In four weeks, stock markets have given back more than three years-worth of gains. For our number-oriented readers, that equates to losses accumulating 40 times faster than gains. As the expression goes; “risk happens fast”. If the month of March has taught investors one thing, it’s that things can go from completely peachy to chaotically crappy with the blink of an eye. As we’ve been reminding our clients over the months, the ability for this to happen increases dramatically in a system that is historically overextended in debt, valuation, speculation, greed, complacency and complexity. There is no question that Covid-19 will impact our economy greatly over the coming months, but in terms of creating havoc in financial markets, its role was as an accelerant; it was not the cause. Overextended markets at the peak of the economic, business, and credit cycles always become earthbound one way or another. That thing which removes the final thrust from the engines is what’s less certain in each cycle. This time around, it was Covid-19.

Summary for Those Wanting the Short Version

The last month with the help of Covid-19 has exposed the vulnerabilities in the financial system and markets leading to a more than -30% drop in the S&P 500. Our take is that although we’ll see typical bear market rallies along the way, this represents the beginning of a larger decline for stocks. This view is not only informed by the record valuations stocks held weeks ago and still hold, but by the rapidly slowing and soon to be contracting domestic and global economies. Against this type of backdrop, it’s hard for companies to perform well, employees to possess extra money to spend, and investors to feel good about paying up for a particular investment.

The Fed is trying to save the day once again, but it may not matter. They are not magicians, nor can injecting more money into the system do anything to solve the problems of the day. Confidence in them or the mass delusion that they have the tools and ability to affect positive change may be ending. This is all very daunting for investors taking on too much risk.

For our clients, these developments aren’t surprising. We’ve talked about the risks consistently over the months and years and we’re prepared. We’ve been advocates of traditionally defensive categories for quite some time knowing that risks can materialize faster than one can reasonably react to them. These categories include cash, gold, silver, and government bond. There are others, but these represent our top allocations because they are the ones we feel are best likely to handle what’s to come.

There has been a high degree of deleveraging over the last few weeks, which has caused almost every asset class to lose value. Stocks, bonds, gold, it hasn’t mattered. When things get bad quickly and there’s lots of debt involved in financial market speculation, margin calls take place. These margin calls force investors to sell whatever they can in order to raise cash to put their accounts back in good standing. The good gets sold along with the bad. This is typical in almost every rapid bear market decline. What’s important to know is that the good investments often bounce back after the initial wave of deleveraging whereas the overpriced or lower quality investments usually continue lower.

When stocks started declining in September of 2000, gold mining companies followed suit for a little over two months at which point they started rising. By October 2002, stocks were almost -50% lower while the gold mining sector was 69% higher.

In 2008, even with precious metals and gold mining stocks at higher, less appealing valuations, everything sold off together in late September. By late October precious metals began rising while stocks sank further. From late October to the eventual bottom in stocks in March 2009, gold was up 25%, silver 39% and the gold mining index 74%, while stocks were down an additional -20%.

A very similar story played out in Homestead Mining Company shares weeks after the initial stock market decline leading up to the Great Depression. Homestead shares stopped falling, began rising, and were up over 200% over the next few years. Stocks were down nearly 90% by late 1932 and took unil 1954 to get back to pre-depression levels.

In short, although things have been volatile in every asset class recently, investors who’ve been preparing for this sort of thing and who are in the right investment categories should be just fine. There’s good historical precedent for this. Although past is not necessarily prologue and no outcome is guaranteed, we continue to feel investors with a healthy allocation toward the defensive categories we’ve discussed will be just fine. By preparing ahead of time, we don’t need to react. If anything, we can be in a position to accumulate more of the “good stuff” that just went on sale.

Back to the Longer Story

It’s amazing to us how much we’re hearing people comment on certain stocks or the market as a whole being “cheap” after falling for a month. Our first reaction (that we often keep to ourselves in order to keep the peace) is that this is almost never how people feel when we’re actually close to a long-term market bottom – when stocks are genuinely cheap. Bear market cycles tend to end when few have the desire or the will to invest. They usually leave people bruised, battered, and disinterested in taking risk. These comments don’t reflect any of this. They are artifacts of the regime we are leaving; the “buy the dip” mentality that has been engrained in our heads over the last 11 years, because risks never quite materialized. We know that when bear markets finally do show up, they absolutely punish those who cling to these old heuristics. When the bounces begin leading to lower prices rather than higher ones, buying them repeatedly can be a speedy way to go broke.

