We have any number of risks to manage in our lives. When it comes to our financial well-being, few risks make us feel as nervous as a banking crisis. In 2008 it was revealed that many financial institutions owned worthless mortgage-backed securities, which sent financial markets around the world into a tailspin. Historically, however, most bank failures were caused by good old fashioned, “It’s a Wonderful Life” style runs on the bank. What makes bank runs scary is that we all know the bank doesn’t have all of our money on hand, as they’ve loaned as much as they can to others, or, especially lately, they have invested the cash as opposed to loaning it out. If everybody tries to pull all their cash out at the same time, banks can only pay out so much before they don’t have enough to cover the remaining requests. Bank runs used to be a lot more common, and to try to mitigate them some requirements were put in place, like the Federal Reserve required reserve ratio, as well as other banking industry regulations.

Currently, banks are required by the Federal Reserve to hold 0% of their deposits in reserve. Historically, that ratio has fluctuated between 0% and 10%. As of 2020, to spur economic growth, the Federal Reserve dropped the reserve requirement to the lowest it could go. However, as of the 2008 financial crisis, banks are required by industry regulations to hold enough cash and liquid assets to cover estimated fund outflows for 30 days. “Fund outflows” is an estimated amount calculated by each bank and is essentially a self-administered stress test that aims to anticipate market-wide shocks and make sure that financial institutions possess suitable liquid assets to ride out any short-term liquidity disruptions that may plague the market. There’s some comforting news in there: though the Federal Reserve is not currently requiring banks keep anything in reserve, banks are still obligated to keep some amount in reserve to handle some amount of short-term outflows. The less than comforting news is that in the event of a run on any one bank, this may not be enough.

The FDIC

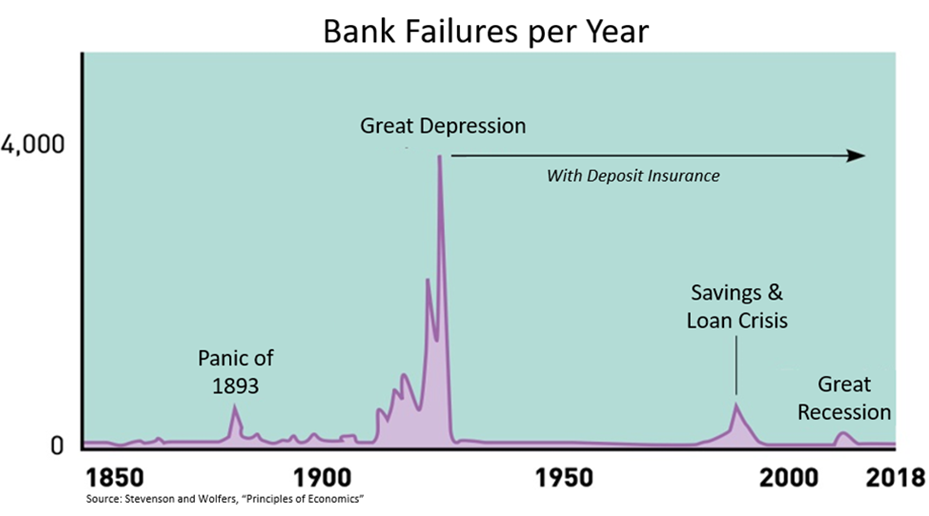

President Franklin D. Roosevelt signed the Banking Act of 1933 into law in June of that same year, which among other things created the Federal Deposit Insurance Corporation, referred to since as the FDIC. The FDIC receives no Congressional appropriations – it is funded by premiums that banks and savings associations pay for deposit insurance coverage. Bank runs are self-fulfilling prophecies, as when people are afraid a bank will fail, they pull their money, and the bank fails. Had the depositors not been afraid of failure, they wouldn’t have pulled their money and the bank wouldn’t have failed. The entire system is built on depositor confidence, and the Banking Act of 1933 was passed to try and restore the confidence lost in the banking system during the bank failures of the Great Depression.

