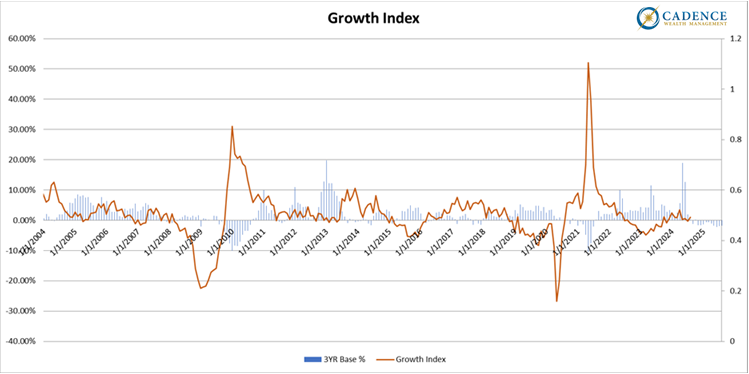

The economy, when looked at through a number of activity and production-based data points other than just GDP, decelerated substantially from its peak in 2021, seems to have troughed last year, and has risen modestly since then. We can say, in looking at our index of economic activity below, that although overall activity doesn’t seem to be weakening meaningfully in recent months, it’s anything but robust. Our index puts us right around the flatline, reflecting stagnation.

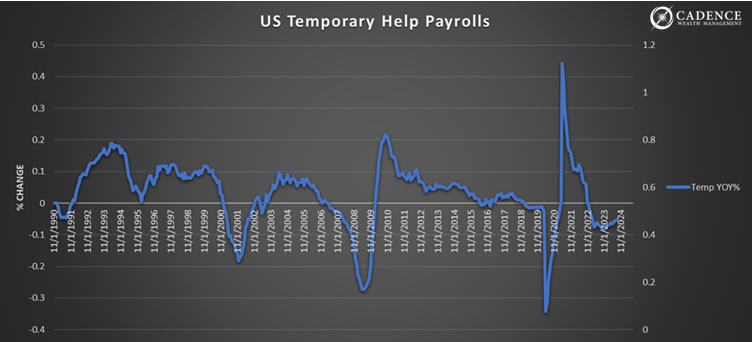

What’s important to note, however, is that the popular definition for recession is when unemployment rises to match the underlying economic weakness. On this front, I have two points to make. First, the Bureau of Labor Statistics every year makes one big adjustment to their non-farm payroll numbers that are reported every month – the numbers that have been oddly resilient over the last year or so. Generally, those adjustments average plus or minus 0.1% of the total number of jobs/employed in the U.S., so roughly 165,000 jobs are either added to or taken away from the BLS’s best guesses throughout the year. That adjustment tends to happen each March for the prior 12 months. Just last week, the BLS announced – quietly – that it overestimated the number of new jobs in the most recent 12-month period by 818,000 and will thus be making a downward revision next March by that amount, about 5x greater than the average revision, and the largest since 2008. Make of that what you will, but the implication is that the jobs market was substantially weaker than most thought. Had those numbers been reported more accurately, many would have viewed the economic state of the union much less optimistically.

The two charts that follow, which we’ve highlighted in recent months, have gone a long way toward reflecting that reality. Temporary help and full-time payrolls have been in contraction for months and still are – a circumstance that historically has closely corresponded to recession and poor financial market performance.

Whatever’s keeping markets buoyant isn’t the economy, but it could be the misguided perception of a strong economy. This is a fragile construct. Despite how well tech stocks and some other stock categories have performed recently, this is an environment that generally favors defensive asset classes. Our suspicion is that this time will be no different once reality catches up with the masses. Anyone telling you the economy and employment picture is great is most likely conflicted and incentivized to say such things.

Editor’s Note: This article was originally published in the September 2024 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.