We actually have a pretty good road map for what may lie ahead for us with respect to financial markets. We’ve been pretty regular in our declaration that we are witnessing the biggest financial bubble of all time. On a number of measures, we stand atop the historical heap of frothiness. The next three closest bubbles in somewhat modern history were the U.S. stock market in 1929 and 2000, and the Japanese stock market in 1989. All of them, when they popped, presented investors with similar “buying opportunities” in the early months. What we know with hindsight of course, is that these sharp drops provided nothing of the sort. Rather, they sucked in capital repeatedly on every bounce, all the way down, until eventually for those with the patience to wait, there were true long-term buy and hold opportunities to be had. A quick math and investing lesson from the Great Depression: How does one lose 90% of their money? Answer: First you lose 80%, then you lose half of what you have left. This to us fully encapsulates why bear markets are so devastating to most.

In 1929, the Dow Jones dropped -47% in a matter of weeks, bounced sharply, then went on to drop an additional -79%. Investors finding stocks cheap after the initial, sudden, and seemingly abnormal -47% drop would have had to wait nearly 16 years to recoup their losses.

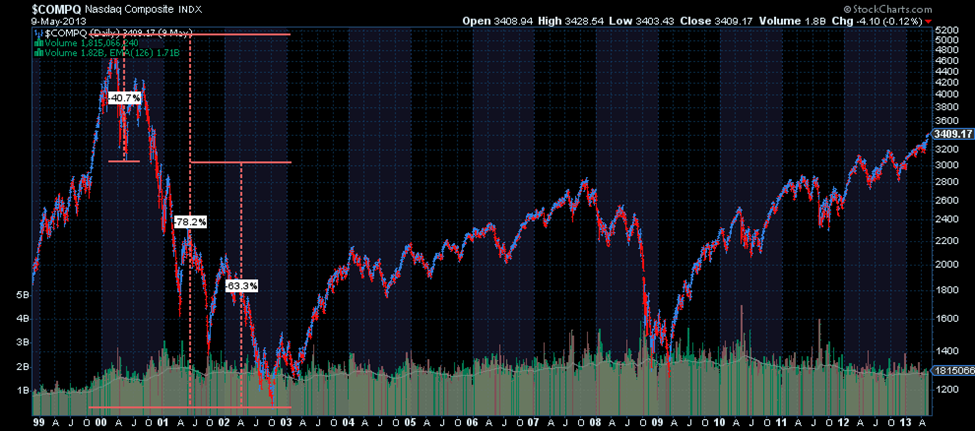

In 2000, a very similar scenario played out. This time the Nasdaq dropped -40%, rallied sharply (just as it always had), then plunged another -63%. Those buying that dip would have to wait until 2012 to get back to where they were when stocks seemed like a bargain.

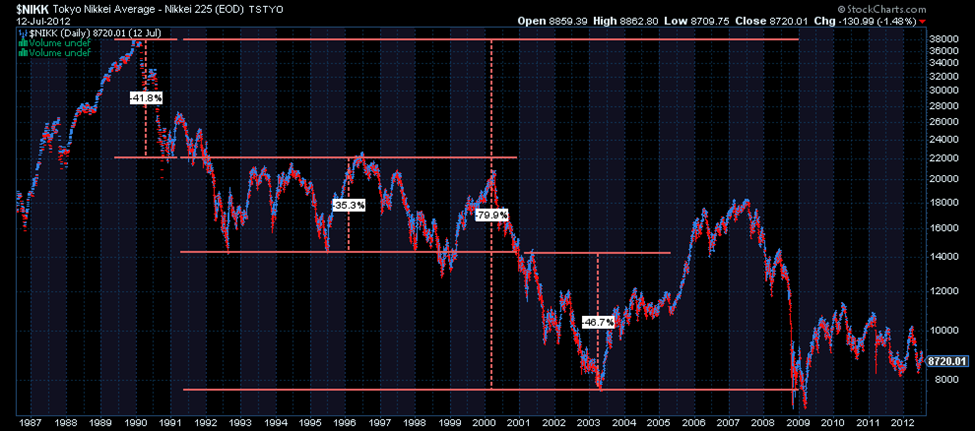

Finally, when the Nikkei in Japan started to crack in 1989, it fell -41% rather suddenly, experienced a shallower bounce, then dropped another -35%, then eventually, another -46%. The Nikkei bear market was one of the most painful and protracted in history in that it still hasn’t fully recovered its losses. Between asset prices being so outlandishly expensive in 1989 and the economy struggling to grow since then under the weight of high debt levels and a tricky demographic mix, the idea that stocks always come back “just because” seems a bit silly. The lesson from Japan is that price, valuation, and fundamentals matter. A lot!

