A couple data points to ponder…

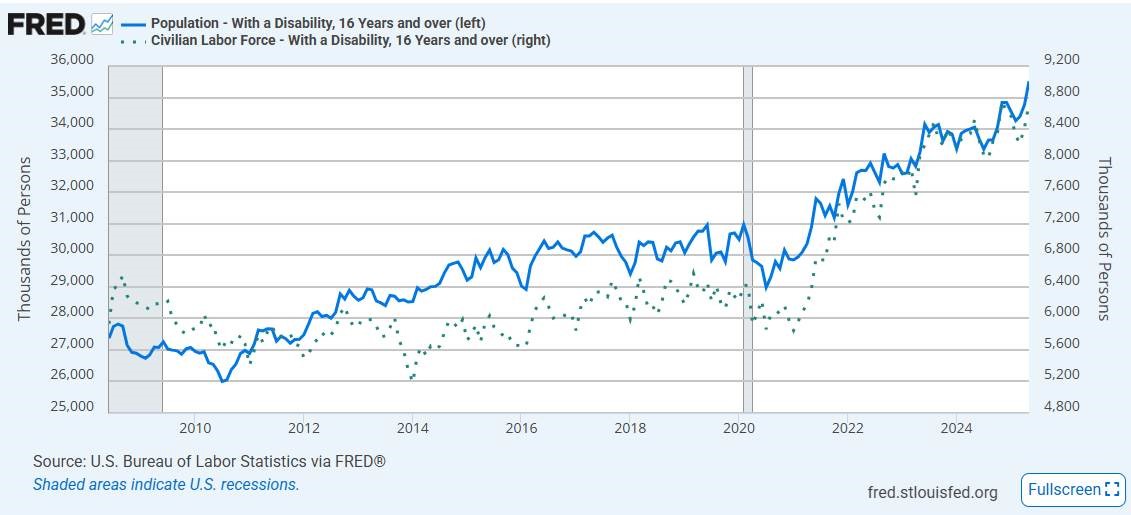

First is an update of disabilities across the general population, and more relevant to the economy, within the U.S. workforce. You can see the trend continues to rise since early 2021. Some would have ideas around what might have contributed to this rise. Regardless, there are fewer healthy, productive people available within the workforce to drive economic productivity. AI couldn’t come quickly enough, but with more people sidelined, it begs the question as to the ability of the consumer to spend tomorrow the same way it did yesterday.

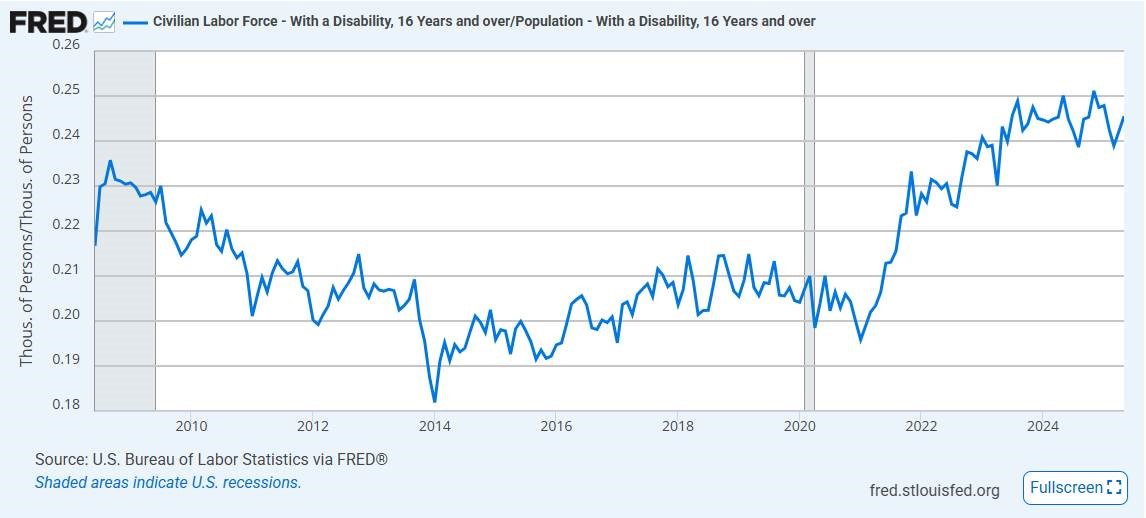

The below chart looks at disabilities in the workforce against those in the broad population. The rise since 2021 suggests that whatever is responsible for this decrease in physical wellness was more prevalent in the workplace.

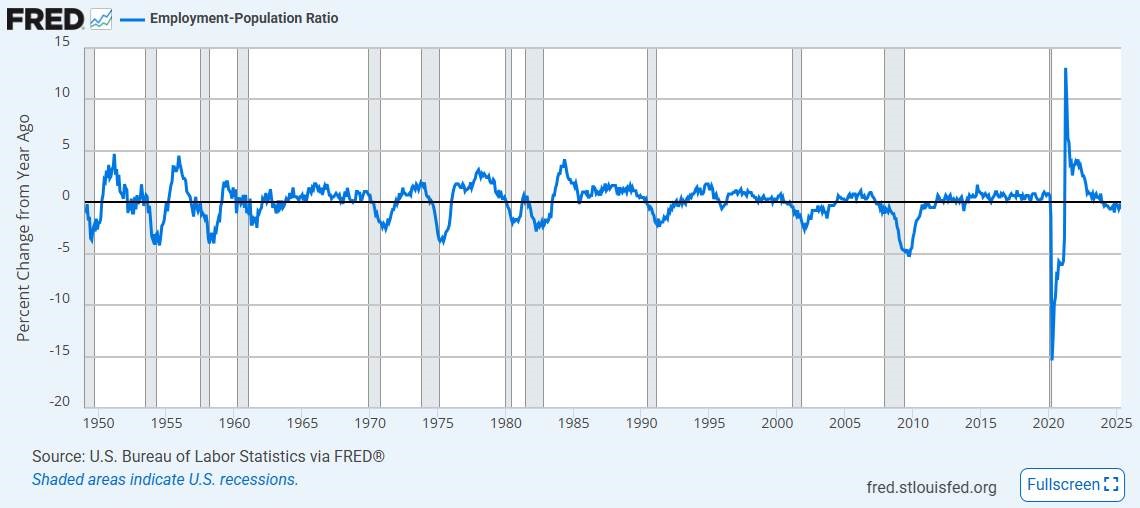

The chart below looks at employment relative to the broad population on a year-over-year basis. As we can see, we’ve been in decline (below zero) for a while now. Looking back more than 70 years, it’s hard to find a time where there was negative growth for any length of time where there wasn’t a corresponding recession. What’s also obvious is that this employment metric often declines toward zero months before we enter recession. Not robust.

Weak fundamentals and asset bubbles typically don’t correlate. One of these things has to change.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.