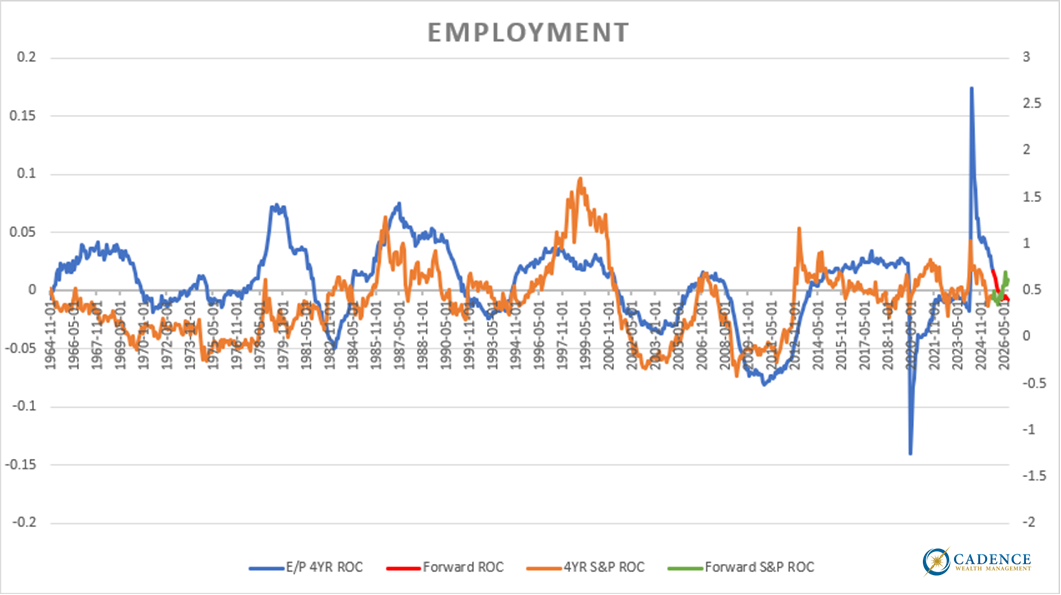

Markets seem to be ignoring the incredibly large and record-setting downward adjustment to jobs (>900k for 2024). However, the state of employment over a long period of time, it turns out, is incredibly important to the stock market. Below we see a four-year rate of change for both the employment to population statistics (now negative for almost two years year over year) and the S&P 500. Extremely well correlated. The little red and green blips on the far right of the chart show how the trends will change in the coming months assuming the current levels stay the same – so just based on comparisons four years prior.

For the relationship to hold, especially if employment continues to weaken, the market has to fall. In fact, the market would have to fall quite a bit faster than the deterioration in employment for the correlation to continue to be what it has been over more than sixty years of history.

Not bullish.