things get difficult as they have in prior Fourth Turning periods since the founding of the United States of America, one’s ability to understand the changing world around them, adapt to it, and function in a way where they are broadly productive and able to bring value to the community is crucial. We suffer from the myopia of specialization today which creates a narrowness of competencies and views. In an information-age world where one could literally acquire the equivalent of a college education and beyond in anything they wish within weeks or months at virtually no cost, there is no excuse for not seeking the knowledge one desires. We have never been more empowered in this respect.

Along those last lines, some of our clients take an interest in financial markets, the economy, and the complexity of it all, which we welcome wholeheartedly. That’s not to say that we don’t have fantastic clients who find it all very dull, but it speaks to the collaborative aspect of a successful relationship. Although we love and take our profession very seriously, and have dedicated countless hours toward educating ourselves on these matters in order to do the best we can for our clients, we don’t have a monopoly on it. Anybody, from any walk of life, can take an interest in financial history, economics, and markets, learn about them, seek to understand them, and aspire to place themselves and their loved ones in a better position. This mindset of empowerment, collaboration, and community is not only what makes life more rewarding and enjoyable, but gets us through difficult times. This is our goal at Cadence – to help foster that community mindset as we strive to take the most productive financial steps forward in leading fulfilling lives. There will be a sea change in how people think about markets, money, and life matters ahead. We’ll traverse it together.

Editor’s Note: This article was originally published in the September 2023 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.