To instill this confidence, the FDIC insures trillions of dollars of deposits in U.S. banks and thrifts – deposits in virtually every bank and savings association in the country. The intention of the Banking Act was to restore depositor confidence by guaranteeing they will receive at least a minimum amount of their money back in the event their bank fails by providing depositor insurance across certain kinds of ownership categories. The products that receive FDIC protection include checking accounts, savings accounts, money market deposit accounts, and certificates of deposit. You can see that since deposit insurance was introduced, there have been far fewer bank failures:

Deposit Insurance

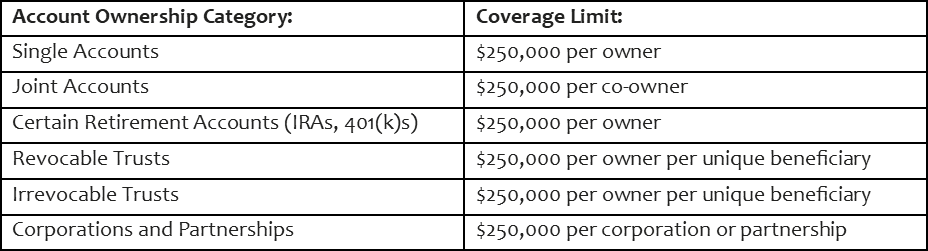

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. Since the start of FDIC insurance on January 1, 1934, no depositor has lost a penny of insured funds as a result of a failure. The FDIC insures deposits only. It does not insure securities, mutual funds, or similar types of investments that banks and thrift institutions may offer. Those will be addressed later in the article. The FDIC recognizes many different ownership categories, and as such, individual investors can receive more than a million dollars of FDIC insurance on their cash investments per institution provided the investments are spread amount multiple account categories.

The most common account types that receive separate FDIC insurance are:

Examples of FDIC insurance limits and coverage in a single institution:

- Single investor who has cash positions of:

$50,000 in a checking account

$125,000 in a savings account

$100,000 in a CD

$50,000 in cash in an IRA account

$25,000 in cash in a second IRA account

This investor would receive $250,000 of FDIC protection for the $275,000 that is in the checking account, the savings account, and the CD. This investor would receive a further $75,000 of FDIC protection for the cash in the two IRA accounts. If this investor were to shift at least $25,000 of the cash in the individual accounts that are not fully covered by the FDIC $250,000 limit to another bank, they would receive a further $25,000 in protection and thereby protect all $350,000 of their cash.

- Married investors who have cash positions of:

$100,000 in spouse 1’s checking account $75,000 in spouse 2’s checking account

$100,000 in spouse 1’s savings account $150,000 in spouse 2’s savings account

$100,000 in spouse 1’s CD $50,000 in spouse 2’s CD

$250,000 in spouse 1’s IRA account $350,000 in spouse 2’s IRA account

$25,000 in spouse 1’s 2nd IRA account $500,000 in spouse 2’s C-Corp account

$350,000 in a joint checking account $200,000 in a joint savings account

Firstly, yes, I know, that is an incredible, barely believable amount of cash. It is highly unlikely we would ever advise anyone hold so much cash, especially in highly inflationary times without some very compelling reason. However, for illustrative purposes, these investors would receive the following FDIC protection:

Spouse 1 would receive the full $250,000 protection on the checking and savings accounts, as well as the CD, as those are all considered under the same ownership category. However, there is $50,000 between those three investments that would not be protected unless spouse 1 moves enough cash to another bank. Spouse 1 would also receive the full $250,000 protection on the IRA investments, but would leave $25,000 unprotected.

Spouse 2 would receive the full $250,000 protection on the checking and savings accounts, as well as the CD, but $25,000 would be unprotected. Spouse 2 would also receive the full $250,000 protection on the IRA investments, but would leave $100,000 unprotected. Lastly, spouse 2 would receive $250,000 protection on the cash in the C-Corp account, leaving just as much unprotected.

There are two joint cash assets, a checking account and a savings account, for which they would receive $500,000 of protection, as each of them receives $250,000 protection on joint assets. This would leave $50,000 unprotected.

In the end, with the account ownerships and assets structured as they are, this couple would receive $1.75 million in FDIC insurance, but would lose $500,000 of cash in the event of this bank’s failure. All they would have to do is start doing business at a second bank and they would be able to fully protect the rest of that $500,000.

