“The Simpsons” debuted on Fox on December 17th, 1989. At that time the patriarch of the family, Homer, was 34 years old, putting him solidly in the middle of the Baby Boom generation. His wife, Marge, also a Baby Boomer, stayed home to manage a household of three children, a dog, and a cat, while Homer reported to work (most days) at Springfield’s nuclear power plant. At that time in 1989, a blue collar worker and a stay at home spouse raising three children was not particularly unusual as one-income families could own their own home, feed their growing families, and still have enough left over to vacation and to spend time with friends down at Mo’s Tavern. There was nothing particularly unusual about that scenario at the time, though their lives certainly weren’t portrayed as glamorous. However, over the past 30+ years, that same scenario – a one-income, owner-occupied household with three kids and two pets – has become practically out of reach for many more Americans. Homer Simpson, who was pretty much looked down upon by the Boomers and Gen Xers who tuned into the Simpsons those early days, might now be seen as a smashing success by Millennials today.

What happened? How is it possible that Homer Simpson’s financial and family situation could be a goal to strive for as opposed to something you wouldn’t want to settle for? Much has happened in America the past 30+ years since the Simpsons debuted, and much of it has made it harder and harder for each successive generation to emulate the path of the generations before and still achieve the same outcome. Additionally, even those earlier generations will probably have to accustom themselves to the investment tailwinds from which they’ve benefitted turning more toward headwinds to overcome. For Baby Boomers, Gen Xers, and Millennials alike, it is time to prepare for a future different than what they’ve known.

HEADWINDS – COLLEGE COSTS, HOME PRICES, AND HEALTHCARE COSTS RISING MUCH FASTER THAN INCOMES

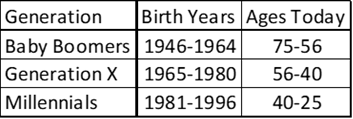

For the purposes of this piece, we will consider the following definitions and time periods when it comes to the different generations:

There are too many socio-economic forces to count that have made it harder and harder for each successive generation to achieve the same lifestyle as those before it since the end of World War II, but there is ample evidence that the average American’s income corrected for inflation has not grown at the same rate as many important expenses and savings goals. Therefore, over the past 50 years as each American turned 25 and started on the path to financial adulthood, the ability to pay back any remaining college loans, pay for an apartment, pay for healthcare, save for a home, raise a family, and hopefully have money left over to save for retirement has gotten harder and harder on average.

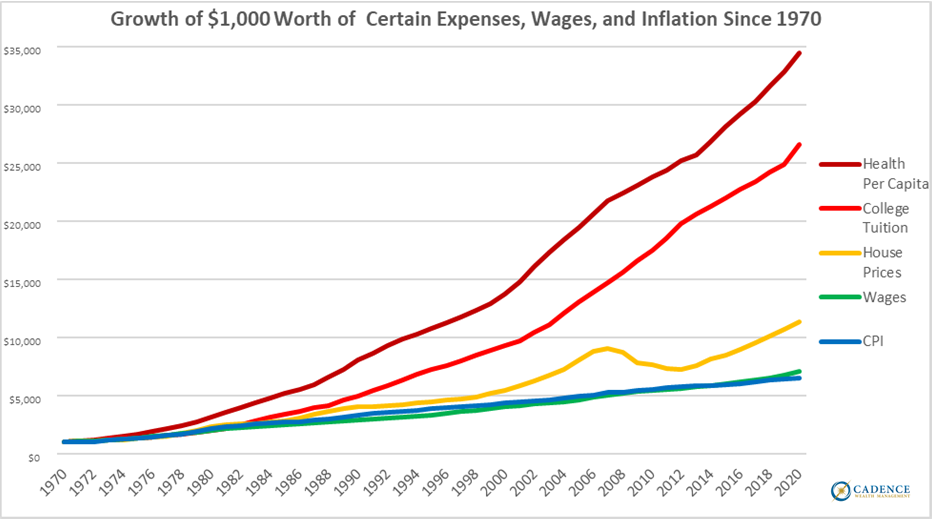

Consider how much college tuition, inflation as measured by CPI, wages, per capita healthcare expenditures, and home prices have increased since the earliest Baby Boomers turned 25 in 1971:

*Data Sources: Peterson KFF Health System Tracker, National Center for Education Statistics and The College Board, Federal Housing Financing Agency, US Bureau of Labor Statistics

