Yes, our clients pay us to lie awake in the middle of the night so that they don’t have to – at least when it comes to financial markets and economic matters that could affect them. We’re not talking anxiety-filled nights, but rather quiet, pondering nights where the chaos of the day has subsided, the routine-related boxes have been checked, and the brain can run free. In somewhat random, freewheeling fashion, here are a few of the thoughts I’ve recently spent time spinning.

Asymmetry

The notion of asymmetry is an important one when it comes to investing: the condition where potential upside outweighs potential downside or the risk of loss. Investors should always attempt to buy assets that offer asymmetric returns over time. To do otherwise isn’t really investing, but rather just random asset purchasing. Sometimes this condition can be hard to quantify, but there are ways to approximate when it exists. For example, if an asset is priced cheaply relative to its historical relationship with some baseline, then one might determine the future upside outweighs the future downside. A good example of this is a wide range of commodity prices relative to the stock market. Most are closer to the bottom of their historical ranges than the top which could indicate, assuming the factors that linked the two in the past are still valid, that these commodities offer asymmetric risk-adjusted opportunity. The same argument can be made for U.S. Treasury bonds given the relationship between their interest rates and the earnings and dividend yields of the U.S. stock market. At the moment, they are very attractive relative to their historical average, which could indicate an asymmetric setup where returns on treasury bonds outweigh the potential for loss. The hard part about spotting asymmetry is that it usually manifests through events that shape investor perception away from noticing it. The point you feel something is a horrible investment due to recent losses is often when asymmetry begins to emerge.

Lower Rates or Falling Asset Prices?

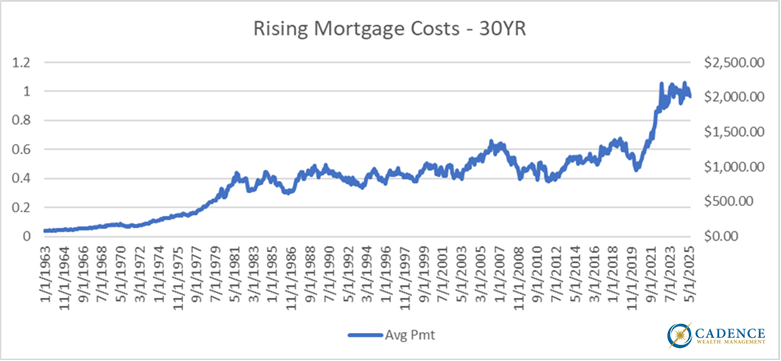

Low interest rates to a financial system that runs on debt and leverage are like crack cocaine to an addict. As long as investment payoffs outweigh the cheap financing, one can’t get enough of it. In addition, it’s nearly impossible to stop as gradually declining investment opportunities (higher prices) require even cheaper financing to maintain profits. This can very clearly be seen in the housing markets as low mortgage rates helped to fuel home price increases in recent years. As we’ve witnessed, since rates have moved well off their lows of a few years ago, the cost of home ownership has spiked rather dramatically (displayed in the chart below.)

There is no way that this type of jump in cost won’t have some sort of impact on things in the near term. Fewer people can buy, which weighs on demand, which ultimately as we’ve seen, weighs on sale prices. In addition, longer term, if mortgage costs don’t come down meaningfully, our kids will find it very difficult to buy homes and start families. So, what’s the answer?

Sure, we can hope that the Fed lowers overnight borrowing rates and that this trickles out to the longer-term rates that are more closely tied to mortgages, but the last time the Fed cut rates, the market feared a return of inflation and pushed mortgage rates higher. We’re being reminded that the Fed doesn’t control free markets, and markets that aren’t free to constantly recalibrate, and accurately sync risk and reward, are bound to be horribly inefficient and destined to break badly at some point down the line. Think of a pressure valve that is covered up for some reason. Eventually, imbalance leads to pressure, which leads to explosion. We don’t want to rely on a handful of fallible humans to make decisions for complex markets. If rates fall because the system leads to it, great. Otherwise, we’re penalizing risk-averse savers by artificially reducing CD and money market rates and forcing risk-taking where it shouldn’t exist. This bears repeating – when the Fed lowers interest rates to prop up financial assets, risk-averse savers like our parents and grandparents can’t earn decent interest in bank CDs. There is a real cost to manipulating interest rates.

