It has been nearly six years since we published a Cadence Clips piece on target-date funds. Since then, they have continued being implemented to the point that I cannot remember the last time I saw a client’s 401(k) investment choices where target-date funds were not offered. Much has happened in six years, and despite COVID, war in Europe, continued political acrimony at home and abroad to name a few, the price of the S&P 500 has doubled since June 2019 when we published that target-date fund piece entitled, “It Pays to Know What Is Under the Hood with Target-Date Funds”. If other metrics had also doubled since then, perhaps that price growth would not be an issue, but whereas the total value of the S&P 500 was 50% more than the size of the US economy six years ago, it is now 100% more than the size of the US economy. By this, and many, many other measures, the S&P 500 remains historically expensive. Unfortunately, the recent stock market losses have done little to dent this, with the S&P 500 only -10% off its February 19, 2025 peak, and only -6% down this calendar year.

Target-Date Funds: A Review

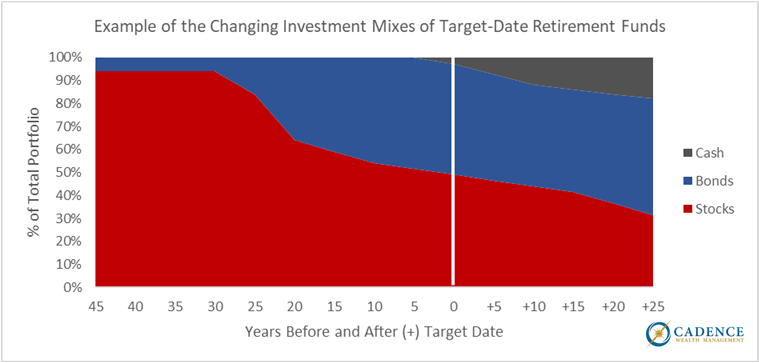

As a refresher, a target-date fund, sometimes called a lifecycle fund, is designed as a one-stop investment shop with a diversified set of asset classes. With a target-date fund, investors pick the year they think they’ll need to access the funds, say, 2030, and then the fund management company manages everything from there. The target dates chosen by the investors usually coincide with when they plan on retiring, but the target date can apply to any reason they feel they will need to access those funds by that date. As that target date gets closer, the funds reduce their exposure to traditionally more volatile asset classes, like stocks, and increase their exposure to traditionally more stable asset classes, like bonds. In this way, target-date funds are considered to be getting safer over time.

Having an investment mix get more conservative over time works in theory; as the goal gets closer there is less time to save and recover from losses, so having the asset mix get more conservative seems to make sense. However, it is short-sighted to base your investing completely on your potential target date. Even investors with decades left before retirement should take into account how overvalued the stock market is currently. Additionally, after a stock market crash, even people years into their retirement should consider getting more aggressive at a time they may be able to more safely increase their exposure to the stock market after it has gone on sale, especially if the sale is historic.

Which brings us to today. The potential for further stock market losses, and potentially historic ones, remains high as I alluded to in the first paragraph. It is logical to assume that the Fidelity Freedom 2020 Fund was geared to protect people retiring in 2020 from large losses, yet it was down -20% during the COVID decline in March of 2020 when the S&P 500 was down -34%, and down over -21% during the 2022 stock and bond market collapse when the S&P 500 was down -25%. There are many retirees who could survive a -20% decline in their asset values, especially if the financial markets rebounded relatively quickly, but how many of them out there could not, and how many out there would then make a panicky move at the wrong time as a result? Also, consider that the stock market was only down -25% in 2022, and the 2020 target-date fund was down a very close -21%. Could the investor survive being down -42% were the stock market to be down twice as much as it was in 2022?

I believe how target-date funds are named gives a false sense of security; people just assume that a fund with a target date of a couple years from now, or this year, or especially with a date a few years past, will not suffer much of a drop at all were the stock market to crash. That is just not the case.

What Should We Do Instead?