As you can see, average wages have increased at a similar estimated rate to one measure of inflation (CPI), however home prices, college tuition, and healthcare expenses have increased by a much faster rate over the past fifty years by all estimates we could find. Inflation reporting is a controversial subject. Much of what the federal government does, from issuing treasury debt with stated rates of interest, to increasing social security payments, benefits from a low reported rate of inflation. The primary way the federal government reports this number, “CPI”, or the “Consumer Price Index”, has been adjusted multiple times over the years, such that it is very difficult now to fully trust this number. By many, many, many measures, CPI understates the real rate of inflation we consumers experience. Acknowledging that the costs of goods and services has been increasing at a rate above CPI, then it is very likely average wages have actually LOST purchasing power over the past 50 years, making the financial hurdles to many people even higher than we can represent here.

A 2018 PEW Research Center study concluded that for decades, while the median weekly earnings in America had barely budged, the weekly wages for those top 10% of earners had increased nearly 16% between 2000 and 2018. Subtract the top 10% from the total, and overall weekly earnings have moved very little over the past two decades for 90% of American workers.

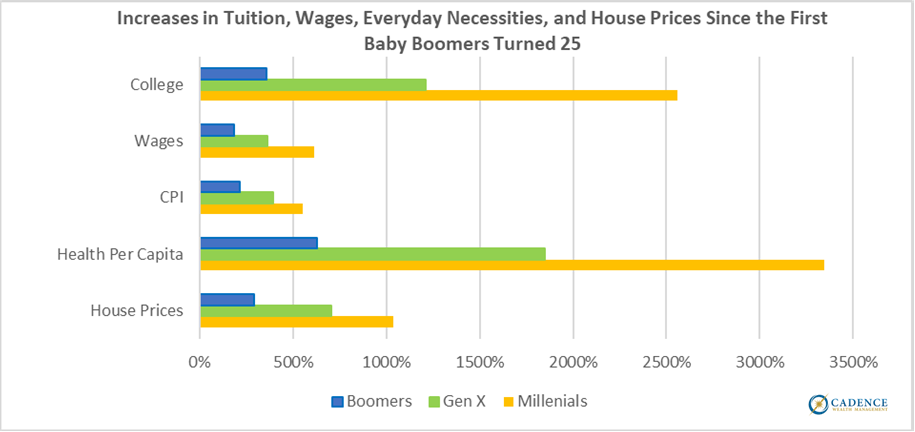

Starting with the Baby Boomers, the oldest of which turn 75 this year, continuing with the Gen Xers, and ending with Millennials, the youngest of which turn 25 this year, walking down the path of establishing oneself, paying for necessities, and saving for major goals has gotten harder and harder for each successive generation for the reasons mentioned, but just how much harder? Consider this:

What the chart above shows is that from the start of the Baby Boomers turning 25 to the last of that generation doing so, CPI-reported inflation had increased a bit more than wages over those 18 years, house prices and college tuition by even more, and health expenses per capita were already increasing at a decent clip. Fortunately for Baby Boomers more so than those who followed, college costs were still low enough to result in either no loans, or very manageable ones, and wages were still high enough to afford the every day necessities, paying for healthcare, and saving for a home. However, as the years passed, tuition got high enough for many Gen Xers to graduate with debt, healthcare started being taken out of paychecks in larger amounts, and home prices continued their increase of nearly double the rate of general inflation.

It was such that by the time the youngest Gen Xer turned 25, college costs had increased 846% more than average wages since the first Boomers turned 25, per capita health expenses by 1,485%, and home prices by 339%. Two-income households became more and more needed to pay back the loans, pay the rent, pay the healthcare, save for houses, pay for daycare (now that there wasn’t a parent at home), and hopefully still be able to save for retirement. Many Gen Xers were able to do all of that, but long gone were the days of a Homer Simpson, single income household and his nuclear power plant pension being enough to achieve the same financial goals for most Americans.

Which brings us to Millennials, the youngest of which are just trying to establish themselves today. Their tuition costs increased an estimated 1,945% more than wages since the first Baby Boomers turned 25. CPI-reported Inflation has increased roughly in line with average wages, though per the earlier discussion on CPI average wages have probably increased less than actual inflation. However home prices and healthcare spending have increased 425% and 2,700%, respectively, more than average wages since 1971. Although the continued income inequality gap, college tuition, healthcare, and home price increases probably cannot continue at these rates forever, there is no way to estimate when any of them may start to slow down relative to lower income growth. As such, the young people of today face a steeper climb to reach many of their financial goals than their parents and grandparents, on average. Though each successive generation has had to face seemingly steeper and steeper financial hills, many of the aforementioned issues are felt by all, like smaller wage growth and higher health expense growth, but there are other forces turning from tailwinds to headwinds that will affect everyone.