Economic Uncertainty

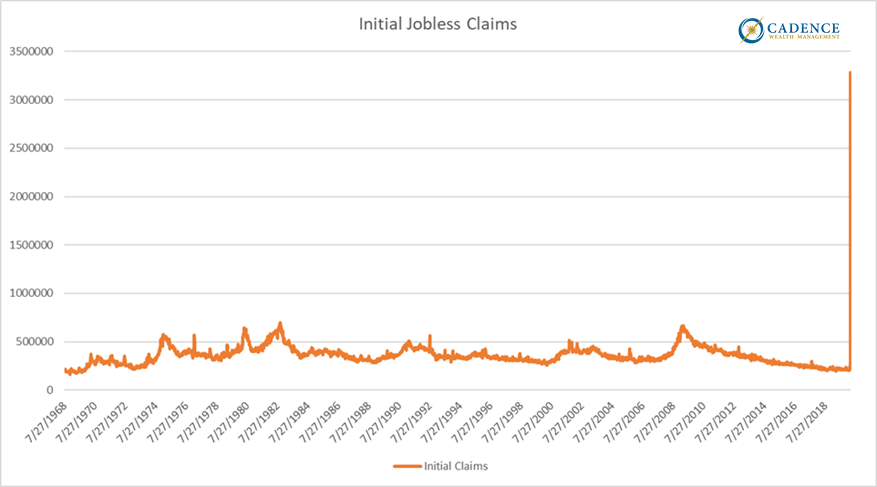

We were facing an economic slowdown prior to Covid-19. Typically, the cycle turns slowly with one domino falling at a time creating a feedback loop where markets fall, credit tightens, bad businesses fail, people lose jobs, corporate profits drop, markets fall further, etc. It’s like a wave building as it approaches the shore. This of course is a complete generalization, but it creates a manageable image as to how a down cycle can play out. With the outbreak of Covid-19, this blueprint goes right out the window. What we’re witnessing is a near complete shutdown of economic activity globally for which there really isn’t any precedent. Last week’s initial jobless claims report highlights just how unusual and severe this economic shock could be, showing more than 3 million people filling out unemployment paperwork. This is more than four times the prior record during the 2008 financial crisis and we’re still early on in our country-wide shut down. Our biggest concern here is for jobs and people. Financial markets are secondary. Needless to say, it’s hard to see the recent drop in markets as an “opportunity” against this economic backdrop.

The Fed Reaction

Markets broke over the last few weeks. Without getting into the details, repurchase markets were failing, credit markets were freezing, money markets were at risk of breaking their $1 net asset value, banks were unable to make good on their commitments to deliver physical gold to buyers. Almost every part of the underlying financial system over the last few weeks has been affected and as a result, the Fed has committed to doing whatever it takes, literally. They’ve announced program after program to try and staunch the bleeding and have even taken to buying bond ETF’s in order to prop up the financial markets, which last we knew isn’t even legal. We are following the footsteps of the Bank of Japan and European Central Bank in this respect, but apparently haven’t learned from their experiences. These massive interventions haven’t worked for them, and likely won’t work for us. They do more societal harm than good, but as we’ve said repeatedly, there is only one way forward for central bankers. Full speed ahead.

Our feeling has been and continues to be that as things repeatedly break within the financial system with greater frequency as they have over the last few years, people will lose confidence in central banks. They’ll come to realize that they possess no magical powers or special abilities, but rather are stealing opportunity and prosperity from the future in order to defer or minimize any economic discomfort today. To us, this is plain as day, and there’s a good chance the masses are starting to recognize this as well. What this means is that gravity could reclaim asset prices over the coming months and years. Those flying too high could well come down while those closer to the ground should do just fine. Gravity reasserting itself will be deflationary. However, with the Fed and other central banks operating at one speed, full speed, that deflation could suddenly turn to inflation. This is where things get really dangerous. Imagine a world where people lose half of their 401(k)’s because they had too much in stocks, then suddenly find that their grocery bills are twice as high. This would not be good, but it’s what could play out once we get debt and asset price deflation and are then left with trillions of dollars floating around in the economy. This is something we think investors should anticipate.

How to Position for This

First of all, in a deflationary environment where things fall in price, there is absolutely nothing wrong with cash. Zero interest is a heck of a lot better than losing -20%, -30%, or -50% of your principal in risk assets. The problem with too much cash however is that most investors can only earn 0% for so long and still reach their financial goals. The good news is that there’s usually opportunity for growth somewhere, and in our opinion, that opportunity at this point in time seems to be in precious metals. We’ve covered this enough in recent letters, so we’ll limit our discussion to the key points.