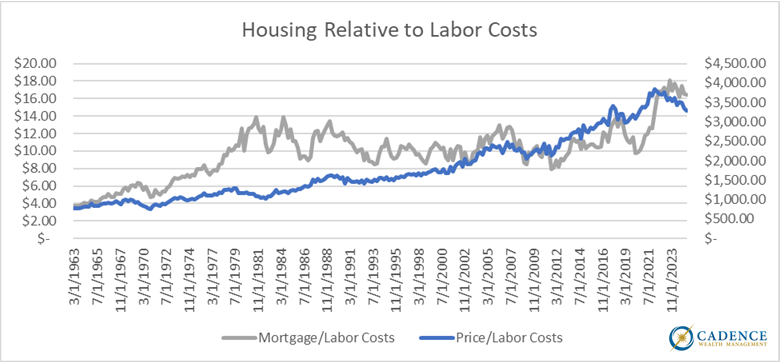

The only long-term solution to unaffordable asset prices, whether housing or otherwise, is for asset prices to be allowed to normalize; to fall. That is the pressure value that in free markets almost always brings things back into alignment. There is nothing unreasonable about a mortgage rate of 7%. By historical standards, it’s rather average. It seems rational that a less expensive house at a reasonable borrowing rate of ~7% would be a balanced outcome. Expecting rates to go back to 3% isn’t realistic. It’s robbing Grandma of interest and covering up the pressure valve.

(The chart below shows housing prices and borrowing costs relative to unit labor costs, which approximates the rise in labor income over time. This relationship is intended to exclude those at the top of the income strata whose total compensations have risen more in line with asset markets, and looks at more median income levels; aka the average American).

Money Quietly Leaving Financial Assets in Favor of Real Assets?

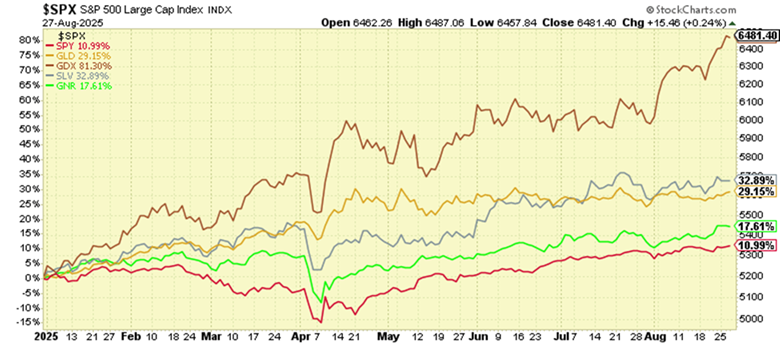

Even though the stock market is still up, it’s starting to underperform a handful of alternative asset categories that typically underperform the indexes in strong economic and financial market environments – namely gold, silver, and the companies that mine them. To a lesser extent, a broad mix of natural resource stocks are also outperforming the major tech-led indexes. This could be an indication that money is already starting to flow out of historically expensive tech stocks and into historically inexpensive natural resource stocks, with a preference for those that are most protective through turbulent times; gold and related categories. While most are still obsessed with artificial intelligence (AI) and the companies that deal in it, the smart money might already be moving on. The chart below, showing year-to-date performance of the categories mentioned, shows pretty clearly where investor preferences have been. In our opinion, given the state of the world, where we are in cycles, and relative valuations across the asset spectrum, this performance gap is likely just getting started. For those anticipating this shift, it’s been a great year so far.

Can We Fix Our (American) Debt Problem?

No. The short answer is we cannot. At least not in the traditional “tighten the belt and get back to basics” sort of way. Rogoff and Reinhart in the 2009 book, “This Time Is Different”, dove deeply into eight centuries of advanced economies and their abilities to return to fiscal responsibility after crossing over a certain level of debt relative to their national economic production (GDP). What they found is that when countries cross over 90% debt to GDP, their growth slows and need for borrowing ultimately increases, creating a feedback loop that is difficult to get out of. We are now over 120% debt to GDP. The interest on our debt is over $1 trillion per year, as large if not larger than our defense and health care budgets. The federal government brings in ~$5.5 trillion through tax receipts each year and spends ~$7 to $7.5 trillion; nearly $2 trillion more than it makes. We have to borrow to make interest payments. The only way to reverse this trajectory is to cut roughly $2 trillion of annual spending, and given that politicians get lobbied, wined, and dined every day in order to maintain the status quo via spending, the odds of this happening are nearly zero. It’s much easier to raise taxes on the people than to cut spending in any meaningful way, much the same way that it’s easier for a morally corrupt individual to sequester funds from elsewhere to maintain his spending habit.

