If the latest data using the best meteorological methods available suggests there’s a storm coming and one takes actions to prepare, does that qualify as panic? One of the things we’ve noticed over the years in raising flags about the risks embedded in markets is that those who question the narrative are quickly criticized and labeled as worrywarts, fear mongers, or worse. This tendency has reached a fever-pitch lately with stocks bubbling up even further and the introduction of the Coronavirus. The use of the word “panic” as a pejorative has become commonplace similar to how most use the term conspiracy theorist. It’s thrown around recklessly and readily in an effort to discredit and marginalize – the ultimate goal being to draw attention away from the truth…facts…or reality of the situation. Just as the storm-prepper has every reason to board his windows and stock a reasonable amount of food and water, folks today have very good reason to take precautions within their investment portfolios and beyond. It’s important not to confuse prudence with panic. They are two entirely different things.

Over the last few weeks, the Coronavirus has worked its way into the public awareness. It’s gone from what most considered a China-specific issue to a legitimate global threat. As of the time of this writing, that realization has manifested into a very rapid -12% decline in the S&P 500. In the coming weeks, months and years, you’ll hear comments about how it was the Coronavirus that was responsible for this market downturn (quite probably much larger by then and very likely with a corresponding recession.) In fact, we’re already hearing it now. Janet Yellen recently commented that the virus will likely drag us into recession. This is a very convenient argument as it completely draws attention away from everything else that helped to create the situation that made the markets and economy vulnerable in the first place. Don’t buy it. The virus represents an exogenous shock. The same type of exogenous shock it represented a month ago before anyone cared to pay attention, the same type of exogenous shock tariffs represented, or the potential war with Iran which markets were quick to shrug off, so on and so forth. Ultimately, these exogenous shocks will only break the system if the system is already fragile. We’ll comment a bit more on our completely pedestrian take on the Coronavirus threat, but first let’s step back a bit and revisit our process for assessing and managing risk.

1) Valuations – If valuations are fair, then market downturns will likely be limited in both size and duration. If they’re cheap, even less so. If valuations are rich, then the risk of a large drop lasting a long time is not only present, but likely. On a one to ten scale going from cheap to expensive, we’re currently a 10.

2) Macroeconomic picture – In the U.S., as well as most of the globe, economic activity is slowing and has been since late 2018. This opens a window of vulnerability to any types of shocks to the system whether endogenous or exogenous. In other words, when economic activity is decelerating and near contraction, anything that goes wrong whether from inside or outside the system could cause the economic and market cogs to grind and lock. What’s important to realize is that it could be anything that triggers this response and if it isn’t one thing, it’ll likely be another. If not tariffs, maybe war. If not war, maybe a repo crisis. If not a repo crisis, maybe a pandemic. If not a pandemic, maybe the next thing. Ultimately it will not be because of any one thing. It’ll be because the system was prepped and ready due to lots of other things over time. This is really critical for everyone to understand because if we don’t, we’ll pick up right where we left off after the next crisis implementing the same failed policies that put us in this situation. “They would have worked had it not been for Corona” is what we’ll be hearing. Mark our words. You’ll hear it, but you’ll know it won’t be true. It’s only that thing that finally got people to wake up and appreciate the risk that was already there.

3) Technical picture/Trends – This one’s pretty simple. If markets are setting higher highs and higher lows, they are trending up. Lower highs and lower lows means they’re trending down. Rocket science indeed, but investors pay attention to it and so it matters. The trend for global stocks and for the median U.S. stock has been flat to lower since 2018. The market cap weighted U.S. indexes have been the aberration, but that’s changing quickly. This context is important.

4) Market internals – We’ve pointed out for months that although the major indexes have been rising, the situation behind the scenes is far less rosy. Since September 20, 2018, the S&P 500 is up about 5% while the Value Line Geometric Index is down more than -14%. That is a huge divergence that illustrates not only just how much the largest companies contribute to the performance of the S&P 500, but also how much the average company’s stock price has struggled via the equal-weighted Value Line index. In addition to divergences across stocks, we’ve also seen extensive weakness in transportation and retail stocks, as well as issues in the credit markets. John Hussman of Hussman Funds likes to point out that when you have lack of uniformity or disagreement across varying segments of the market, what John calls weak internals, this represents risk-avoiding behavior rather than risk-seeking behavior. This shift in investor preference is required for an over-valued market to break its upward trajectory. Valuation alone isn’t enough to bring prices back down to sensible levels. That greater fool must first be questioning his ability to sell his hot stock to another fool down the road for more than he bought it.

5) Potential for endogenous shock – Bank liquidity, leverage, repo crisis. System built on cheap credit for 10 years with a bent toward speculation and malinvestment. Check.

6) Potential for exogenous shock – Tariffs, conflict with Iran, Corona. It’s a conveyer belt of issues. This is always true, but this latest one has real disruptive potential.

The sum of all of this equals high risk. Again, risk is high before we even get to endogenous or exogenous shocks. Those just provide the impetus for investors to start caring. To start thinking. To wake up.

