We had a piece in the September 2013 Cadence Clips called “The Cost of Panic”. In it, we showed how investors who panicked and deviated from their investment plans when stock prices dropped from 2007 to 2009 caused irreparable harm to their wealth. We have certainly seen a shock to global stock markets this year, with the potential for more losses to come. As of this writing, many asset categories have bounced off their recent lows giving investors an opportunity to breathe a bit. Many are asking themselves if now would be a good time to get more aggressive, while many others are wondering if this is just a pause in the downward cycle and if it would be a good time to get more conservative to reduce losses that may start again sometime soon.

It’s understandable that investors wonder where to go from here after a shock to the system. That’s a normal emotional reaction to losses. To show the potential impact of acting on emotional impulses during rapidly declining asset prices, we will revisit and update that September 2013 piece to illustrate the risks of adjusting investment strategy based purely on the kind of stock price changes we’ve seen recently. The other piece in this month’s newsletter lays bare the meaningful distinction between stock prices and stock values. For example, values frequently go up as prices are dropping. Unfortunately, the lion’s share of investors make moves based on price changes as opposed to value changes.

As our clients know by now, properly allocating an investment portfolio takes many things into account, namely timeframe, ability to survive a loss of a given size, tolerance for risk, and where asset values are at this point in time relative to where they may go over the investment timeframe. You’re more likely to prioritize protecting your assets when asset prices are expensive relative to their value as they’ve been over the past few years, while you’re more likely to feel better about getting more aggressive with your allocation, or at least you should, after a meaningful drop in asset prices relative to their values.

The three investors in our September 2013 newsletter had all allocated their portfolios half in US and foreign stocks, and half in US and foreign bonds. More than likely, that is NOT the allocation we would have recommended for at least two of the investors. Instead of taking into account the factors we identified above, most investors look at past price changes in assets to decide how much of each asset class to own going forward. By late 2007, looking backwards only would have led many people to take more risks than they should have, which has also been happening for the past few years.

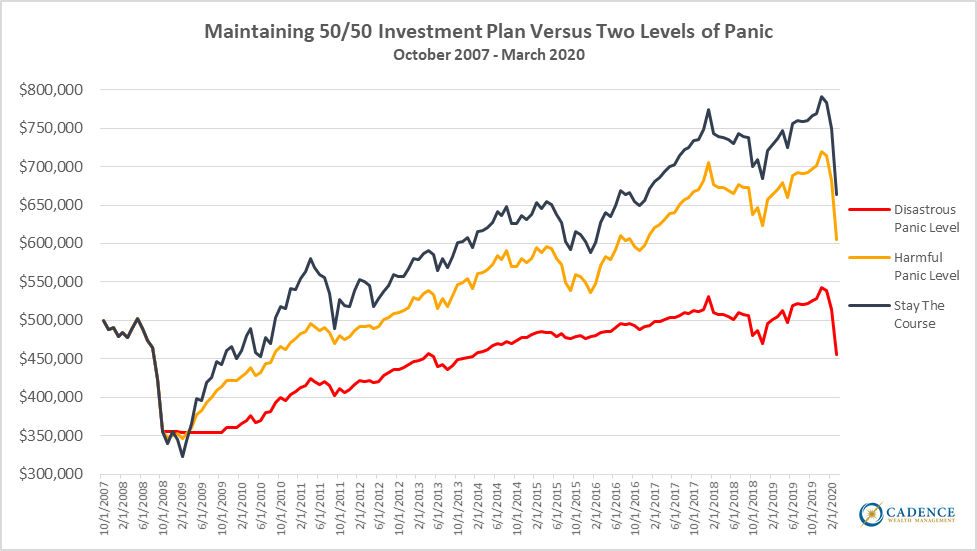

We’re going to assume one investor stayed with his or her planned 50/50 stock/bond mix over the entire period, October 2007 to March 2020, and we are going to nickname that person “Stay the Course”.

We’re going to assume a second investor sold all equity positions at the end of October 2008 as markets were crashing hard, invested that portion in the bond market instead, and finally got comfortable enough to get back into the stock market early in 2013. We’re nicknaming this person “Harmful Panic Level”. With a name like that, you can probably see what’s coming for this investor.

Finally, we’re going to assume a third investor panicked, liquidated everything and left it in cash in late 2008, found the way back to bonds a year later, and eventually got pulled back into stocks in early 2018. We’ll nickname this person “Disastrous Panic Level”. With a name like that, you can definitely see what’s coming for this investor, and are probably already feeling a bit badly for him or her. That shows you’re a good person, which doesn’t surprise us.

To summarize:

Investor 1 “Stay the Course” – Half stocks, half bonds the whole way through.

