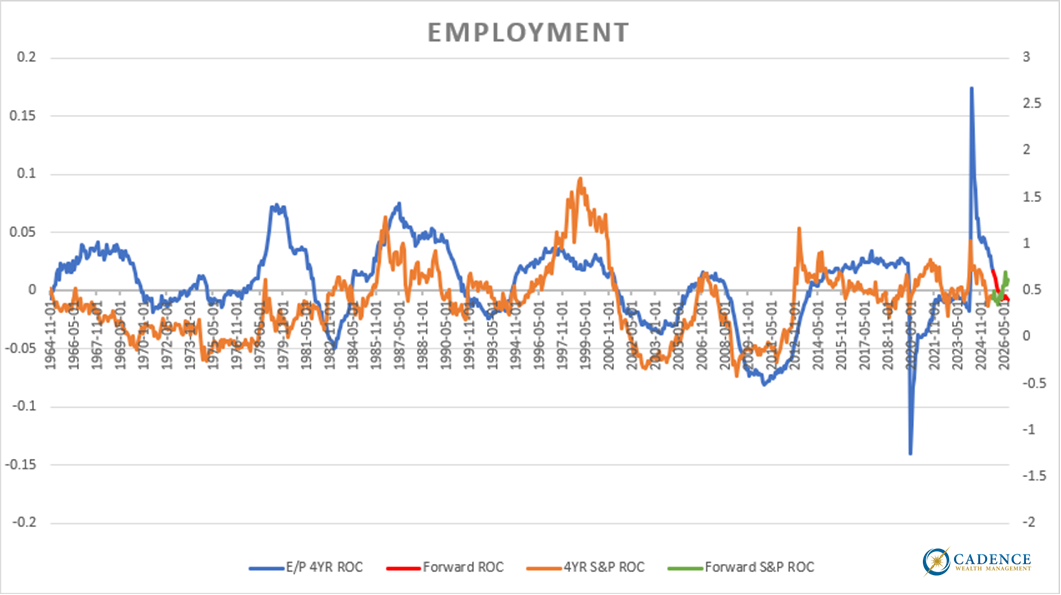

Markets seem to be ignoring the incredibly large and record-setting downward adjustment to jobs (>900k for 2024). However, the state of employment over a long period of time, it turns out, is incredibly important to the stock market. Below we see a four-year rate of change for both the employment to population statistics (now negative for almost two years year over year) and the S&P 500. Extremely well correlated. The little red and green blips on the far right of the chart show how the trends will change in the coming months assuming the current levels stay the same – so just based on comparisons four years prior.

For the relationship to hold, especially if employment continues to weaken, the market has to fall. In fact, the market would have to fall quite a bit faster than the deterioration in employment for the correlation to continue to be what it has been over more than sixty years of history.

Not bullish.

Important Disclosures

This blog is provided for informational purposes and is not to be considered investment advice or a solicitation to buy or sell securities. Cadence Wealth Management, LLC, a registered investment advisor, may only provide advice after entering into an advisory agreement and obtaining all relevant information from a client. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Past performance is not indicative of future results. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses and is not based on actual advisory client assets. Index performance does include the reinvestment of dividends and other distributions

The views expressed in the referenced materials are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.