Back to Corona

We are not expert virologists or epidemiologists. Not even close. What we do have the ability to do however is crunch numbers objectively and think about potential outcomes. Our job is to manage risk for clients. Corona represents risk and so we care. We’ll make a few points here understanding full well that crunching numbers and thinking freely is an open invitation for criticism – we’re okay with that. Our job is to call it as we see it because we operate from a place where we can. Nobody’s editing our words in an effort to protect a conflicting interest. We think our clients appreciate that objectivity.

→Corona cannot be compared to the modern flu. The fact that so many really smart people are making this comparison tells us that markets don’t truly appreciate the disruption risk that Corona poses. The flu kills somewhere in the vicinity of 40,000 people per year in the U.S. This is bad and it’s too high. It is a big number and by comparison, Corona has killed far fewer. But calling the flu a bigger threat at this point is like saying that since a Cat 5 hurricane just offshore hasn’t yet made landfall that it’s not a risk that should be taken seriously. It’s worth pointing out that over the last couple of years, traffic accident deaths are also right around 40,000 per year. Again, this is a number that’s way too large and we should endeavor to lower it, but as a percentage of the population it represents a very small risk to any one of us. It represents an even smaller risk of disrupting economic activity.

→We’re learning more about just how virulent the Coronavirus is every day as more and more clusters of infection begin popping up around the globe. For a host of reasons, China’s data can’t be trusted. It’s no secret that the Chinese government operates in a command and control fashion and thus has an interest and an ability to publish numbers that don’t reflect the situation on the ground. The financial community has accepted this for a long time with respect to the official economic numbers China reports and so we shouldn’t expect any different with the Corona figures. Entire cities in China have been quarantined, hospitals overrun and businesses shutdown. As a result, new hospitals are being built at breakneck pace to accommodate the sick. This sounds neither like a normal virus nor a normal reaction.

→Outside of China, we’ve witnessed a cruise ship, the Diamond Princess, serve as a giant petri dish while floating in Yokohama harbor, while more than 10 Italian towns have been placed on lockdown and Corona positive patients have been found on every continent on the planet save for Antarctica. Experts are estimating that the transmissibility or infectiousness of the virus is anywhere from 2-5 times that of influenza while the mortality rate is between 1% and 3% – 10 to 30 times that of influenza. When one does the math on these numbers, she soon realizes that should Corona make its way around the world unabated, the eventual impact would dwarf that of the flu. Our hope is that these estimates all prove too high and that the virus fizzles out. That’s certainly possible, but for those looking to manage risk, we plan based on the information in front of us and hope things turn out better. The alternative is not only irresponsible, but it leaves us vulnerable.

→There are two ways the Coronavirus could impact financial markets. First, it causes investors to acknowledge the risks currently imbedded in markets and leads to a shift in risk appetite. This is the type of reaction we’ve seen over the last few days. It rattles confidence for a bit, but may not create a lasting shift unless developments continue to get worse. The second and more lasting impact on markets would stem from the economic disruption that is created as a result of this virus. We’ve already seen a dramatic drop in economic activity in China due to the widespread lockdowns, and we’ll likely see more of this type of response in other parts of the world, albeit on a smaller scale. Event cancellations, travel reductions, supply chain issues; all of this creates a ripple across the economy that weighs on corporate profits as well as one’s ability to work. For a market that was already completely detached from the underlying economic fundamentals, this makes that chasm even larger. It’s also worth reiterating that the economic fundamentals were already cycling downward before this shock. There’s a better than decent chance that this downturn in economic activity picks up steam over the coming months as a result of the aforementioned reactions to the virus.

→Finally, we have to acknowledge the conflict that public authorities face when dealing with a situation like this. They must weigh the pros and cons of being truthful with the public. Tell us too much and we may panic. Don’t tell us enough and it could come back to bite them through lack of preparedness and loss of trust. Recognize this, apply common sense and draw your own conclusions about how you should react in your financial planning and personal preparedness. Don’t panic, but also don’t be afraid if others confuse your prudence for panic. That truly is their shortcoming, not yours.

1918 Spanish Flu Market Impact

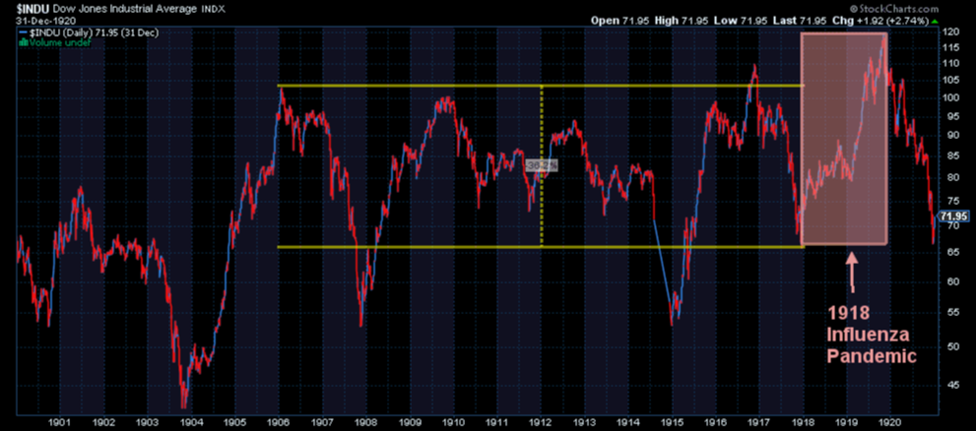

As we mentioned earlier, exogenous events don’t cause markets to fall or crash. They merely have a chance to create a spark that catalyzes an explosion within an already combustible system. The Coronavirus certainly has the potential to provide such a spark to a system that we know is very combustible.

