Contributing to a 401(k) plan is good, right? Then contributing the maximum possible to a 401(k) is even better. However, there is one small mistake we see people making that can have a surprisingly big impact over time: hitting the maximum they can contribute before the final paycheck of the year.

It may be best to illustrate the mechanics of this with an example. Consider someone making $125,000 per year, paid out as $5,208 gross twice per month. If that person decides to save 18% of his or her salary, he or she would contribute $938 every paycheck and would hit the $18,000 limit this year on paycheck number 20, leaving 4 paychecks with no 401(k) contribution.

That can feel great toward the end of the year, as there’s more in each paycheck, and just in time for Christmas!

However, employer contributions are usually in the form of matches, and unless the plan has a “true-up” provision, for any paycheck an employee is not contributing to his or her 401(k) plan, neither is the employer. In this example, the employer is matching 100% of the first 5%, which is one of a variety of ways employers match. As a result, the employee needs to be saving at least $260 per paycheck (5% X $5,208) to receive the maximum match from the employer, which in the case of this employee would be $260.

Therefore, those 4 paychecks where the employee is not contributing will cost him or her $1,042 (4 X $260) in lost employer 401(k) contributions. Just think, giving up over a thousand dollars per year just because you got your withholding percentage a little off.

Unfortunately, though, it’s even a little bit worse than that. In the 20th paycheck, which is the final paycheck of the year this employee is contributing, the employee is only allowed to contribute $188, or he or she would go over $18,000 for the year. The problem for this paycheck is that $188 is only 3.6% of the employee’s pay, and therefore the employer also only has to contribute 3.6%, not the full 5%. So to add insult to injury, instead of not receiving $1,042 in employer matches, this employee is also forgoing just a little bit more, $73 to be precise. That brings the total lost matching dollars to $1,115 on the year.

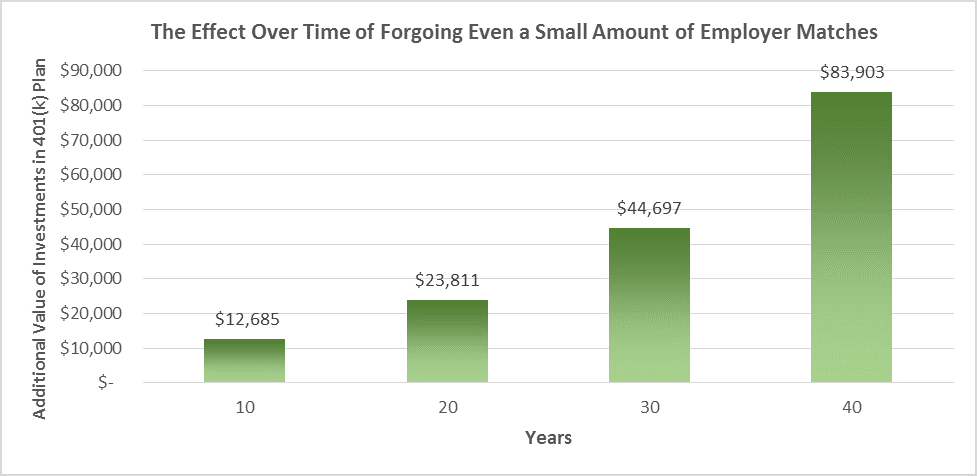

One year of this is not the end of the world by any means, but imagine the effect of doing this year after year. 401(k) contribution limits change frequently, but for illustrative purposes let’s assume this person foregoes $1,115 every year for 10 years, and the growth rate on his or her investments over those 10 years is 6.5%. At the end of that decade, he or she would have $12,685 more invested by fixing this mistake than by letting it continue.

If the mistake ended at this point, because either the employee caught it or retired, the effects would still keep growing over time. Carrying that extra $12,685 forward over a variety of timeframes at that same 6.5% results in:

As you can see, that “little” mistake keeps compounding to the point where 30 years in, it would be nearly a $45,000 mistake, and 40 years in nearly an $84,000 mistake!

To prevent making this little mistake that could grow into a much bigger one:

Check with your employer if your 401(k) plan has a “true-up” provision. If it does, then you can rest assured you’ll get the full match on all of your contributions as though they were spread out over every paycheck throughout the year. If there isn’t one, then read on.

• Make sure you are withholding a percentage that will result in your contributing every single paycheck.

• To figure out the percentage you need to save to hit the max, just divide the yearly max by your salary. In the example above, that would be 14.4% ($18,000 / $125,000).

• If you have annual bonuses or commissions that also contribute to your 401(k) savings, it will be trickier. You will have to keep an eye on how much you’ve saved toward the max as you go.

• If your employer only allows you to save in whole percentages, as opposed to the 14.4% above, we recommend you round up to start, and then downshift to a lower percentage later in the year. In this case, the employee would start by saving 15%, and then switch to 14% on the 10th paycheck, which would be his or her second paycheck in May.

• Always remember: on your final paycheck, you must save at least as much of your pay as will allow you to get the maximum employer match. In this case, the employee needs to save at least 5% to get the full 5% employer matching contribution.

All things being equal, contributing to a 401(k) plan is an important way for an employee to save for his or her retirement. To get that maximum employer match in any year you intend to save the maximum, you’ll have to do a little work, but we believe this little amount of work is worth $45,000 more dollars 30 years down the road. If this type of calculation is not your strong suit, then please ask us for help.