Given the reality that big debt tends to snowball rather than reverse course, how does this thing end? A few possibilities are:

- The U.S. eventually defaults on its debt when it can no longer borrow money to make good on current obligations.

- Economic growth accelerates and makes it possible to slow the growth of the snowball.

- There is some sort of refinancing or soft default event where bond investors take losses and/or get swapped into new instruments with inferior terms.

- Government debt becomes backed by, and exchangeable for, gold, cryptocurrency, or something else. This could, in theory, allow for debt to be paid down very quickly with newfound wealth that didn’t really exist before.

If I’m thinking about this issue from the perspective of global leaders, I probably know that expecting growth to accelerate as debt increases isn’t realistic. I also know that any type of default where investors lose big isn’t at all good for a nation and its status in the world. I also know that a coordinated western default, although better than defaulting alone, would also create quite a bit of collateral damage that threatens the status quo and existing order of things. For current global leaders, status quo is good, regime change is bad. That last one though; that one’s interesting. You mean I can revalue something (like gold), and with the wave of a wand appear more solvent than before? Or, essentially invent some form of digital currency, swap it for our debt, and walk away with less debt than before – even if that digital currency proves ultimately worthless? Interesting.

We don’t love the idea of owning U.S. government debt long term. There are too many unknowns. The short term seems much less perilous, however. The factors surrounding the ultimate solution to the debt crisis seem much more interesting and potentially asymmetrical to us. The potential for a gold revaluation? It’s happened before to fund the massive government spend of the Roosevelt era. Why not again? That would clearly impact gold and related categories. Cryptocurrency as a solution? The impact there is less certain. Would it be Bitcoin? A similar national cryptocurrency? There are too many variables surrounding this one to devise an actionable investment strategy. In the meantime, Bitcoin continues to act like the Nasdaq, which is one of the asset categories that we believe money is leaving. There’s plenty to watch along this front. It should be interesting. We’ll aim to stay flexible in our thinking.

Political Division

This is on purpose. Don’t fall for it. Powerful forces, be they government, large corporations, or entrenched interests, have an easier time maintaining their places in the world and doing the things they do when people aren’t looking, and when their resentment and animosity is directed elsewhere. This whole left/right thing is classic divide and conquer. Everyone, regardless of ideological viewpoints, can agree that the real struggle within any society is up/down. Those with power tend to want to keep it and it behooves them not to let too many others have it. A human tale as old as time. At the top, people don’t care about left/right beyond perpetuating it for those on the bottom.

I think about this because it has everything to do with money, markets, economics, and people. Money (and control) drives all of these phenomena. Wall Street is the epicenter. Seeing the world through this lens not only allows us to see everything in it more clearly, and make better decisions, but it immunizes us from subterfuge. It compels us to ask, “Why do differences, whether in race, color, or creed, continue to get emphasized by those at the top (media, politicians, institutions) rather than common, unifying characteristics?” Or, “Who benefits from me being angry at someone else?” Or, “Who is served by this constant, cortisol-inducing, life-reducing, us versus them drumbeat?” The answer most certainly isn’t you or me.

It’s times like these when division and vitriol seem peaked that we need to pay attention more than ever. Not where we’re directed to look, but in the very direction from which the divisive messaging is coming. The financial world is in a very late-stage, delicate place at the moment. If people reprioritized their concerns and started asking tough questions about the very dubious happenings within it, they might not like the answers. Biggest bubble ever, financial institutions buying up homes and pricing people out, banks getting bailed out to protect their wealthy clients, driving narratives that are extremely profitable, but largely false: the list goes on and on. Maintaining this is all so much easier if people are distracted. We have to pay attention. If we don’t, we’re likely to get blindsided. The history books are littered with examples of people getting led in the wrong direction by their emotions. It’s human nature, and one of the easiest things to predict.

We’re doing our best to stay curious, ask questions, and anticipate rather than march to the same institutional drumbeat as most. So far this year, that has worked out very well for our clients. The big test still remains. We will continue to ponder the world in the wee hours of the night to make sure we’re doing everything we can, to the best of our abilities, to pass it.

Editor’s Note: This article was originally published in the September 2025 edition of our Cadence Clips newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.