TAILWINDS TURNING TO HEADWINDS – EQUITY AND FIXED INCOME PRICES AT ALL-TIME HIGHS

On January 1st, 1980, the Revenue Act of 1978 went into effect, which included an obscure provision called Section 401(k). In 1981, the IRS issued rules that allowed employees to contribute to their 401(k) plans through salary reductions, and the investment world became much more accessible to the average American worker. In 1970, around 45% of non-public sector employees were covered by company pension plans, but since the rollout of 401(k) plans, a much cheaper way for companies to offer retirement benefits, this has dropped to less than 15% of non-public sector employees still being covered by a company pension plan. That has shifted the risk of investing for retirement from professionals employed by private companies to the every day American worker, very few of which have a level of investment understanding that one would consider proficient.

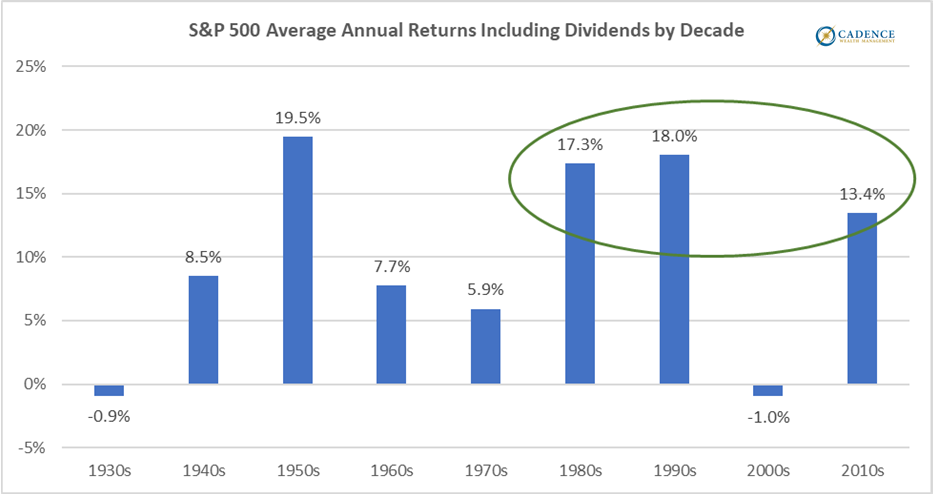

But for a while, that hardly mattered. Two of the three best decades for the S&P 500 happened within the past 40 years since 401(k)s were first rolled out:

So right out of the gate, Baby Boomers investing in their 401(k) plans were seeing some of the best investment returns since the Great Depression. The relatively low total returns on the S&P 500 in the 1960’s and 1970’s set the stage for very favorable valuations poised for growth. That’s not to say it was always smooth sailing, as the oldest Boomers were ten years away from retirement at age 65 when the Tech Bubble burst, and they were only three to four years away from that typical age 65 retirement when the Financial Bubble burst. However, both stock market crashes, though severe, rebounded far faster than the average Bear Market, and at some point one of the next Bear Markets will take far longer to bounce back. (See the Cadence Clips July 2017 Article “Could Multiple Decades of Zero Growth Happen to You?”)