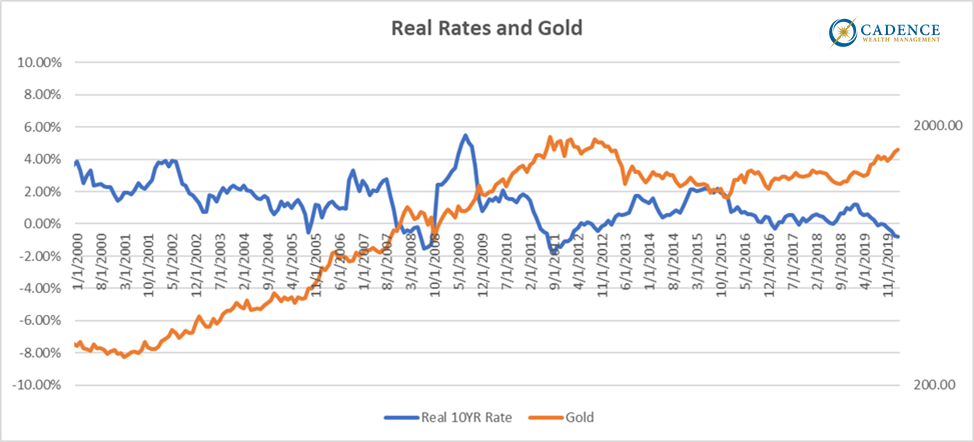

Precious metals are inexpensive relative to financial assets, miners especially so. Central banks are intervening at “full speed ahead” pace. Confidence in the Fed is in question. Inflation is likely coming as a result. Although all of these things are typically favorable for precious metals, it really comes down to one thing; the level of inflation-adjusted interest rates or real rates. Quite simply, when real interest rates fall, gold typically rises and vice versa. Interest rates could rise, but if inflation is rising faster, then gold could do well. If interest rates are falling, but inflation is falling faster, leading to higher real rates, then gold could struggle. Our view is that we’re likely to see real rates continue to fall over the coming months and years, which should support precious metals markets. This isn’t to say that interest rates won’t rise, it’s just that inflation could rise faster. You’ll notice below the high inverse correlation between real rates and gold.

Recent Volatility in Safe Havens

It’s worth pointing out that no safe haven investment other than cash comes without risk. Everything worth investing in can and will lose value over some period of time. Government bonds and precious metals are no exception. Over the last few weeks, everything had its turn getting hit hard. This is especially common during fast, sharp market sell-offs where deleveraging is taking place. Deleveraging is something that tends to happen in most cycles when over indebted investors are forced to sell whatever holdings they can in order to raise cash and meet margin calls. It’s the dirty side of speculating with debt. When it gets thrown into reverse, it can take down most markets simultaneously.

What we know from previous market sell-offs is that typically the quality investments bounce back once this forced selling subsides, whereas the overpriced, more speculative investments ultimately continue lower. In every market bubble we reference above, 1929, 2000, and even 2008, precious metals sold off in the initial phase of the market declines, but after weeks or months began moving higher while the broad market continued lower. Although history never repeats perfectly and no outcome is guaranteed, there’s good reason to believe that fund flows looking for better opportunities over the coming weeks and months could make their way toward the precious metals sector. For this reason, we view any short-term volatility as just that, short term.

There will come a time when we can get excited about other sectors as well. Energy is incredibly cheap, but is could well get cheaper as the economic cycle continues to slow. It’ll likely be the first thing on our radar once the dust settles a bit and economic activity seems to be stabilizing. Tech stocks? At some point they will offer more upside than downside. We’re not there yet. There’s still plenty of air in that balloon.

We have no axe to grind and are never wedded to any particular investment category. If the cycle favors traditional stocks, you’ll find us optimistic about their return prospects. Bonds, same thing. We can recall loving most categories of bonds back in 2009 as the risk to reward balance was incredible. Gold in 2010? We weren’t fans. It had a tremendous run since 2001 and the euphoria and speculation around it was uncomfortably high. Some of our clients will recall our lack of enthusiasm. When the data and circumstances change, we will change. Our expectation is that there will be many things changing over the next 1 to 2 years and we’re excited about that. For the first time in quite some time, this should create real, lasting opportunity for investors who actually view themselves as investors rather than speculators.