On the other hand, the 1918 influenza pandemic that infected roughly a quarter of the global population and killed somewhere between 10-20% of those infected (50-100 million people) created a spark that did not catalyze a stock market explosion. How can this be? The simplest explanation is that markets were already so deeply discounted coming into 1918, that they just weren’t combustible. They had already exploded and so rather than drop, they actually rose, a lot.

How cheap were stocks? When the Spanish flu pandemic arrived, the stock market via the Dow Jones Industrial Average was -36% lower than it was 12 years prior and at the same level it occupied in 1900, 18 years earlier. According to data published by Professor Robert Shiller of Yale University, the cyclically adjusted price to earnings ratio (CAPE ratio), which indicates how cheap or expensive the overall stock market is, was 6.1 at the beginning of 1918 compared to an average of 17 over almost 140 years of data. The market was about as cheap as it had ever been when the Spanish flu hit in 1918. It was a veritable pile of ash already that absorbed the spark from the flu as though it were water. Today’s Shiller CAPE ratio? It’s over 31.

Can the Fed Save Markets?

It will try. The Fed’s aim today is to eliminate the business cycle. Only up all the time. And so anything that threatens that upward trajectory will be met with lower interest rates or more asset purchases. It really is that simple. This will only stop in our opinion when inflation runs so high and impacts the cost of living for the average American so much that the Fed can’t obscure it or ignore it. It’s then and likely only then that the Fed will be forced to step back toward more normal monetary policy practices. Reasonable interest rates for savers, no meddling in financial markets with made up money, etc. Until this happens, their interest (those at the Fed) is in not letting the system self-correct, which is to say they want to continue to obscure the markets natural price discovery process. Jim Grant of Grants Interest Rate Observer, much to the dismay of a certain CNBC anchor on set with him at the time, mentioned today that the solution to the market’s and the economy’s problems today would be price discovery. “The reason the Fed can’t keep doing what they’re doing is because it distorts judgement.” “We are extended in valuation, we are extended in time, and we are extended in leverage” – Jim Grant.

The fact that the most firm and decisive official response we got from authorities on how to address the Coronavirus threat was centered around interest rate cuts and monetary injections is laughable. Central bankers only have to protect markets if they’re at risk of exploding in the first place – if they’re too big to fail. We agree whole heartedly with Jim Grant on this one. The Fed has over-stepped and needs to let market participants discover what fair prices are for themselves. This is the only long-term solution as painful as it may be in the short term.

Central bankers cannot print a cure for the Coronavirus, but try they will. Government officials will throw money at the problem. It might work for a while, but will only increase debt and systemic risk within the system. It continues to be our view that the best risk-adjusted opportunities exist in U.S. government bonds, precious metals, and precious metals mining shares. Treasuries because the Fed will feel they have no choice but to cut rates aggressively throughout the economic slowdown. This bodes well for bond prices. Precious metals because they are relatively cheap by historical standards and often serve as a safe haven for funds leaving stocks and most bonds. There will of course be ups and downs, but we’ve already seen a shift in investor preference away from equities toward these categories over the last 17 months. We would expect this to continue over the coming months given the circumstances. (Aforementioned asset categories 17-month performance below).

The next few months will be telling. Regardless of how the Coronavirus evolves, please remember that the risk inherent in markets now has nothing to do with the virus. It’s there regardless. If you’ve already adjusted your portfolio in anticipation of this type of thing, then kudos. If you’re a client of ours you likely have. If you haven’t and you’re caught making some last-minute tweaks, be careful not to confuse prudence with panic. Panic would be making emotional decisions for no good fundamental reason. De-risking your portfolio now would not qualify as panic. Add the risk of the Coronavirus to the mix and the possibility of it throwing off a spark that catalyzes an explosion in an inherently unstable financial system and well, we think playing it a bit safer qualifies as prudence…twice over.

Here’s an important thing to remember about managing risk; the risk doesn’t always play out. If there’s a 50/50 chance of losing half your money, you may luck out and be okay with no planning whatsoever. But if that risk materializes and you lose half, your financial life changes. When the magnitude of the risk is too large to ignore, it needs to be addressed even if the probability of it playing out is low. When that probability is high, like now, there is no excuse not to manage risk, and we should have no regrets if that risk doesn’t materialize. Stay prudent.

Editors Note: This article was originally published in the March 2020 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.