Employer-provided retirement plans have some tremendous advantages over other investment accounts. They are convenient, allow for relatively large contributions, and usually receive employer-provided matching contributions. Unfortunately, they also have some large disadvantages, some of which matter more today than they have since the last major market crash, like a serious lack of diversification options. If the next major financial crash is like the last one, where both stocks and bonds lose meaningful value, then there is nowhere to hide in a 401(k) or 403(b) plan that does not have alternative investment options. Likewise, seemingly diversified options like retirement date or target date funds do not have a meaningful allocation to alternative investments, and many of them are allocated more aggressively than their owners realize, which we discussed in the June edition of Cadence Clips. Both of those could cause serious issues during the next stock market downturn.

Additionally, many employer retirement plans do not allow the beneficiaries to stretch the distributions out over their own lifetimes, which may lead to a higher percentage of taxes being paid, lower tax-deferred growth, and ultimately a smaller amount being transferred over time.

One solution to the lack of diversification and beneficiary options is to do an in-service withdrawal. Most employer plans allow this, though there are rules to follow specific to every plan. Regardless of the details, an in-service withdrawal allows the employee to roll a partial or complete balance from his or her 401(k) or other employer plan while still employed to an IRA under his or her control without paying a premature distribution penalty or income taxes. The benefits of in-service withdrawals include:

1) More investment options: Most employer-provided plans have a severe lack of choices in some asset categories, especially those that may help protect investment value during the next major downturn.

2) More beneficiary options: Not only do IRAs allow beneficiaries to stretch distributions, and therefore reduce the impact of taxes on the account, but also provide account owners more beneficiary options should their wishes around what happens with their assets involve multiple groups of people and charities.

3) More control: With employer plans, you can only choose from what you are given, and these plans are much less flexible than IRAs available elsewhere. Also, employers occasionally change plan providers, leaving employees to choose a whole new set of investments.

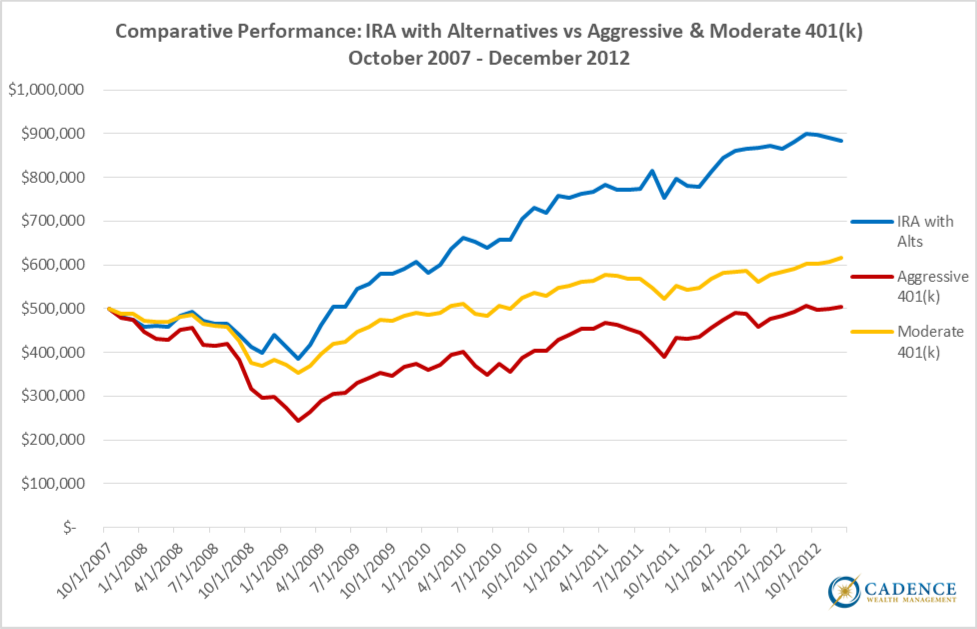

Considering the aforementioned lack of diversification, one of the investment allocations we use for our clients specifically to minimize the kind of damage done during the last financial downturn has a meaningful allocation toward alternative investments. The chart below shows the estimated performance of a relatively aggressive 401(k) allocation, a moderate 401(k) allocation, and a moderate IRA allocation with alternatives:

An investment mix with alternatives would have protected more on the downside and still provided upside growth during and after the last market crash of 2007-2009. As you can see, there can be a large enough performance increase from including alternatives in an investment mix during and after meaningful market drops to make their inclusion in a portfolio beneficial.

There are still some things that may cause an investor to keep all of his or her money in the employer plan, like the ability to borrow against those assets, or the presence of post-tax contributions, or something specific to the plan that affects the ability to contribute after a withdrawal is made. The summary plan description has to be reviewed to help make any decision. With around 70% of all employer plans now allowing for in-service withdrawals before age 59 ½, it is a worthwhile move to consider for anyone concerned his or her employer plan will not protect assets to the level they would want during the next downturn.

Editors Note: This article was originally published in the October 2019 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.