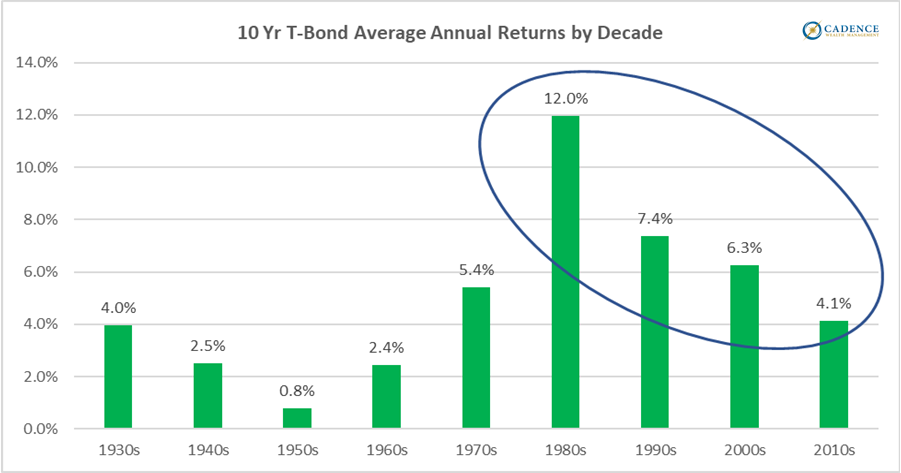

Additionally, interest rates peaked in 1982 and fell for multiple decades. Since bond prices have an inverse relationship to interest rates, this means that while the stock market was booming in relative historic terms, so was the bond market. As incredible as the S&P 500 returns have been the past 40 years by historical standards, bond market returns, here measured by ten year T-Bonds, HAVE BEEN EVEN BETTER. Three of the best four, and four of the best five decades for the bond market since the 1930’s have been the most recent ones:

With both stock and bond markets having such good decades since 1980, investing in a 50% S&P 500, 50% Ten Year T-Bond portfolio yielded a 10% average annual return between 1980 and 2020. Considering the average annual return of the S&P 500 since 1927 is also around 10%, there is a very good chance we will never see another forty-year period where an investor could put only half of their money in the stock market, and the other half into the relative safety of bonds, and STILL equal the long-term returns of the stock market.

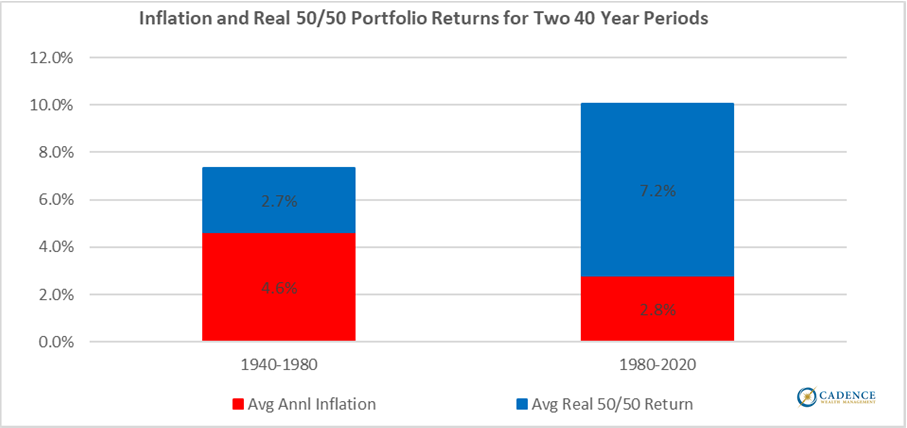

AND AS IF THAT WEREN’T GOOD ENOUGH, inflation over that same 1980-2020 period was also low by historical standards. Comparing the returns above inflation (“real” returns) of two 50/50 stock/bond portfolios for two different forty-year periods shows just how incredible investing has been since 1980:

An investor can make a lot of mistakes, or can afford to be a little more wasteful with their money, when they’re earning 7.2% above inflation while only having half of their money in the stock market. On the other hand, there is a lot less room for error, and a lot less room for poor financial decisions when making only 2.7% above inflation for four full decades.

Nearly everyone investing today has benefited from incredibly fortuitous stock and bond returns, as well as very low inflation. It is understandable that the last four decades are going to heavily influence what people expect from the future, but recognize the past forty years for what they are: possibly the absolute best time in the history of investing for stock and bond returns above inflation. With asset valuations at all-time highs relative to so many different measures – US GDP, corporate profitability, margin-adjusted CAPE valuations, and on and on it goes – is it reasonable to expect the next decade, or two, or three to be as good as the last four?

We think you know the answer. At some point, investment returns, which for so long have been tailwinds for investors striving to reach their financial goals and have now led to incredibly high asset prices, will turn into headwinds like they have at other times in history. You just cannot expect way above average to last forever.

With certain costs increasing at rates much higher than wage growth, and with asset valuations pointing toward protracted lower returns, what is a:

- Retired or soon to be retiring Baby Boomer, or a;

- Gen Xer with full family health insurance to pay, and college tuitions to pay or save for, while also saving for retirement, or a;

- Millennial with college debt to pay off, rent to pay, savings to accumulate for a home, retirement, or whatever, and the hope to start a family in the not too distant future to do?