What Is, and Isn’t, Protected in Your Accounts at Charles Schwab?

These examples are well and good, but what’s the reality of your situation with your Charles Schwab assets? You receive no FDIC protection from Cadence Wealth Management because you actually do not need to. Cadence is not the entity that holds your investments. We partner with Schwab who holds assets on behalf of our clients, and as such, our clients receive their FDIC protection on the cash-based products they hold in their Charles Schwab accounts.

Cash-Based Products

Cash you hold in your Schwab accounts is afforded the FDIC protection described previously. Individual, joint, IRA, and trust accounts all have their own ownership category and all the cash held in the various account types are added together for the purposes of protection. If you have three IRAs at Schwab, you receive one $250,000 protection amount across those three IRAs. It’s not the number of accounts you have, it’s the number of different ownership categories represented by those accounts. If you have an individual account, a joint account, an IRA, and are the beneficiary on a trust account, that’s $1 million in FDIC protection divided into four different $250,000 amounts – one for each account type.

CDs are treated differently when owned in a brokerage account as opposed to at a bank. The CDs bought in your Schwab accounts are usually issued by different banks. As long as the CDs are FDIC insured, they will receive up to $250,000 per CD per issuing bank. So, a Schwab account with 4 $250,000 CDs all from different banks will receive a total of $1 million in FDIC insurance. Along with frequently giving investors access to CDs with higher rates, increased FDIC insurance potential is an advantage of owning CDs in a brokerage account, like our clients’ accounts at Schwab.

But what about your non-cash investments? What about your mutual funds, your individual stocks, your ETFs, your closed-end funds, and the rest? The FDIC insures cash products, but not securities. In the event Schwab or any other institution failed where you had accounts that held securities, what would happen to those investments?

Non-Cash Securities

The non-cash securities that Cadence investors hold most often in their accounts include mutual funds, money market mutual funds, exchange-traded funds, individual stocks and bonds, and closed-ended funds. I cannot speak to institutions other than Schwab, but as far as Charles Schwab is concerned, your securities are held separately from Charles Schwab’s assets. After all, they’re your assets, not Schwab’s. As such, your assets are protected from any of Schwab’s would-be creditors should Schwab ever encounter its own potential failure, as extremely unlikely as that is.

Investors used to receive physical stock certificates that showed how many shares they owned. When you purchase a security now, as it has been for a long time, the institution that has your account holds those investments for you in what’s called “street name”. The security is registered in the name of your brokerage firm on the issuer’s books, and your brokerage firm holds the security for you in “book-entry” form. “Book-entry” simply means that you do not receive a certificate. Instead, your broker keeps a record in its books that you own that particular security. In this way, any security you own in a Schwab account is considered an asset AT Schwab, but not an asset OF Schwab. There is a third party, known as the Depository Trust Company, that also records your ownership in any security. In this way, there are multiple parties that know you own what you own, which helps further safeguard your ownership of those assets. If you own shares of stock that are held at a brokerage that goes out of business, that does not mean those shares of stock are destroyed. It just means the DTC would step in to help a new record keeper record those shares for you.

There are enough moving parts to what goes into buying, holding, and selling securities that identifying each thing here would make for a pretty effective sleep aid. What is important is for you to know that were something to ever happen to Schwab to threaten it as a going concern, as incredibly unlikely as that would be, the investments Schwab holds for you are held separate from their own assets, are 100% considered your assets and not theirs, and parties outside of Schwab know that you own those assets as well. If you own 100 shares of mutual fund ABCDX and Charles Schwab fails as a business, you still own those 100 shares of ABCDX and the custody of those shares would be moved to a different firm. You would be 100% safe in that investment in that scenario.

If Fraud Were Involved

In the event you have securities go missing from your account at a failing institution, which is far more likely to occur at a much smaller institution than Charles Schwab, there is another form of protection that would spring into action. This protection is offered by a non-profit organization known as the Securities Investor Protection Corporation, or SIPC. In the event you have securities go missing at a brokerage institution which fails, the SIPC will protect up to $500,000 per ownership type account. “Ownership type account” here is similar to the different ownership types protected by FDIC insurance. Ultimately, SIPC protects against fraudulent activity. An institution can fail without investors needing SIPC protection, as they may have no securities go missing from their accounts. In the event a brokerage fails AND securities go missing, the SIPC steps in to help investors. Considering how Schwab separates client assets from corporate assets, and how client accounts are administered at Schwab, it is incredibly unlikely SIPC insurance would ever have to be a factor for investors at Schwab. It is one of the advantages of having Schwab custody investment assets, and one of the reasons we chose them to hold client assets on their behalf.

