The only certainty about the future is that it is uncertain. When it comes to retirement planning, identifying the uncertainties and their potential financial impacts are our best shots at protecting ourselves from those things that could prevent us from reaching our retirement goals. Researching the “top issues facing retirees” yields list after list of future uncertainties, everything from living too long, to the solvency of the Social Security system, to speculation around future asset prices. While we reviewed many of the issues facing retirees today, we saw some we thought important enough to highlight, but we also noticed some important omissions.

It seems many of these articles are not written by financial planners that are sitting face to face with retirees and near-retirees on a daily basis. As professionals who possess specific knowledge of retirement finances and planning, we’d like to highlight those things that we as actual financial planners and retirement income specialists would like you to know. This list is not comprehensive, there are things on this list that may not apply to you, and there are things not on this list that may apply to you, but we believe these areas of concern are not given the attention they deserve, or aren’t explained to the degree they should, or are just flat out overlooked. And so, issue one in our six-part series:

Retirees’ expectations are based on a past that will probably not be the future.

Our expectations on what will happen in the future are shaped by many things, and one of the most prominent is something called “Recency Bias”. In a nutshell, we assume things will continue as they’ve been recently, so our assumptions around retirement are shaped by the fact that the U.S. stock market is currently enjoying its longest recovery ever from a bear market, Social Security is paying out its benefits as promised, and inflation remains near historic lows, among other things. Few are the people who assume, based on current conditions, that U.S. stocks and other investment assets will face below average returns, that Social Security benefits will drop, and that inflation will once again spike. For different reasons, all three of these scenarios are more likely now than they were ten years ago. The extent to which all of these things turn unfavorable at the same time is unknowable, but as all three are currently in retirees’ favor, it is not at all a stretch to assume they could all break in the wrong direction.

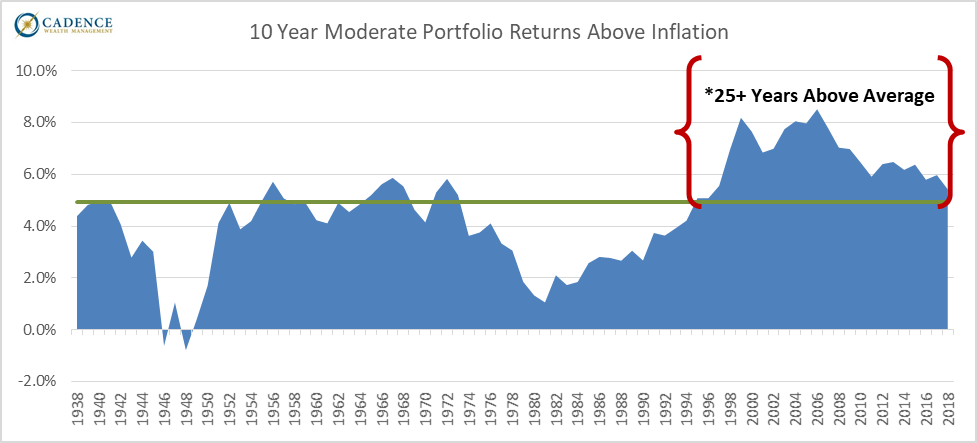

After a record decade-plus bull market, investor expectations have been conditioned for this favorable environment to continue. In fact, moderately-allocated portfolio returns above inflation have been above average for over 25 years, even taking into account the two market crashes in that time period, because returns have been relatively high and inflation has been relatively low. Add to that reliable social security checks, reduced income tax rates, and a host of other factors, and it is easy to understand why most people assume these favorable conditions are “normal”, as opposed to historically great as they have been. At some point, many of these favorable conditions will have to once again be “bad”, and retirees who have used rosy assumptions unknowingly could easily find themselves in worse shape financially than they’d anticipated. Assuming a 7.5% rate of return above inflation on a half stock, half bond portfolio is understandable when considering the past 25 years, but we are already trending lower, and there have been many 10 year periods where returns above inflation have been much lower than that.