Baby Boomers – Get Used to Lower Investment Returns and Higher Inflation, and Adjust Your Retirement Plan Accordingly

7% returns above inflation in a moderate portfolio cannot continue forever. In fact, real returns on 50/50 stock/bond portfolios have fallen to around 5.7% over the past 16 years, so the tailwinds have already decreased and it has started getting harder to make such a large return above inflation with a moderate portfolio. Although it is easy to define what we directly experience as “normal”, the financial markets you have been investing into are not normal by historical standards. Equity returns have been a bit above their long-term averages, bond returns have been way above their long-term averages, and inflation has been below its long-term average, which all result in very forgiving investment circumstances. Additionally, whether it felt like it at the time or not, college for you was cheap by today’s standards, as were the first houses you bought. It is time to adjust your expectations for the decades to come to not be so favorable.

- Revisit your retirement plan to verify you can maintain your desired lifestyle with higher inflation and lower investment returns going forward.

- If you do not already know, find out how much your investment portfolio might lose in the event of another 2007-2009 stock market crash and shield yourself as best you can.

- Look outside of stocks and bonds for investment growth.

- If you have not completed a financial plan within the past five years to help you know if your projected investments and income will be enough to fund your desired retirement lifestyle for as long as you need it to, you should, whether that means updating an existing plan, or planning for the first time.

- It is also time to take a very serious look at whether you have the assets or insurance in place to pay for potential long-term care expenses.

Gen Xers – Don’t Sacrifice Saving to Keep Up with the Joneses

The oldest Gen Xers will be hitting the traditional retirement age of 65 at the end of this decade, so some can see the finish line, while the youngest Gen Xers still have a quarter century to go. In the meantime, caring for aging parents and trying to save for children’s college educations can easily reduce the amount that gets saved for retirement. While stocks have returned around their long-term averages while you’ve been investing, bonds have returned more than their long-term average. Expect both will have a much harder time over at least the next decade, and possibly beyond that, so now would be a good time to save as much as possible expecting your rate of investment return at the same level of risk going forward to not be as good as it has been over the past fifteen to thirty years.

- Like the Baby Boomers, you need to update any financial plan you have done five or more years ago, or do one for the first time if you have not, and assume investment returns will be lower than they’ve been and inflation will be higher.

- Look outside of stocks and bonds for investment growth.

- Prioritize savings, even if that means decreasing your lifestyle expenses where possible. The Joneses you may be trying to keep up with may be killing their finances to take the nice trips and have the nice things that many Gen Xers have been conditioned to want for themselves; nothing you can buy today will be as valuable as the security you could have during retirement if you just saved as much as you could.

- Because you will not be able to borrow to pay for your retirement, prioritize retirement savings over others, assuming you already have an adequate cash reserve. As expensive as college has gotten, your children can still borrow to pay for it, unlike retirement.

- Be very, very careful with the higher education choices you and your children make. No one wants to deny their child a dream college experience, however you have to be realistic about the cost/benefit of different colleges. Is it really better to go to a college and graduate with a mountain of debt that will hinder your child’s creating a sound financial foundation than to pay for something less expensive that will ultimately carry less debt?

- Make sure your aging parents have their finances, wills and trusts, and end of life arrangements squared away as much as you can. And while you are at it, it’s time for you to make sure you have your own wills and trusts in good order (trusts if needed).

- If you have not already, consider looking into long-term care insurance. As you saw earlier, health related costs are increasing much faster than general inflation, and paying 100% out of pocket for those expenses in the decades to come may completely drain your retirement accounts.

Millennials (and Gen Z if you’re reading) – Prioritize Good Habits That Will Help Lay A Successful Foundation