But What Happens If the Mutual Fund Company Itself Goes Out of Business?

Our previous examples were about Schwab being the broker who holds the assets for you, but what about the actual mutual fund company itself? We know that if we own stock in a company and that company goes out of business, we will more than likely lose 100% of our investment. But what happens with mutual funds?

Luckily, owning a share of a mutual fund does not mean you own a share of the mutual fund company, nor does giving money to a mutual fund company to invest for you mean that money is at risk if the company fails. The money you’ve invested in the “DeBothCo Special Equity Fund” for example, ticker ABCDX mentioned earlier, is safe even if DeBothCo goes out of business, like Lehman Brothers did in 2008, or if the company needs some kind of special federal bailout or other such deus ex machina, as Merrill Lynch did. There are multiple levels of protection. First, you’re actually a shareholder of the mutual fund not a depositor in the mutual fund company, and as such your money isn’t an asset of the fund company itself. The securities inside the mutual fund – stocks, bonds, others – are held in a custodial account separate from the mutual fund company’s assets. It’s similar to how your assets AT Schwab are not assets OF Schwab. Second, you and all the other shareholders in the fund actually own the securities inside the fund; the DeBothCo mutual fund company does not own them. Third and last, on top of all of that, mutual fund companies carry mandatory insurance. As a result, based on how the securities are owned at the mutual funds, plus the mutual fund assets being segregated from the mutual fund companies’ assets, plus that insurance, you would not lose your mutual fund investments in the event the mutual fund company itself went under. Another financial institution would likely swoop in and manage the mutual fund assets. It would turn into the “ClarkeCo Special Equity Fund”, for example, and you would become a shareholder of it. By the way, DeBothCo is a well-run shop. Tight as a drum. So no need to worry about ABDCX. I’m familiar with upper management there.

What Does the Future Hold?

Thousands of years ago, people who looked pretty much just like us got up every day, hunted and foraged, protected themselves from predators, and looked for and maintained shelter from whatever elements were present for that particular season – snow, rain, sun, whatever. Get too old to hunt or forage, break an ankle, fail to hear the saber tooth sneaking up behind you, and that was it. They had to manage those kinds of risks every day to live their lives. Humans have been dealing with risks since the first primate stood up just tall enough to be considered a human. The majority of the risks we deal with on a daily basis today differ from the saber tooth dodging days of our ancestors. Thank goodness. However, we do still have risks to manage in the course of living our lives.

Banking panics are not fun. We have come to trust these institutions over the years, and when our trust in them gets shaken, we feel unusually vulnerable. Not break your ankle and it’s all over vulnerable, but still, bank failures make us feel like the whole system is coming down. The industry itself has multiple levels of safeguards, and despite how scary runs on the banks are, per the FDIC’s website, not a single depositor has lost a single penny on FDIC insured accounts since the 1933 act was passed. As your advisors, we monitor what’s going on out there. Not just in the investment world, but also when it comes to the institutions themselves. There is a certain level of trust we have to afford those helping us hold and manage our money, but that does not mean we also shouldn’t be vigilant and take precautions.

What can you do to make sure you are protected from these particular risks?

- The first and most obvious thing is that at every institution that holds cash-based products, make sure the checking, savings, cash, and CD amounts add up to no more than $250,000 for each of your ownership categories. The cash products in your single accounts, your IRAs, and any trusts for which you are a beneficiary cannot add up to more than $250,000 for each category. Likewise, for any joint accounts those amounts cannot add up to more than $250,000 per account owner. If they do, it would be wise to shift money to another institution that would allow you enough FDIC protection to be made whole in the event of a bank failure.