Investor 2 “Harmful Panic Level” – Switched to bonds and then back to half stocks, half bonds.

Investor 3 “Disastrous Panic Level” – Switched to cash, then to bonds, then back to half stocks, half bonds.

“Stay the Course” made no changes to his or her investment mix, which means he or she possibly had the right allocation from the beginning. By not panicking, the assets were able to grow 6.5% per year from when they bottomed out in 2009 through this March.

“Harmful Panic Level’s” changes did some damage. By trying to preserve his or her assets and abandoning stocks completely for a while, he or she reduced returns from the 2009 stock market bottom from 6.5% to 5.1% per year.

“Disastrous Panic Level”, unfortunately, has done some incredible damage. The bouncing from cash to bonds and then finally back to stocks when valuations were actually warranting less stock exposure as opposed to more dropped returns from 6.5% all the way down to 2.3% per year. What’s even worse is that the ending balance as of March 2020 is actually lower than it was at the start back in October 2007. This illustrates how dangerous the right intentions mixed with the wrong allocation and knee-jerk reactions are for many people.

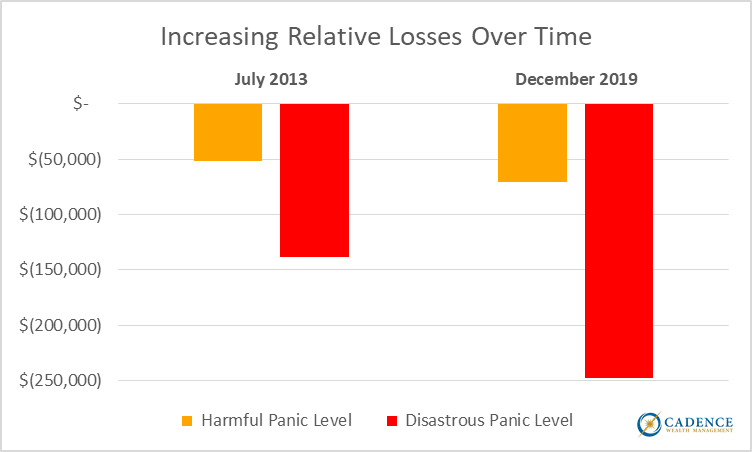

If you were already feeling badly for our two panicky investors, this next bit isn’t going to help. There’s some sinister math to all this that can allow mistakes to grow over time. By the end of July 2013, these two investors’ portfolios were ~$52,000 and ~$138,000 worse, respectively, than our “Stay the Course” investor. However, over time, those relative differences have increased:

What this chart shows is that the dollar value of investment mistakes can grow over time. “Harmful’s” relative loss grew by 36%, from about $52,000 to over $70,000 between the middle of 2013 and the end of 2019. That’s around a year’s worth of retirement expenses for many people. “Disastrous’s” relative loss increased by nearly 80%; from around $138,000 to a whopping $248,000. That’s easily three years’ worth of retirement expenses for many people.

What we hope this illustrates is the benefit of having a plan consistent with your tolerance for risk, financial needs and timeframes, and where we are in the investment cycle. As long as an investor understands how much their investments may lose during a downturn and can both afford to be down that much and also sleep at night, then there are clear advantages to sticking to the plan.

You know how the best time to plant an acorn was 20 years ago? The best time to get your investment mix right is BEFORE a market crash. Now, it is possible that investors tried their best to create an asset mix that took into account all that was important to them and are unfortunately finding out their tolerance for risk was lower than they thought, or their understanding of where asset values were was off, or perhaps they cannot afford as large of a loss as they thought they could. Like at any time, they need to get the proper measurement of these plus, at the very least, their needs and timeframe, and not make changes solely based on what happened during the recent drop. Nobody should knee-jerk some reactions and become “Harmful Panic Level”, and at all costs, should avoid becoming “Disastrous Panic Level”. If this year’s asset price drops made you seriously question your investment allocation, it’s best to figure that out before a continuance of this year’s investment losses causes you to panic.

However, for those who weathered this year’s storm and feel like they are positioned well to handle further market drops, then the recent price declines may already provide selective opportunities to acquire some investments at favorable valuations, which we have already started doing for our clients. As the other piece in this month’s Clips highlights, wholesale risk increases probably aren’t yet appropriate to pursue, but unique value opportunities could start to present themselves sooner than later. Some already have. While there is a definite cost of panic, investors who get their mixes right are in a position to actually enjoy the benefits of other people’s panic. Just because you felt badly for “Disastrous Panic Level”, that doesn’t mean you shouldn’t consider buying assets from him or her at the right price.

Editors Note: This article was originally published in the May 2020 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.