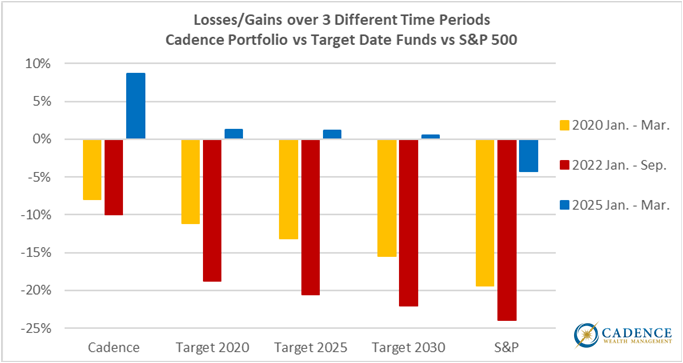

An investor willing to look outside of target-date funds has the ability to tailor their mix to not just their situation in life, but also the situations present in the investing and wider worlds. Consider how target-date funds handled the losses in 2020, 2022, and so far in 2025. I will compare the average performances of target-date funds from eight different fund companies to what the S&P 500 did over three different time periods, as well as a model Cadence client portfolio of 30% in one of our separately managed accounts, and 70% in one of our 20/80 core stock-bond portfolios.

Between January and March 2020, the S&P 500 was down nearly -20%; the target-date funds were down between -11% and -15%; and, the Cadence allocation was down -8%. Overall, the target date funds held up relatively well, but the Cadence portfolio’s ability to own assets outside of traditional stocks and bonds allowed it to protect the investor’s value even better.

2022 was a harder year for the target-date funds: They shared between 60% and 80% of the S&P 500’s losses in 2020, but they shared between 80% and 90% of the S&P 500’s losses from January through September 2022. The Cadence allocation, on the other hand, shared in roughly 40% of the S&P 500’s downward moves in both 2020 and 2022. Extrapolate that out, and if those ratios stayed the same were the S&P 500 to have lost -50% instead of -24%, that would translate to the target-date funds being down between -40% and -45%. The Cadence portfolio, with its ability to diversify beyond traditional stocks and bonds, would be down somewhere in the neighborhood of -20%. No one enjoys being down -20%, but at a time when the market is down -50%, and target-date funds are down between -40% and -45%, that -20% looks pretty good. At that point, a lot depends on the bounce back, and were you down only -20%, there’s room to buy into the stock market once it’s half off, and there’s less your investments have to recover to get back to where you started. The target-date funds, on the other hand, with their rigid allocations wouldn’t be buying more stocks; they’d actually be reducing their stock exposure.

The first three months of this year was an even more interesting story: The target-date funds held up pretty well, being up around 1% for all of them at a time the S&P 500 was down -4%. The Cadence allocation, on the other hand, was up 9% as of the end of March.

The message here is clear, I hope: Temper your expectations around just how much a target date fund will protect you during a stock market decline, especially during a crash. A target date 2025 fund sounds like it was created to protect asset values for someone retiring this year, but were it to lose -43% when the market is down -50%, I wager no one would be feeling all that protected. Don’t let the names fool you: Target date funds were designed to give exposure to a mix of assets based on a date, and nothing else; not your risk tolerance, not your actual retirement date, and certainly not the historical value of the stock market.

That being said, an investment that has reduced its stock exposure over time to 40% from a starting position of 90% would probably protect an investor better for what may come next than had they maintained their initial 90% stock exposure. If you are using a target-date fund in your workplace retirement account, or anywhere else, the answer may not be to abandon it entirely. More retirement plans offer gold, or other commodity-based choices that could be used to further diversify those investments. Consult your Cadence advisor on if and how to utilize a target-date fund properly, and by all means consider whether those assets can be moved to an account that offers more than cookie cutter solutions.

Editor’s Note: This article was originally published in the May 2025 edition of our Cadence Clips newsletter.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.