There is no such thing as a “market” crystal ball, or a perfect indicator, measure, or data point, but if we were to pick one tool from our “market conditions toolbox” to give us a sense of potentially imminent risk present in the stock market and broader financial system, it would probably be the Hindenburg Omen metric. We spoke about this briefly in our May Cadence Clips newsletter, but given the importance of it coupled with the fact that we’ve tacked on more than ten additional Omen days since then, we figured we’d bring it back into consciousness.

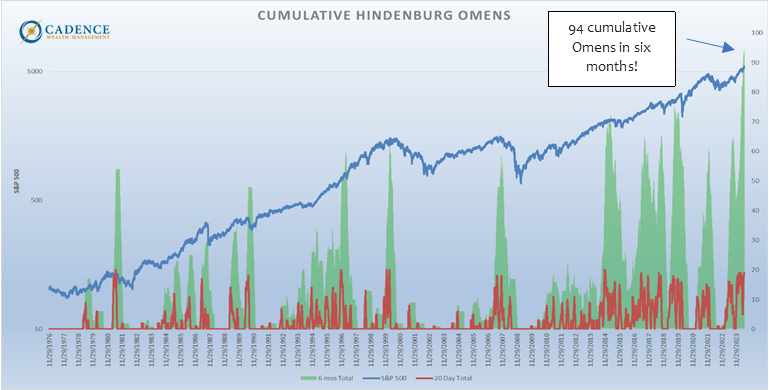

Popularized by Jesse Felder of The Felder Report, the metric essentially tracks the total number of days over a period of time when there are both a minimum number of companies on an exchange making new highs and new lows on the same day. In other words, it keeps a tally of those days where there are completely divergent sentiments being expressed by investors across different parts of the stock market. Although there are variations of this metric, we count these divergent days when the market is higher than it was 50 trading days ago, and has both 1.5% (we also use 1.75%) of the Nasdaq exchange making new highs and new lows on the same day. We look at the six-month count total (green on chart on the following page) as well as the twenty-day total (red on chart).

We also wrote about the Hindenburg Omen indicator in our January 2022 Clips newsletter, where we called out the spike in both the short and longer-term Hindenburg counts. As it turned out, the market peaked within days of that Clips discussion and proceeded to lose ~-25% into October of that year. We don’t expect to be that lucky this time, but the indicator succeeded in reflecting the market risk that ended up playing out over the next three quarters. What’s not hard to notice in looking at nearly fifty years of data, is that while not every spike in Omens led to big market drops, almost all of the major tops in the market were preceded by spikes in Hindenburg Omens. This is entirely consistent with how we define risk – it doesn’t mean something bad is going to happen for certain, but rather that the probability of it happening is higher than usual. It seems reasonable to view this indicator as a measure of conditions, that when present, represents the potential for trouble. It becomes increasingly useful to us when looked at within the context of other economic and market indicators. For example, when economic conditions are weaker and/or trending weaker, inflation and interest rates higher than they have been, and market valuations stretched, we interpret there to be much more investment risk than if we saw an Omen spike without those things being true. It’s worth noting, all those things are true right now. Finally, it’s hard to ignore the record level of Hindenburg days that have piled up over the last six months. Ninety-four for the Nasdaq, which is a good deal higher than two months ago, or at the prior peak observed just before the harrowing Covid market drop in early 2020.

So, what does all this mean? Simple. Buckle up. We may not need the seatbelt over the next week, month, or quarter, but there’s a pretty decent chance that we will. Conditions are ripe. For our clients wondering if we’ve already clicked in – we have.

Editor’s Note: This article was originally published in the July 2024 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.