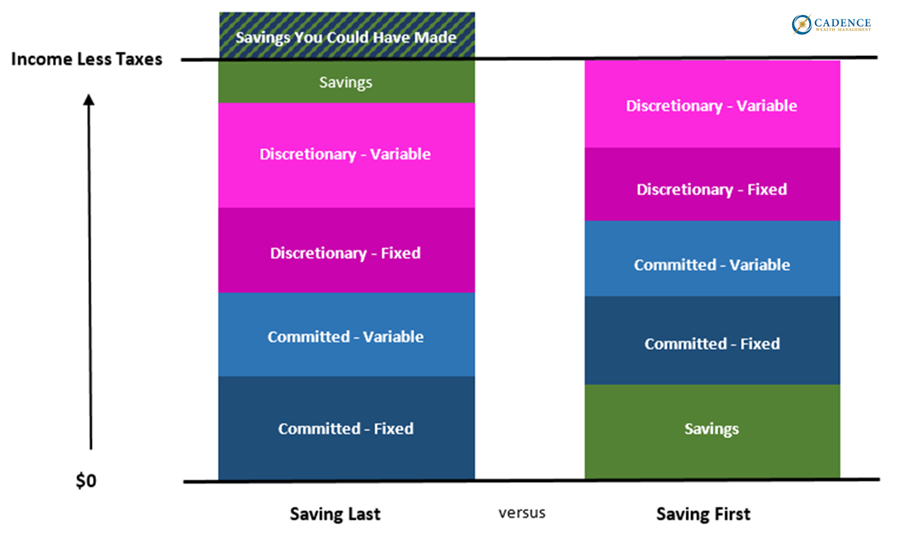

The oldest of you are already staring down 40, while the youngest of you will be hitting 25 this year. The habits you have already created, or will create between these years will go very far in determining how solidly you build a financial foundation to help you achieve your life’s goals. The most important thing you can do, even if you’re an older Millennial and haven’t yet successfully done it, is to save. Make it a point to save. Decide what you can and cannot afford to do AFTER you have already saved a percentage of your income.

The majority of people save from what is left over, which can quite easily result in saving less than if you put saving first:

You are far more likely to save 15-20% of your income if you stash that somewhere first before making other financial decisions than if you wait to see what is left over every month.

- Focus on saving, even more so than “investing”, to make sure you get in the habit of saving at least 15-20% of your income.

- Like Gen Xers, you should avoid extending yourself financially to keep up with the Joneses and accept fewer “things”, and be satisfied with the security healthy finances brings. You should prioritize retirement savings above most other things, and be very careful with the higher education you and your children commit to pay for.

- You are not too young for financial planning, no matter how young you are. If you have not yet done a financial plan, do so. It’s never too early to get on the right path.

- Also like Gen Xers, especially older Millennials should help their parents with their estate planning documents. Keeping as much money in the family as you can by helping them will likely benefit you when the time comes.

- And, like all other generations, get ready for the next twenty to forty years to not behave like the last twenty to forty when it comes to investing. The two and a half to four decades you have been alive have been some of the best in history when it comes to stock and bond returns. Regardless of returns over the next ten years, keep saving as much as you can toward your future and be prepared to take advantage of opportunities that arise throughout and after a prolonged period of stock and bond market underperformance.

When discussing fifty years of expense growth, and even more than that for investment returns and inflation, and when discussing entire generations of Americans, we’ve had to rely upon averages, which do not tell the entire story. Almost no one is “average”, and there are many Baby Boomers that were not able to take advantage of the beneficial economic forces at work, and there are many Millennials who will be able to graduate college without debt, start a family, and buy a first home before the age of 30. Additionally, there is much evidence to suggest that though average wages have increased over the past 40 years to roughly match inflation, once you remove the top 10% of wage earners from that average, then wages have actually decreased relative to inflation for the rest. And we have paid very little attention to those college graduates entering the workforce during recessions and the permanent impact that has on their wage growth going forward, or the need for younger American adults to rely on expensive daycare so both spouses can work to pay off their college debt and try to save, and many other specific situations that make financial stability easier or harder to obtain.

However, the forces at work are undeniable: it is more difficult today to go to college, graduate, and save for a home, family, and retirement than it was 50 years ago, and the extremely good investment returns of the past 40 years have resulted in asset valuations that indicate investment returns going forward may be a lot lower for an extended period of time than we may be used to. Despite all of this and the additional challenges to come, you can still set and achieve financial goals, just like people have been doing throughout many tumultuous periods the past one hundred years. The best way to achieve your financial goals is still to create good habits, live within your means, avoid the risks you cannot afford, and save 15-20% of your income. Nothing defeats adversity like a well-executed plan, and though each of the American generations and those to come will have to work with whatever forces make it easier or harder for them to reach their goals, they can still make good decisions that will help them do so, unlike the VAST majority of the decisions Homer Simpson has made the past thirty years.

Editor’s Note: This article was originally published in the June 2021 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.