The Path Forward

The economic fallout will be real. Companies big and small will struggle. The only way this won’t be reflected in financial markets in the near to intermediate term is if participants have confidence that central banks and governments can find a solution that will ultimately heal the economy and all those companies negatively affected. Tall order in our opinion as not everyone can or will be bailed out. Investors will finally witness the fall of zombie corporations who’ve been kept alive with increasing levels of debt at lower interest rates over the years. How quickly cheap debt as a panacea can blow up right in front of us. What we’ve learned over the last few weeks is that many U.S. corporations, despite the illusions that they were, are no more financially solvent than the average American. Both as it turns out are only 1 or 2 monthly paychecks from financial disaster. Understandable for Americans struggling to make and save a fair wage, utterly incomprehensible and unacceptable for corporations that have used their profits and savings to buy back shares in recent years as a method for enriching executives. Bailouts of these companies will not come without societal backlash, nor should they.

Investors would be correct in extrapolating these failures to other large swaths of the public markets and valuing their shares accordingly. For this reason, we’re skeptical as to the Fed’s ability to keep the charade going. The jig’s likely up, and the markets refusal to rise in response to historic and continual barraging of monetary band-aids over the last few weeks seems an indication of just this. Under the current circumstances of a real, undeniable economic slowdown, it seems investors have finally come to grips with gravity being more powerful than man’s ability to defy it.

This outcome we should remember is just an extreme resolution to an economic cycle that has been massaged and coaxed to go up and stay up. The economy grows, more risk is taken to achieve profits, debt is used, some overdo it and fail to plan for tougher times, and so when tougher times arrive, they fail. Creative destruction also plays out through normal cycles adding a quicker knock-out blow to those companies who operated recklessly. The point is, failure, loss, and market downturns are a normal part of a healthy cycle and without them, there isn’t enough room for new, better, and more responsible entrants to the market. The subsequent good times will not be as good if this process isn’t allowed to play out. We should all remember that the harder, more difficult environment we’re facing now is normal in many respects. Where it most likely won’t be normal is in size and scope. Investors need to understand this and keep their focus on where we’re going rather than where we’ve been. Forget the last 35 years of financial market history, which for most is all they’ve know. Just as U.S. investors experienced phase transitions in the 30’s and 70’s, and Japanese in the 90’s, we’re most likely also entering a transition period where things will be different now. Not necessarily bad, just different.

With respect to markets, the 9% average annual return of the Dow Jones Industrial Average for the 38 years from 1982 to 2020 was an historic acceleration supported by debt, financialization, and a societal shift toward increasing stock market importance and focus. What many don’t fully appreciate is that for the 82 years prior to this, the average annual return was closer to 3%. In addition, almost exactly half of the last 120 years the market spent going nowhere (see chart below).

The Bottom Line

The bottom line is that investors shouldn’t anchor so strongly to stock market performance. Be flexible, data driven, and reasonable in your risk-taking. If we are in fact undergoing a generational phase transition in economic activity and markets, potentially accelerated by the recent Covid-19 outbreak, we need to keep our heads up and eyes wide open. These are the moments in history we read about, when not only risks play out and fortunes are lost, but opportunities arise and positive change takes place. This may be one of those moments. All that we view as less than ideal, broken, or out of whack, we have an opportunity to fix going forward. Unfortunately, as most of us have learned along the way, things tend not to get addressed until they have to. Whether it’s corporate buybacks, wealth inequality, our healthcare system, or less quantifiable societal issues, if there’s a positive side to sliding down the backside of this economic and market cycle, it’s that all these things are more likely to be given serious attention.

Please be safe over the coming weeks with respect to your health and Covid-19. Without health, none of this matters. Beyond the next few months, prepare for the most likely outcome, which is an economic disruption and financial markets that most likely continue to struggle. If this doesn’t play out, then great, but we’re thinking and acting on probabilities. We’d suggest focusing on the phase we’re most likely moving into rather than the one we’re leaving. Which investments historically have done well through this type of transition and which have done poorly? What happens if central banks don’t have the answers? If free markets were left to price assets, what would they be worth? Asking these types of questions won’t always lead us to the best returns this week or next, but they tend to help us expose where the true risks lie as well as the potential magnitude of those risks.

Over time, if we can sidestep the bulk of the truly dangerous, portfolio damaging situations, then it’s that much easier to take advantage of lasting opportunities along the way. This is precisely what we’re attempting to do at the moment. There’s an expression that there are decades where nothing happens; and there are weeks where decades happen. The world is moving very quickly these days. This is when we either get a lesson in risk or a shot at opportunities and it all comes down to preparedness. We’ve planned for this.

As always, if you have any specific questions or concerns, don’t hesitate to reach out to your advisor at Cadence. Whether a simple question or a longer discussion about making sure you’re participating in the type of planning we’ve discussed here, we’re here to help.

Editors Note: This article was originally published in the April 2020 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.