- The second, and less obvious thing is that even if you have all the protection you need at any one institution you use, consider having some cash in at least one other institution. Even if you would be made whole were your one banking institution to fail, you cannot count on being made whole immediately. It’s anyone’s guess as to how long it would take the FDIC to get you your money. As a result, having money at a second institution which you could access until you were made whole may help you avoid a situation where you need cash that you cannot access. If you have a bank as well as cash at Schwab, that may be enough diversification.

- Third, talk to your advisors. Talk to your bank. If you are nervous, reach out to get the peace of mind you need to feel better.

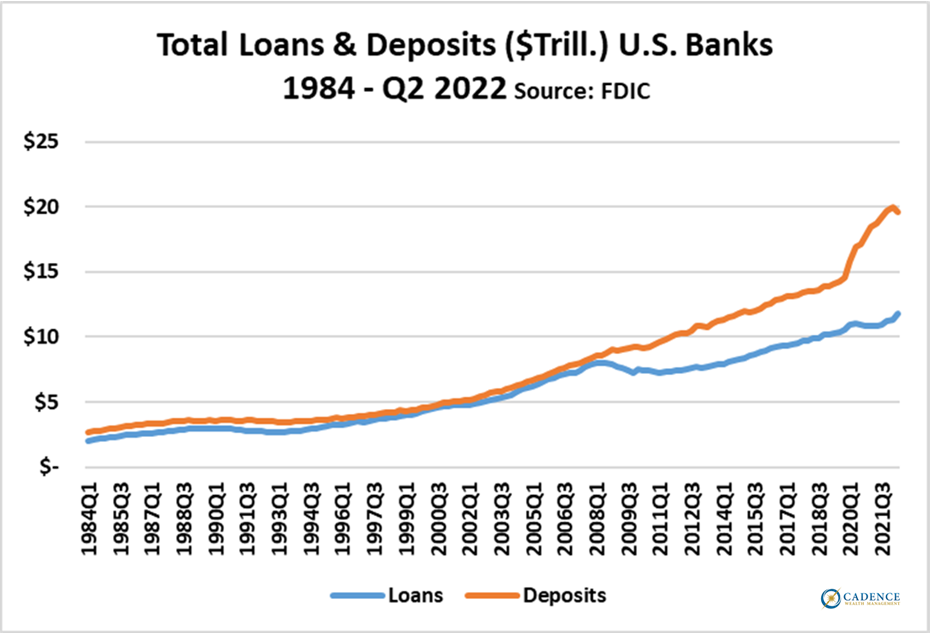

- Lastly, just remember the industry exists to make money for itself. We always assume banks are lending out our deposits, and in that way the fixed amounts they are paying us as depositors are being paid for by even higher fixed amounts that banks are collecting from their debtors. As of the financial crisis of 2008-2009, it was deemed much safer by many banks to invest our cash instead of loaning it out. You can see this in the chart below where the amount of bank deposits, orange line, is just above the amount of bank loans, blue line, from when this chart time period starts in 1984 up until 2008. At that point, deposits continued increasing but the amount loaned out fell. This got absolutely supercharged during the COVID stimulus period with deposits spiking but loans not coming vaguely close to rising enough to match suit. Instead, the banks were taking those deposits and buying mostly safe, but low interest US Treasury bills, notes, and bonds:

Once interest rates started climbing quickly, the value of the investments that were purchased with the deposit cash declined. As a result, a run on the bank would force many institutions to liquidate investments that have lost value in order to cover those requests, like happened with the Silicon Valley Bank.

From the end of 2007 to the beginning of 2012, 465 banks failed in the United States. I find the fact that there were that many failures without FDIC insured accounts losing money to be comforting. All of us at Cadence were advisors during that time, and the fact that 465 banks could fail without any of our clients being affected tells me that as fragile as a trust-based system is, it is also resilient. We are here to help you manage your financial risks. Your non-cash securities at Schwab are safe. The cash you have in various places, provided you do not have more than $250,000 in a given ownership category at any one institution, is also pretty safe based on the track record of the FDIC. In times like this, we are monitoring what is happening to the system as a whole. We do not know if we are in the early or late innings of the banking uncertainty, but regardless, we will be here to help you get through however the current uncertainties play out.

Editor’s Note: This article was originally published in the April 2023 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.