Although not everyone fully understands inflation and its pernicious impact on standards of living over time, all of us have experienced it and know what it feels like in the moment. It’s annoying to pay more for something than we did just a little while ago. If it’s the type of price increase that’s part of a temporary ebb and flow based on normal supply and demand of the product in question, no problem – that’s life. When on the other hand, it’s a true lasting price increase on not just one or two of the things that we consume, but most; well, that’s inflation – and it can be very, very difficult to deal with. For workers, the hope is that wages and salaries can increase at a similar or greater rate than the cost of those things consumed. Should this occur, and that’s in no way a given, then theoretically inflation wouldn’t be much of a problem for this group. However, for those on a fixed income as most retirees are, the only way to combat inflation is to grow one’s assets at a rate that compensates for it. This, like wages, is also not a given, and requires some careful planning.

Before looking at some illustrations of exactly how inflation can affect retirees, it’s worth mentioning that there are differing views on the origin of inflation and its drivers. Some feel that inflation is purely a monetary phenomenon, which is to say that it all comes down to how much money is floating around in the financial system at any point in time. This line of thinking gives credence to the ability of central bankers to control inflation since they have control over the short-term interest rates – which can encourage or discourage lending and the creation of bank credit – as well as the proverbial “printing press”. Others feel that inflation is driven more by factors such as demographics and productive capacity. When a large generation such as the boomers in the 1970’s is in its peak spending years, coupled with limited or maxed out productive capacity, this creates an inflationary scenario – lots of money going after a limited number of goods. The same can be said about the inverse of that scenario, which we find ourselves in now. Population growth is much slower than it has been in prior decades and our economy is not running at full productive capacity while carrying a much higher debt load than it has historically. This could well explain why it’s been so hard for the Federal Reserve and other central banks around the world to achieve the inflation they’ve been seeking.

There’s most likely merit to both arguments. The demographic one seems to us the formula that creates the natural backdrop for inflation or deflation and is most empirically supported by history. Again, this approach seems to favor disinflation or deflation over inflation. That isn’t to say that if central banks work at it hard enough, however, that they can’t push a boulder uphill. Proving a hypothetical is nearly impossible, but it’s logical to assume that had central banks not been so active in lowering rates and providing liquidity to markets over the last decade that inflation would have been even lower than was experienced. There’s little question in our minds that these actions have absolutely played a part in creating asset inflation primarily due to the fact that those who benefit most from this central bank liquidity are those with assets to begin with – hence our belief that central banks have contributed directly to and have promoted an increase in wealth inequality. True price inflation however – that which affects the average American more directly and negatively – most likely comes when the Federal Reserve directly subsidizes government spending, and most crucially, government spending that puts money directly into the hands of the average American. We’ve seen this important pivot over the last year and will likely see more of it going forward from government as a “solution” to a struggling middle class and wealth inequality problem. The extent to which this inflation pushes the more secular, disinflationary boulder up the hill remains to be seen, but it’s a risk we all need to take seriously – especially those who are retired and on a fixed income.

The Effects of Different Inflation Rates on Retirement

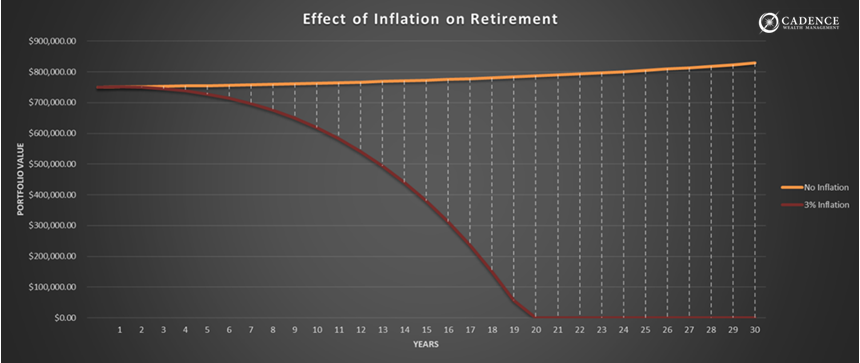

To see just how serious inflation can be over a long period of time, we’ll look at a basic retirement scenario and apply three different inflation rates to it. We’ll assume our retiree(s) has a fixed income of $40,000 per year that for simplicity does not rise at all from year to year, spends $70,000 per year, has an investment portfolio of $750,000 earning 6% annually, and pays an average tax rate on both the fixed and portfolio income of 20%. The chart below shows both a scenario where there is no inflation and one where inflation pushes up the $70,000 expense level each year by 3%. The difference? With no inflation, our retiree(s) lives very happily with no depletion to their portfolio whereas in a 3% inflation scenario, the portfolio declines almost immediately and is fully depleted within 20 years.

