A simple macro observation…

In the past, recessions followed inverted yield curves – when long-term market rates dip below short-term market rates. That hasn’t been true this time around, yet, probably because that phenomenon typically involves aggressive Fed rate cuts to help normalize the yield curve (bring it back into positive territory). This time, the yield curve has begun normalization without those cuts, mostly due to long duration rates rising because of inflation fears, solvency concerns, and other factors.

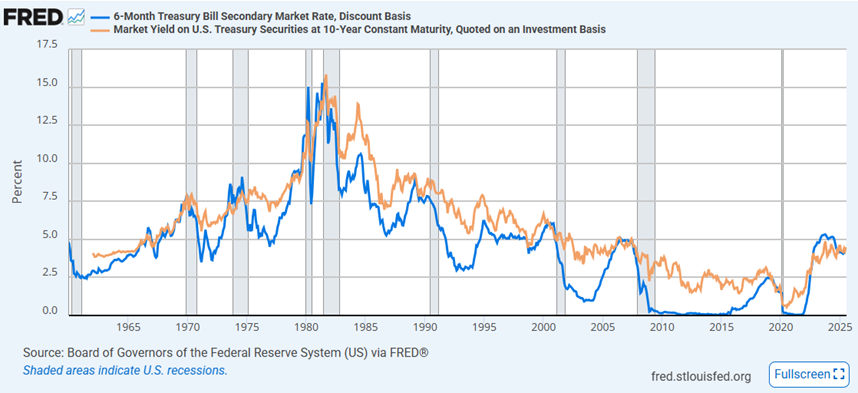

Probably a cleaner and more accurate way to think about interest rates and their effect on the economy is to look at general levels across durations relative to where they have been. So, both direction and rate of change. What’s clear in looking at that in the chart below is that recessions are always proceeded by rising rates, both short and long duration. Thus far, we haven’t seen the rise in rates over the last few years result in an official recession declaration. This seems odd given the long period of low rates from which we came. It seems reasonable that the economic drag from this change will eventually lead to real world consequences, just as it almost always has in the past.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.