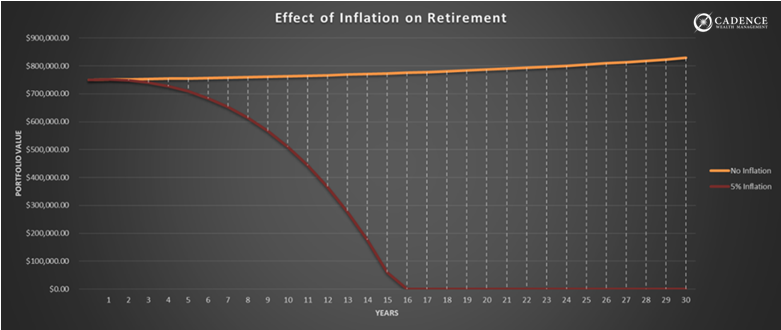

But is 3% inflation too low? Could the costs of living going forward actually be higher than that? One could argue we’re already experiencing more than 3% inflation especially when considering the products and services that we actually consume rather than the government created Consumer Price Index (CPI). So, what happens when inflation goes from 3% to 5%? As we can see below, this leads to the portfolio being depleted within 15 years, 5 years faster than at 3% inflation.

It’s one thing to look at a hypothetical situation such as this one and brush it aside as a numbers exercise, but if you throw your name on the top of these charts and think of this scenario as your own, would it affect you differently? As advisors and fiduciaries, our clients’ names both literally and figuratively are on the tops of all of the charts we look at. This is not a mere academic exercise for us. We know and care about every person on the receiving end of these scenarios, which is why when we hear monetary officials talk about how they don’t see evidence of adequate inflation and actually want to create higher inflation, our blood pressure rises. Again, some inflation either for short periods of time or due to the ebbs and flows of generational and economic cycles is normal. This tends not to last forever and typically comes with counterbalances such as higher interest rates to compensate one fairly for this inflation. When central planners on the other hand are trying to whip inflation up where it doesn’t belong, where there aren’t countervailing factors such as higher interest rates to help savers offset its pernicious effects, inflation is bad. It’s that simple. Those with assets can survive it and possibly even benefit from it while those without and living paycheck to paycheck struggle dearly to keep up.

What Can We Do About It?

On the policy front, just know that there is no free lunch. An increase in government spending that ends up as supplemental income for Americans, especially when subsidized by the Federal Reserve, has a good chance of generating the unnatural type of inflation. The world has tried this before, and it has never been a successful substitute for income earned through more economically productive and valued means. If the logic gets fuzzy at any point in trying to comprehend all the fancy jargon of the day with respect to Modern Monetary Theory or the like, just revert back to the old adage “there is no free lunch” or if you prefer, “you can’t get something for nothing”. Our efforts as a society would be much better spent working on the root of our issues; education, jobs training, aligned incentives, a renewed focus on small business rather than near-monopolistic big business, etc. The list goes on and needs have nothing to do with politics. We’d all be better off throwing our political beliefs out the window and starting from scratch on common ground and with common sense.

From a portfolio perspective, we have to be willing to step out of the box with respect to allocation. Cash and fixed income investments simply won’t keep up with inflation if it’s running at 3% or above. One could also argue, and we would, that a good portion of the stock market would struggle greatly if inflation gets out of hand. Not only would inflation disrupt the profit margins of companies that aren’t able to pass price increases along to consumers, but higher interest rates that typically accompany inflation would change the valuation calculus; and as we all know very well, valuations are currently resting on the summit of Everest.

This leaves commodity-related assets as a potential solution to the inflation problem. Why, you ask? Because they are literally the things that inflate when we have cost inflation. Whether it’s wheat, coffee, oil, gas, fertilizer, gold, copper, or tin, owning commodities directly or the companies that deal in them is a viable strategy. How much of each and how to achieve diversification is crucial as all investments carry risk. Treasury Inflation Protected Securities (TIPS) are also a tool some use to combat inflation that involves a base rate plus an inflation bonus based on the CPI. The problem with TIPS in this low interest rate environment though is that the base rate is currently negative, and as we alluded to earlier, the CPI is generally far lower than our actual personal rate of inflation. So, although TIPS earn more when inflation rises, they would likely still fall well short of helping investors keep pace with inflation.

The bottom line is that a standard run-of-the-mill diversified portfolio is almost surely not the tool for the job should inflation start to rise meaningfully. This standard cookie cutter approach, which almost all age or retirement date-based funds use, was engineered based on the last 40 years of falling interest rates and falling inflation. If we get the opposite going forward, then that whole model breaks; and it’s a very, very big model. This creates opportunity for those who can read the tea leaves and take a differentiated approach before everyone else does. The goal isn’t to be right in every moment; it’s to grow and maintain your hard-earned wealth and to use our heads and the options available to us to do that. This is part of what makes our investment management approach at Cadence unique. We’re not afraid to leave the emotional safety of the pack in order to carry out our fiduciary duty in serving our clients’ interests. Doing things the same way despite the fact that the investment landscape has changed entirely over the last 10 years or so is the true risk. When it comes to investing today, one must challenge the norms and conventional thought, be curious in seeking rationale and answers, think critically, and act bravely. Come to think of it, one would be well served applying this to everything.

Editors Note: This article was originally published in the May 2021 edition of our “Cadence Clips” newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.